EXECUTIVE SUMMARY[1]

- The tourism industry, one of the most important components of Penang’s services sector, has been heavily and negatively impacted by the Covid-19 pandemic, sustaining tremendous losses upon the loss of tourists and the obliteration of most tourist activities.

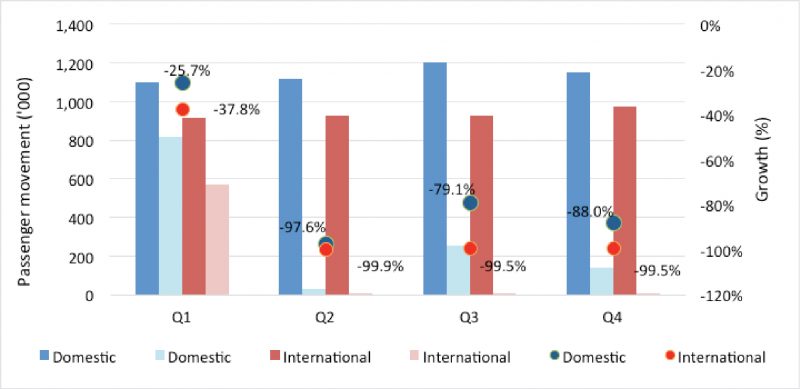

- Passenger movement for Penang International Airport for the last three quarters of 2020 recorded year-on-year declines of between 79.1% and 99.9%.

- Activities in other subsectors of the tourism industry such as medical tourism, meetings, incentives, conventions and exhibitions (MICE tourism), heritage tourism and ecotourism are also brought to a halt, with domestic tourism spending falling for the first time in 13 years.

- The tourism workforce had to confront retrenchment, unemployment, forced leave, and reduced pay and benefits, all of which greatly impacted their livelihood.

- A four-phase staggered strategy is suggested for Penang’s tourism industry, with a focus on mobilising tourism workers as volunteers in immunisation programmes and mass screening initiatives, advocating for a tourism green zone, supporting digital marketing and training for tourism professionals, and providing support in upskilling and reskilling workers.

1. Overview

With its abundant and unique mix of culture, heritage and food, Penang is one of the most popular and attractive tourist destinations in the world. Therefore, the tourism sector represents one of the key components in Penang’s services sector, and is undeniably a huge contributor to the state’s GDP and economic growth. However, since the onset of the Covid-19 pandemic in March 2020, the tourism industry has suffered greatly in terms of losses in profit and revenue, while a huge proportion of the tourism workforce has faced loss of employment and income. International tourist activities have been brought to a complete halt with the closure of international borders. At the same time, domestic tourism underwent significant disruption with intermittent lockdowns and prohibition of interstate travel pertaining to the severity of Covid-19 infections. At the time of writing, most of the country remains in Phase 1 and Phase 2 of the National Recovery Plan (NRP), and domestic borders are sealed.

International arrivals in Penang began tapering off in February 2020, as the pandemic began to take root globally. With the movement restriction order implemented in mid-March, domestic passenger movement saw a 61.6% drop, while a 74.5% decrease was seen in international passenger movement. Further and more drastic drops were observed from April onwards, with Q2 of 2020 recording a 99.9% decrease in international passenger movement and a 97.6% reduction for its domestic counterpart (Figure 1).

With no easing of international borders, international passenger movement remained stagnant for the remainder of the year[2], with Q1 of 2021 not seeing any significant difference. Domestic passenger movement saw a slight increase of 18.5% from the previous quarter in Q3 with the reopening of state borders on the 10th of June. However, the reinstatement of the interstate-travel ban on the 9th of November until the 6th of December resulted in a slight reduction of domestic passengers in Q4 of 2020. This decrease continued with the reimplementation of a full lockdown in January 2021, with a 48.4% decline in domestic passenger movement, in comparison to the previous quarter.[3] With Penang remaining in the red zone thus far in the year, this percentage is unlikely to increase.

Figure 1: Passenger movement and growth rate at Penang International Airport, 2019 – 2020

The above has clearly illustrated the serious implications of the pandemic and the lockdowns on tourist movement in Penang. While domestic tourism fared better than international tourism, the negative impacts are still fairly substantial. Domestic visitors to Penang for 2020 saw a negative growth of -42.2%, where the number of tourists and excursionists dropped by 29.6% and 46.3% respectively.[4] If we are to use the negative growth rates to generate a rough estimate of the total loss of domestic tourist receipts[5], it will be an approximate loss of RM3.6 billion in total receipts.

