EXECUTIVE SUMMARY

-

- The agriculture sector in Penang has been affected by reduced agricultural labour as a result of containment, and limited access to agricultural inputs and market because of supply chain disruptions.

- Restrictions on transportation and movement of people have led to some logistical challenges, slowing agricultural services and preventing farmers, especially smallholders, from getting their products to market, leading to great loss of produce and income.

- These disruptions are not expected to be severe in the short term, however, as food supply has been sufficient and the market has been largely stable.

- Price spikes may be expected for higher value products such as perishable commodities rather than for staples that are still in adequate supply.

- It has become obvious even in the short-term, that increased adoption of digital technology is a necessity. In the longer term, this trend appears even more unavoidable in helping to improve agricultural productivity, reduce labour dependency, and link farmers to buyers and logistics services.

INTRODUCTION

Covid-19, a new strain of the coronavirus, has posed challenges to all economic sectors, especially agriculture. In Malaysia, the Movement Control Order (MCO)[1] initially caused some panic buying. With people staying indoors, cooking at home has been on the rise. This has led to high demand for fresh food items at local markets and supermarkets. At the same time, the lockdown to contain the coronavirus outbreak has been hurting the supply of labour and disrupting supply chains in the agriculture industry.

Food security is multidimensional in nature, involving factors such as food availability (supply), food accessibility (affordability) and utilisation (food safety and nutritional meals). The Covid-19 crisis has already been affecting food security and the food supply chain directly through impacts on food supply and demand, and indirectly through changing consumer behaviour, and affecting the capacity to produce and distribute food. The varied impact will however, affect the poor and vulnerable members in society most.

FOOD SUPPLY CHAIN DISRUPTION

The food supply chain is a complex network covering production, processing, distribution, retailing and consumption. So far, there has been no shock in Malaysia where the supply of food is concerned, but disruptions in the transport of food and in meal delivery have been repeatedly reported. A supply chain disruption is likely to affect higher-value items first, since these items tend to involve more tiers of suppliers and human interaction, and puts nutritious food more at risk than staples.

On the supply side, less production is expected, but at the time of writing, this is not yet noticeable. Road closures and transport restrictions have slowed down agricultural services and prevented farmers, especially smallholders, from selling their products or buying inputs, and this has led to loss of produce and loss of income. This may affect cultivation in the near term.

In addition, Malaysia’s agriculture sector is heavily dependent on foreign workers. Restrictions on the movement of people especially affect foreign workers and result in labour shortage on the farms. This affects the crops, livestock and fishery sub-sectors, especially the labour-intensive ones, and its impact is felt along the whole agriculture value chain, affecting food availability, and therefore market prices.

