EXECUTIVE SUMMARY

- This brief discusses the prevailing investment landscape in Penang and Malaysia, recent challenges businesses are facing, and the need for long-term plans to attract high-value, high-technology investments.

- Despite present challenges, Penang continues to record consistent inflows of investments in 2021. Unsurprisingly, the approved investment of RM1.1 billion (January-March 2021) is lower than the average values in recent years but promoted sectors in Penang’s economy continue to receive attention from investors. E&E companies in the state expect a positive outlook despite the current situation.

- Apart from Malaysia’s political instability and the immediate effects of pandemic measures on Penang, certain companies in the state which have supply chain linkages to companies in other parts of Malaysia more badly hit by the pandemic have experienced disruptions.

- This paper argues for the need to promote certitude through long-term plans involving continuous collaborations, and evidently proper execution of those plans at the national level. Despite its enviably strong situation, the advancement of Penang’s innovation ecosystem clearly requires such commitment from the stakeholders involved.

INTRODUCTION

Malaysia is currently suffering from political instability and declining public health in the face of the Covid-19 pandemic (Nambiar, 2021; Leng and Rajah, 2021). Based on data from the Department of Statistics, Malaysia recorded the largest contraction in Gross Fixed Capital Formation (GFCF) since the 1997/1998 financial crisis, at -14.5% in 2020, with all economic activities being affected. GFCF refers to the acquisition of produced assets, including purchases of second-hand assets and the production of such assets by producers for their own use, minus disposals (OECD, n.d.). As such, the fall holds potentially long-term detrimental impact on production and output. The Gross Domestic Product (GDP) by expenditure approach also indicates that encouraging net export performance alone cannot sustain overall economic performance.

Penang, as a state with robust investments and business activities in its promoted sectors, especially in electrical and electronics (E&E), machinery and equipment (M&E), medical devices, global business services, and ancillary sectors, is undoubtedly facing huge challenges. It exhibits strong resilience. This is based on its strong relationship with investors, evident in the decades-long foreign and local major companies based there which not only continue to operate but which also seek re-investments and pursue synergies with the state and with other companies in the ecosystem.

Be that as it may, political stability and policy certainty remain key considerations for investors. Committing capital expenditures rests upon expectations of beneficial operating conditions. Past public announcements show that the process to reach a decision to invest/re-invest in Penang may take up to several years, and this makes socio-political stability and policy certainty ever more important. Samirin (2015) succinctly explained policy certainty thus: “Businesses can navigate fluctuating currency and high inflation by hedging currencies and sharing the impact of rising costs with consumers. However, companies are powerless in the face of policy uncertainty. Fortunately, improving policy is not expensive…including infrastructure and human capital.”

This brief discusses the prevailing investment landscape in Penang and Malaysia, recent challenges facing businesses there, and the need for long-term plans to attract high-value, high-technology investments.

Penang Still a Preferred Destination

Recent research continues to show Malaysia being centrally placed on investors’ radar screens. Two separate surveys with senior executives from China (Standard Chartered, 2021a) and Europe (Standard Chartered, 2021b) done by Standard Chartered in April 2021 both rank Malaysia second as investment destination with expansion opportunities. Both, however, also highlight the need for Malaysia to ensure availability of a skilled workforce.

Another survey conducted by the Japanese Chamber of Trade and Industry Malaysia (JACTIM) for the first half of 2021 also see sentiments among the Japanese business community in Malaysia improving, and being even more positive than in the pre-Covid period. However, ascertaining the longer-term impact of Covid-19 on the national economy is notedly the most important determinant for future investments among the respondents.