With the substantial decline in the number of travellers, the hotel industry has undeniably been significantly and negatively impacted. Although the industry saw periods of revival with the lifting of interstate leisure travel bans, this has not been sustainable due to rising Covid-19 cases. MCO 2.0 had resulted in Penang hotels seeing single digit occupancy rates of between 2% to 4%[6], a situation that is likely to be worsening with the implementation of the even more restrictive MCO 3.0. Furthermore, the financial impact from loss of international travellers is hugely substantial and cannot be underestimated. To date, nine hotels in Penang have ceased operations, due to the fall-out from the pandemic, among which are Holiday Inn Resort and Equatorial Hotel, two of the most established and longest-operating hotels in the state.[7] Closure of more hotels may be imminent, if the current situation persists (See Table 1 in Appendix for list of hotels that have announced closures).[8]

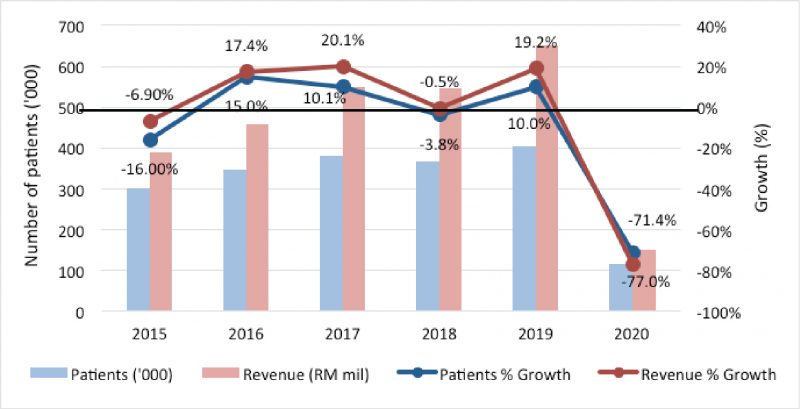

As one of the most profitable subsectors of the state’s tourism industry, medical tourism has contributed significantly to the state’s economy. Penang was the preferred destination for medical tourists to Malaysia; the state accounted for 56.8% of Malaysia’s health tourists and 60.7% of total medical tourism revenue in 2018.[9] As a result of the international border closure, the industry, which had enjoyed strong growth rates both in number of patients (19.2%) and revenue (10%) in 2019, saw its growth rate brought to an abrupt halt. 2020 saw the number of patients and revenue declining by 75.4% and 79.5% respectively, in comparison to the previous year. This mirrors the projection of a loss of 70% to 75% loss from the Malaysian Healthcare Travel Council (MHTC)[10].

Figure 2: Number and annual growth rate of health tourists and revenue generated for the medical tourism sector in Penang, 2015 – September 2020

The council further estimated a recovery in 2021 where revenue was projected to be 50% of 2019’s revenue, but looking at the situation thus far where it has been no different from the previous year, the projection is likely to be hugely overestimated. The recovery of the medical tourism industry therefore hinges on the reopening of borders, which hopefully will be expedited following an efficient global vaccination rollout, and the re-establishment of Penang as a safe and trusted medical hub.

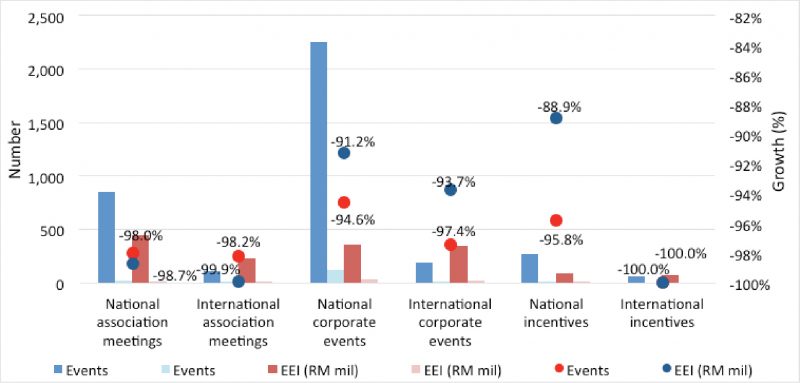

MICE (meetings, incentives, conferences and exhibitions) tourism is another sub-sector that generates a significant amount of revenue for the state’s tourism industry. The industry, however, has been greatly hampered by both the travel restrictions and event restrictions. As MICE tourism typically involves huge gatherings of people in meeting rooms, convention halls and exhibition centres, this has been disallowed during various periods of lockdowns. Even with intermittent easing of restrictions permitting the organisation of events, profit and revenue are affected as full capacity is not allowed, given the need for social distancing.

In terms of estimated economic impact (EEI), national events generated a higher value in EEI of RM889.6 million in 2019, when compared to international events’ EEI of RM644.8 million. Both these types of events and their EEI, however, saw unprecedented negative growth rates in 2020. Association meetings recorded 98% and 98.2% reduction in national and international events, along with a 98.7% and 99.9% decrease in EEI accordingly (Figure 3). There were no international incentives events held in 2020, rendering a negative growth of 100% in both events and EEI.

Figure 3: Number of events and EEI and annual growth rates in the MICE tourism sector, Penang, 2019 – 2020

As it goes, national corporate events and national incentives fared best in terms of EEI. However, there was still a respective negative growth of 91.2% and 88.9%, clearly illustrating the MICE industry’s heavy losses due to the pandemic. The industry has reinvented itself by hosting and organising hybrid and virtual events in the periods of lockdown, which undoubtedly would not generate as much revenue as physical events. Nevertheless, hybrid and virtual events are here to stay and are expected to be a part of the new normal. The reopening of the industry in terms of widespread physical/face-to-face events will not eventuate until the pandemic is under control.

The vulnerabilities of heritage tourism have also been exposed by the pandemic. Before the pandemic, it was a usual occurrence to see crowds of tourists enjoying the sights and food that George Town has to offer and participating in food and cultural festivals, or groups of tourists enjoying heritage trail walks and converging at heritage attractions such as the Clan Jetties, Fort Cornwallis and similar sites.[11] The pandemic has brought all of this to a halt, and this has subsequently altered the landscape of heritage tourism. The presumption is that mass tourism is unlikely to be rejuvenated, even with vaccination measures in place. Social distancing measures are likely to persist, and tourists are anticipated to shift their preferences to enjoying tourist activities in small groups, and shying away from crowds. In this sense, more sustainable ways of conducting heritage tourism will need to be formulated.

The carefully preserved hundred-year-old rainforests, natural parks, mangrove swamps and beaches in Penang have made ecotourism one of the most popular forms of tourism for the state. The loss of tourists has also resulted in substantial losses for the subsector of ecotourism, which is then extended to economic losses for the local communities providing important services such as guided tours and homestays. As with the rest of the sector, it will be difficult for ecotourism to recover while border lockdowns remain in place. On the other hand, the model of ecotourism is seen as one of the ways forward in rethinking post-pandemic tourism. Its emphasis on wide-open spaces and on small groups of tourists for the purpose of nature preservation and sustainability is anticipated to be preferred by travellers in the shift away from mass tourism.

Since fighting the pandemic continues to be a global battle, the gargantuan challenges encountered by the tourism industry will remain in place. The rejuvenation of the industry will be largely dependent on an effective management of Covid-19 cases, a successful national and global rollout of the vaccination programme, and a clear plan specific for all major industries. As it stands, the time to total recovery still looks fairly uncertain.

2. Workforce in the tourism industry

The tourism industry is undoubtedly a large employment generator for Penang’s economy. With the pandemic halting all tourism activities, the tourism workforce was faced with, and is still facing, turbulence and uncertainty. Retrenchment, unemployment, forced (paid, partially paid and unpaid) leave, reduced pay and benefits are all the issues plaguing tourism workers as the industry suffers from colossal losses of profit and revenue. According to a survey conducted by JobStreet in September 2020[12], 63% of workers in the tourism/travel sector in Malaysia had been permanently retrenched or not working. In other related sectors, 66% of hospitality/tourism workers and 62% of workers in hospitality/catering underwent retrenchment or were unable to work. Employees in the sectors of food and beverage (60%), mass transportation (47%) and retail (42%) were equally confronted with retrenchment and the lack of ability to work. Although the survey covered the whole of the country, it can be assumed that tourism workers in Penang are affected to a similar degree.