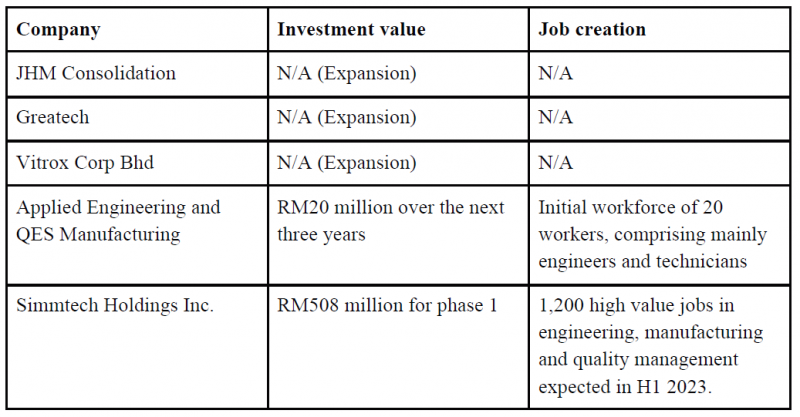

Where Penang is concerned, consistent inflows of investments have been recorded in 2021, though at a subdued level. The approved investment of RM1.1 billion so far is below the average values of recent years, but the state’s promoted sectors continue to receive substantive attention from investors (see Table 1, and Table 3 in Appendix). Importantly, the approved investments from the past few years are being realised on the ground and many have started operations. Hiring by these companies continues to take place at a steady pace. The spill-over effects of major foreign direct investments (FDI) in Penang’s promoted E&E sector recently documented in an investment research brief particularly highlighted localisation opportunities (see Potential Beneficiaries of Lam Malaysia’s Push by Maybank [2021]).

Table 1: Selected public announcements of investments in Penang in 2021

Source: Individual company’s announcements, InvestPenang and Malaysian Investment Development Authority (MIDA)

Recent Investment Issues

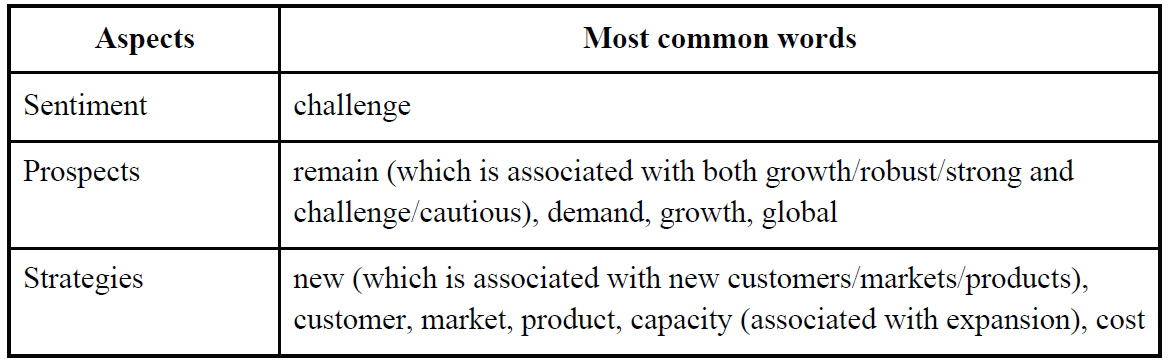

In capturing key themes of concern to investors, we examined key opinions of selected trade chambers, industry associations and studied quarterly reports (prospects section) of Penang-headquartered companies on Bursa Malaysia1 released between 1 June 2021 and 29 July 2021. 1 June 2021 marks the beginning of the full MCO in Malaysia. A particular limitation in using quarterly reports is that they are about ex-ante events, and may not totally reflect current business sentiments.

As a preliminary analysis, the most common words2 (see Figure 1 in Appendix) that appeared in the reports seem to reflect an overall challenging situation but exhibiting some optimistic sentiment. Besides, they also indicate strategies adopted by these companies to navigate these challenging times. Selected words associated with sentiment, prospects and strategies are listed in Table 2.

Table 2: Selected most common words that appear in the quarterly reports

Furthermore, by employing topic modelling (see Table 4 in Appendix) and combining that with the results in Table 2,3 three main themes have been identified which concern the companies:

Theme 1: The political stability factor benefiting Malaysia in investors’ decision making may be diminishing in relevance

Various forms of MCO that have been imposed since March 2020 have heightened uncertainties for investors and businesses. This has led to uncertain economic scenarios and may weaken the confidence of foreign customers. At the same time, the emergency announced in January 2021 and the ensuing political instability diminished Malaysia’s conventional political stability advantage.

Businesses are also concerned about the threat posed by the Delta variant of the virus, and the possibility of delays in re-opening and recovery. Reduced capacity, not only for their own business, but also among suppliers and customers in the entire value chain, pose uncertainties for businesses to plan and operate.