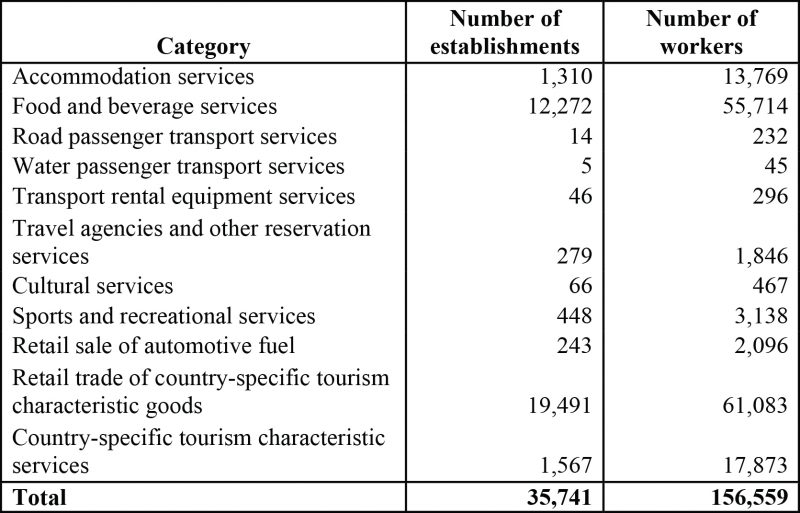

Table 1 details the number of establishments and number of workers involved in various subsectors of the tourism industry. While the data presented are numbers accumulated in 2015, it is deduced that the tourism workforce in 2020 was not be significantly different in terms of volume. Going by Table 1, tourism workers represented 53.8% of total workers in the overall services sector.[13]

Table 1: Number of establishments and workers in the tourism industry, Penang, 2015

Workers in retail trade services and food and beverage services made up the majority of all workers, standing for 39% and 35.6% respectively. Country-specific tourism services (11.4%) and accommodation and hospitality (8.8%) were another two sectors considered to be significant employers. It is presumed that the total number of tourism workers affected by the pandemic will be reflective of the numbers presented in Table 1.

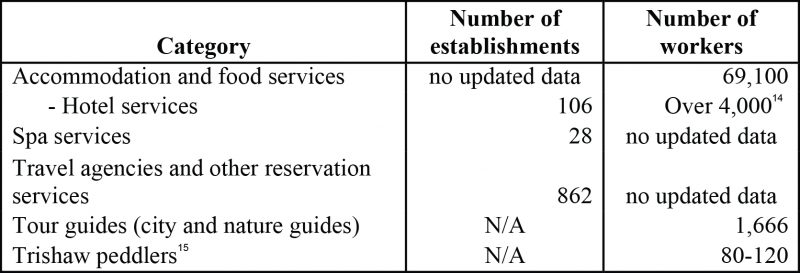

Table 2 displays the most recent data available for selected sectors of the tourism industry. As it stands, 69,100 workers in accommodation and food services are assumed to have suffered the loss of income and/or employment, where more than 4,000 workers are in the hotel industry. Employees in 862 travel agencies would have been confronted with the same difficulties. Both city guides and tour guides, totaling 1,666 workers, would be equally affected by the massive decline in tourist activity.

Trishaw peddlers, daily wage workers who are highly dependent on tourists, would have seen next to no income over the course of the pandemic.

Table 2: Number of establishments and/or workers in the selected sectors of the tourism industry, Penang, 2020[14][15]

The challenges faced by tourism workers are expected to persist as tourism activity remains prohibited under the movement restriction orders and amidst the consistently high number of Covid-19 cases. Significant measures and assistance will be needed to ease the burdens of the tourism workforce.

3. Staggered strategies

Towards a new normalcy, this brief suggests a four-phase staggered strategy for Penang’s tourism industry, aligned to the federal government’s NRP, Penang state government’s announcements and MOTAC’s recovery plan. Unless stated otherwise, the phases described below follow the four phases in the NRP.

3.1 Initial phase

As the tourism and tourism-related sectors are the most affected by the pandemic and the lockdown, more immediate and enhanced actions are required to sustain the industry and the workers’ livelihoods. Given the ongoing National Immunisation Programme (PICK) and the related programmes such as Public-Private Immunisation Programme (PIKAS) and Construction Industry Vaccination Program (CIVac), it is proposed that tourism workers be prioritised as non-medical volunteers in these programmes

These workers will receive allowances while the tourism sector is unable to operate, and contribute to the vaccination drive. As vaccination is discussed, there is also a need to highlight that tourism workers need to be vaccinated, especially as preparation for later phases of recovery. Industry players have stressed that additional vaccination is the key to recovery.

Additionally, it is also proposed that in the state’s mass screening known as Penang Covid-19 Screening, tourism industry workers are recruited as non-medical volunteers and be granted the same allowance rate as PICK volunteers.

Noticeably, Penang State EXCO for Tourism and Creative Economy (PETACE) has initiated the Covid-19 safety accreditation programme.[16] This is to enhance preventive measures undertaken by Penang’s tourism industry players, the first to be undertaken in Malaysia with the objective of instilling confidence in travellers visiting Penang.

This accreditation is issued to tourism industry establishments that meet and adhere to strict hygiene and safety standards set by the local authorities, namely Jabatan Kesihatan Negeri Pulau Pinang (JKNPP), Majlis Bandaraya Pulau Pinang (MBPP), Majlis Bandaraya Seberang Perai (MBSP), PETACE and Penang Global Tourism (PGT).

Penang’s tourism industry players are eligible to partake in this accreditation programme, and those interested may visit https://penanglawancovid19.com/accreditation for more information.

3.2 Second phase

In the second phase, it is proposed that the ongoing initiatives in the initial phase be maintained.

Given the tourism industry’s contribution to Penang’s economy, it is proposed that the state government advocate for a tourism green zone for certain parts of Penang – a similar model which was mooted for Langkawi and Kuching. Tourism players such as the Malaysia Association of Hotels Penang Chapter[17] are also in favour of this idea. A similar model has been adopted by Phuket (see Box Article 1); tourists there need to provide certain documents before being allowed to enter the island. One possible innovation would be to designate the beach resort areas in Batu Feringghi for domestic tourists. Domestic tourists will be required to register with travel agents and all activities are pre-planned. It is proposed that the framework for domestic tourism during MCO2.0 be adopted for this plan with stricter SOP and compliance tracking. For avoidance of doubt, the proposal is to advocate for a travel green zone in Penang as planning is ongoing for Langkawi and Kuching instead of implementation of a travel green zone in Penang at this juncture.

3.3 Third phase

In the third phase, it is proposed that the ongoing initiatives in the previous phases be maintained and snowballed.

Understandably, the state government is supporting digital marketing initiatives and programmes on domestic and international travel. Besides that, PGT also has been collaborating with travel associations and online travel websites, e-shopping and airlines on tactical campaign to boost domestic tourism (including those on the “buy now, use later” concept). These include rebate vouchers or subsidies on travel packages. In this phase, it is seen that acceleration of these programmes should be increased to attract more interested travelers. At the same time, consideration could also be given to the future of ecotourism and homestays (Box Article 2).

Contentions over medical tourism

Undeniably, during Covid-19, medical tourism emerged as a contentious issue. On one hand, the contribution of this sub-sector (as highlighted in Section 1) is significant to Penang’s economy, yet on the other hand, there is a need to consider risk of infections, and the perceptions of the community and the effect on other stakeholders not within this sub-sector (as observed in an incident in 2020[23]).

It is proposed that a soft-landing approach is to be taken towards normalisation in this sub-segment during Phase 3:

- The state government should collate and consider the measures and recommendations by private healthcare providers on the future reopening of the sector, to allow for the safe travel and efficient management of healthcare travellers.

- Important messaging should be communicated with regards to this sector, especially on humanitarianism aspects such as the fact that Penang’s medical service providers are saving lives such as continuing cancer treatment for people from countries that do not have the treatment. A similar but enhanced SOP can be formulated based on the existing SOP for business travellers, the Phuket tourism sandbox and Malaysia’s travel green zones of Langkawi and Kuching.

- The federal and state governments should consider partial reopening for healthcare travellers in Phase 4.