At the same time, the businesses have all been committed to ensuring the safety of employees and the community, and accelerating the pace of vaccination. Amid these challenges, they have highlighted that they aim to improve efficiency and maintain healthy cash flows.

Trade chambers, business associations and businesses have also voiced concerns over changing standard operating procedures (SOPs) and over inherent inconsistencies in some instances. In the short-term, confusion and difficulty in following the changes define the ‘new normal’, and in that sense, are acceptable; but there are concerns that this may affect expansion decisions in investors’ selection matrix in the future.

Theme 2: Businesses are well integrated within supply chain networks

Penang companies are strongly integrated into global value chains.4 Several parts of Klang Valley going under the enhanced MCO this year and manufacturing and business operations were disallowed spotlighted the regional value chain in Malaysia itself.

Companies in Penang with linkages to other companies in other parts of Malaysia experienced disruptions as some parts and components could not be manufactured and delivered despite the fact that operations of companies in Penang continued.

Some significant weak links in the supply chains are found within Malaysia itself, and thus the political uncertainties in other Malaysian states affect decision making among investors in Penang as well. In the long term, this situation affects Penang’s situation negatively, and be beyond its ability to do anything about.

Theme 3: E&E companies expect a positive outlook

By and large, the semiconductor, semiconductor-related, and E&E companies, which are vital to Penang’s economy, are optimistic and are not generally affected by the Covid-19 pandemic. These companies are also reporting capacity expansion, material sourcing and diversification, key markets expansion, and efforts to capture bigger market share to ride on the global E&E demand.

Local companies are also keen to upgrade themselves up the value chain with new product innovations and research and development (R&D) initiatives. In addition, some companies are eyeing expansion overseas to build synergistic linkages with major customers and partners in the global value chain.

While the above three themes do not directly address the issue of human capital, it must be noted here that the need for Penang to continue generating and empowering talent in the Industry 4.0 transition remains strong5. As companies navigate the challenges, pivot to new ventures or expand within a thriving segment, they require skilled talent.

With new realised investments taking off, the state government has noticeably also facilitated talent development and is exploring opportunities in Penang, especially where skilled talent demand is expected to persist.

Long-term Plans and Good Execution

Penang and Malaysia have a solid position on investors’ radar, backed by the country’s cumulative industrial experiences gained over the decades, its skilled talent pool, conducive business environment, and focus on promoted economic areas. The robust development in selected sectors such as E&E and medical devices (related to public health management) since last year has also spotlighted Penang’s solid foundations and the commitment to these key industries over the decades. However, there have been rising regional competitors in recent years, and Penang and Malaysia require continuous advancements in industrial strength and socio-political resilience.

Since Penang has a proven track record in manufacturing and business services, propelling innovation and allowing a collective rise up the value chain among industries in Penang should not be difficult. State economic advisor, Lee K. C., in a recent article proposed that the state set up a billion-Ringgit industry investment fund to invest in innovating businesses in Penang and nurture them to become global players.

This paper highlights the need for holistic long-term roadmaps with proper execution at the national level to navigate long-term economic and industrial development. Several reports and calls by investors have highlighted how important the availability of a skilled labour force is; the onus is on governments at all levels to clearly map out human capital plans in building a workforce equipped for Industry 4.0. Such plans would in turn be useful to stakeholders such as institutions of higher learning and industry members in crafting strategies for the future.

Finally, collaborations with all stakeholders remains an important factor for investment promotion. Support and facilitation from government agencies are important and the uncertainties during the MCO as voiced by industry members show that more needs to be done to promote a conducive business environment.

For list of references and appendix, kindly download the document to view.

Editor: Ooi Kee Beng

Editorial Team: Sheryl Teoh, Alexander Fernandez and Nur Fitriah (Designer)

You might also like:

On the Many Non-Economic Benefits of Flexible Work Arrangements

Reducing Moral Hazards in Malaysia’s Public Healthcare System

Penang's Economy is Healthy and Strong, with Incomes Rising and Inequality Decreasing

Food and Nutrition Security for Urban Low-income Households in Penang

The Value of Private Member’s Bills in Parliament: A Process Comparison between Malaysia and the Uni...