3.4 Fourth phase

In the fourth phase, the NRP aims for a full re-opening, with a focus on domestic tourism. Hence, it is important to ensure that a solid foundation towards re-opening has been established in the earlier periods. Workers should continue to receive support in their roles, especially if some job functions or operations are re-organised or re-structured after a prolonged lockdown. Hence, it is important for government-industry support and collaboration to continue in upskilling/reskilling workers. Industry players may also tap on online platforms such as using the United Nations World Trade Organisation (UNWTO) Online Academy (free courses) for employees’ training.

Some of the initiatives to modernise and digitalise tourism regionally during Covid-19 include employing robots for services[25], adopting contactless services[26] and the digitalisation of safety and health certification[27]. The discussion has also revolved around the need to ensure great customer experience while balancing efficiency in the tourism industry. As Penang looks towards re-opening the tourism sector and bouncing back, incentives to energise the tourism industry should continue to be revised and benchmarked against best regional practices. Continuous engagement and discussion between the federal government, state government, relevant agencies, tourism industry players and all relevant stakeholders on re-energising the industry should remain as a priority. At the same time, as this episode of Covid-19 becomes more normalised (as the vaccination rate rises), emphasis should again be paid to the four main thrusts, 11 sub-thrusts, 84 initiatives and 13 signature projects outlined in the Penang Tourism Master Plan[28].

Table 3: Thrusts and sub-thrusts in the Penang Tourism Master Plan

4.0 Conclusion

In conclusion, the road to complete recovery for the tourism industry is highly dependent on the containment of the pandemic, globally and nationally. As it stands, industry experts have predicted that a minimum period of two to three years is needed before the industry is able to flourish as it once did.[29] It will be necessary for the tourism industry to continually reinvent itself in order to be more sustainable and resilient in facing future challenges of this magnitude. Partnerships and perpetual engagement between all stakeholders on building the resilience of the tourism industry will be necessary going forward.

For list of references and appendix, kindly download the document to view.

Editor: Ooi Kee Beng

Editorial Team: Sheryl Teoh, Alexander Fernandez and Nur Fitriah (Designer)

Image by Keith Chan (Unsplash)

[1] The authors are grateful to Penang Global Tourism for their review and for their invaluable comments.

[2] International arrivals from April 2020 to March 2021 were in one or more of the following categories, as defined by the

Ministry of Tourism, Arts and Culture: essential business travelers, foreign spouse arrivals, medical tourists (pertaining to special permission obtained from the Department of Immigration) and long-term pass holders.

[3] The year-on-year decline for domestic passenger movement in Q1 of 2021 is 91.3%.

[4] Department of Statistics Malaysia. (2021). Domestic Tourism Survey 2020.

[5] Estimation of loss of domestic tourist receipts = negative growth of domestic tourists in 2020*total receipts from year 2019

[6] Dermawan, A. (26th January, 2020). More hotels in Penang may cease operations if the MCO and interstate travel ban continue. Retrieved from https://www.nst.com.my/news/nation/2021/01/660750/more-hotels-penang-may-cease- operations-if-mco-interstate-travel-ban

[7] FMT Reporters. (29th January, 2021). Penang hotels rocked by MCOS. Retrieved from https://www. freemalaysiatoday.com/category/nation/2021/01/29/penang-hotels-rocked-by-mcos/

[8] The Star. (15th May, 2021). Hotels in Penang struggling to stay afloat. Retrieved from https://www.thestar.com.my/news/nation/2021/05/15/hotels-in-penang-struggling-to-stay-afloat

[9] Statistics from Malaysia Healthcare Travel Council (MHTC).

[10]Batumalai, K. (5th February, 2020). Medical Tourism Revenue Projected At Half Of 2019. Retrieved from https://codeblue.galencentre.org/2021/02/05/medical-tourism-revenue-projected-at-half-of-2019/

[11] According to the Penang Tourist Survey 2018, the visitation of historical sites was ranked the third most popular tourist activity (for both international and domestic tourists) in 2018.

[12] JobStreet COVID-19 Job Report, August 2020, retrieved from https://www.jobstreet.com.my/en/cms/employer/ wp-content/themes/jobstreetemployer/assets/loa/report/my/JobStreet-COVID-19-Job-Report- Malaysia-Sept-2020.pdf

[13] Department of Statistics Malaysia (2016). Economic Census 2016: Tourism Statistics.

[14] Dermawan, A. (8th July, 2020). Govt urged to speed up Covid-19 vaccination for hospitality industry. Retrieved from https://www.nst.com.my/news/nation/2021/07/706463/govt-urged-speed-covid-19-vaccination-hospitality-industry-nsttv

[15] Dermawan, A. (7th June, 2021). Penang trishaw peddler’s struggling for food, shelter amid Covid-19 pandemic lockdown. Retrieved from https://www.nst.com.my/news/nation/2021/06/696677/penang-trishaw-peddlers-struggling-food-shelter- amid-covid-19-pandemic

[16] Penang Lawan Covid-19. (n.d.). Accreditation. Retrieved from https://penanglawancovid19.com/accreditation

[17]The Star. (28th June 2021). Consider us for tourism bubble plan, say hoteliers. Retrieved from https://www.thestar.com.my/news/nation/2021/06/28/consider-us-for-tourism-bubble-plan-say-hoteliers

[18] The list does not include Malaysia

[19] General Information – Phuket Sandbox. (2021). Retrieved from https://www.tatnews.org/2021/06/initial-information-phuket-sandbox/

[20] Chua, A. (7th July, 2021). ‘Phuket Sandbox’ expected to net 100,000 tourists by end-September. Retrieved from https://www.flightglobal.com/air-transport/phuket-sandbox-expected-to-net-100000-tourists-by-end-september/144482.article

[21] Hotelworks. (2020). Phuket Hotel Market Update. Retrieved from https://www.c9hotelworks.com/wp-content/ uploads/2020/02/phuket-market-update-2020-01.pdf

[22] Promchertchoo, P. (7th July, 2021). Phuket reports first overseas visitor with COVID-19 after reopening without quarantine requirements. Retrieved from https://www.channelnewsasia.com/news/asia/phuket-reports-first-international-traveller-covid19-sandbox-15172620

[23] Malaysiakini. (17th August 2020). Penang to shutdown medical tourism after three arrivals from Indonesia. Retrieved from https://www.malaysiakini.com/news/538914

[24] Airbnb. (2021). Airbnb Report on Travel & Living. Retrieved from https://news.airbnb.com/wp-content/uploads/ sites/4/2021/05/Airbnb-Report-on-Travel-Living.pdf

[25] Chew, H. M.. (7th June 2020). Contactless service and cleaning robots: Here’s what your next travel experience may be like. Retrieved from https://www.channelnewsasia.com/news/singapore/covid-19-travel-experience-hotels-contactless-service-12792376

[26] Selvadurai, P. (23rd March 2021). Balancing technology adoption with service and human connection. Retrieved from https://www.ttgasia.com/2021/03/23/balancing-technology-adoption-with-service-and-human-connection

[27] TTG Asia. (29th May 2020). Global tourism’s comeback entail digitalisation, safety protocols: UNWTO. Retrieved from https://www.ttgasia.com/2020/05/29/global-tourisms-comeback-entail-digitalisation-safety-protocols-unwto/

[28] Penang Tourism Master Plan 2021-2030. Retrieved from https://petace.gov.my/wp-content/uploads/2021/05/ PGTMP_small_version.pdf

[29] Ng. J. (6th July, 2021). Crippled by the pandemic, will Penang’s tourism industry ever emerge from the nightmare? Retrieved from https://www.lifestyleasia.com/kl/travel/destinations/crippled-by-the-pandemic-will-penangs-tourism-industry-ever-emerge-from-the-nightmare/

You might also like:

![Making Food Hawking in Penang Sustainable]()

Making Food Hawking in Penang Sustainable

![Perbandingan Hukuman Hudud untuk Kesalahan Sariqah dan Hirabah di Brunei, Aceh, Kelantan dan Terengg...]()

Perbandingan Hukuman Hudud untuk Kesalahan Sariqah dan Hirabah di Brunei, Aceh, Kelantan dan Terengg...

![Facing Climate Change Begins at Home]()

Facing Climate Change Begins at Home

![Unleashing Potential: Policy Insights for Malaysia’s Creative Industries]()

Unleashing Potential: Policy Insights for Malaysia’s Creative Industries

![A Critical Need for Effective State-Federal Relations in Malaysia]()

A Critical Need for Effective State-Federal Relations in Malaysia