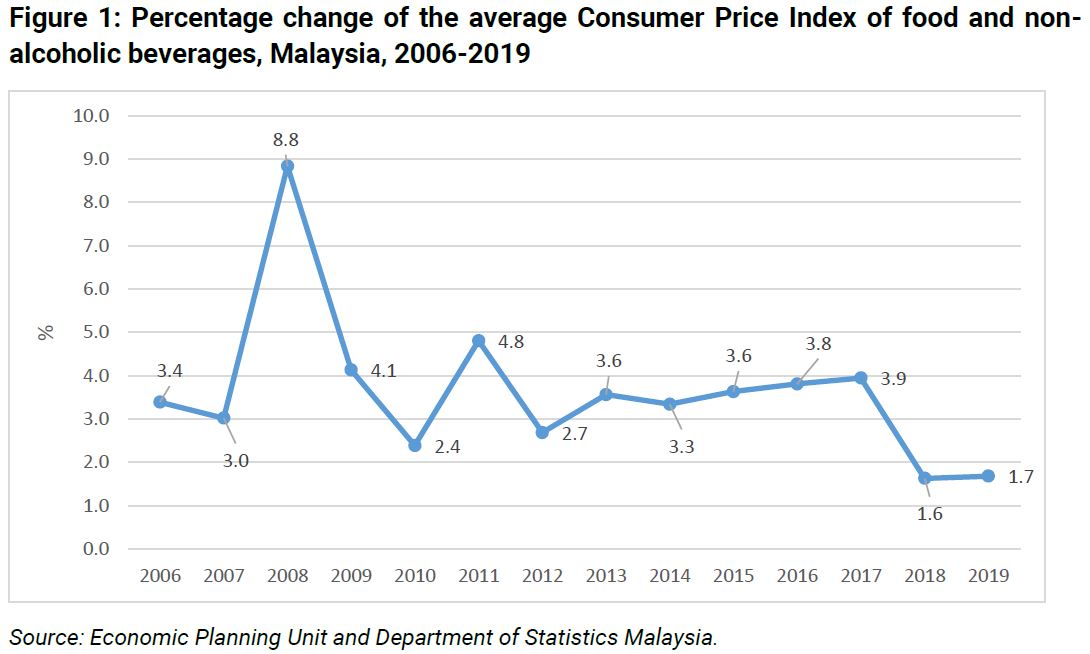

On the demand side, at the beginning of the outbreak, the market observed a significant rise in the demand of food, but this smoothed itself out quite quickly. Food demand is generally inelastic, especially for basic food commodities, and overall consumption over a limited span of time does not tend to vary much, even if dietary patterns may change.[2] An unusual and temporary increase in demand, tends to have an inflationary effect, prices of healthy foods may rise, and this will change the dietary pattern of consumers. Since poorer households typically spend the largest share of their income on food, a rise in food prices, however temporary, will hit them most. A quick glance at the global financial and economic crisis in 2008 shows that there was a significant increase in food prices in Malaysia (Figure 1). In early 2008, many food-exporting countries imposed export restrictions on food commodities, especially rice, corn, wheat and soybeans, to secure supplies to domestic markets. Consequently, food-importing countries showed signs of panic and resorted to ‘panic buying’ to prevent social unrest.

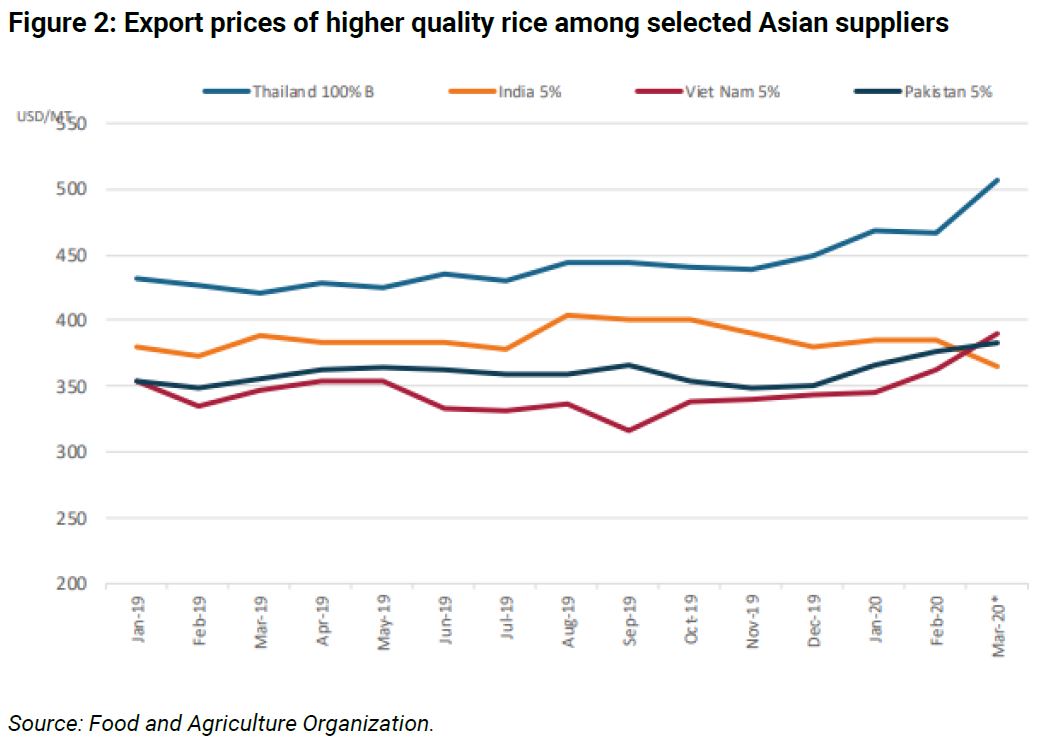

Similarly, as the Covid-19 continues to spread across the world, panic buying and concerns over food supply chain disruptions have caused some countries to stop exporting some staple foods to avoid domestic shortages. For instance, Vietnam, the world’s third-largest shipper, has reduced its rice exports by 40% in April and May compared to the same period last year, while Myanmar has also said that it may cut overseas sales to shore up domestic supplies. According to Reuters, rice prices in Thailand have reached their highest in seven years as Thai exporters anticipate higher demand for Thai rice after fellow top exporters India and Vietnam both cut the volume of their exports of the item (Figure 2). If left unchecked, the chain effect of this sequence of development could lead to global food price crisis, precipitated by heightened demand for a key item.

CURRENT STATUS OF THE AGRICULTURE SECTOR

The crops sub-sectors

Although the agriculture industry was labelled by the federal government as critical during the MCO, allowing businesses to operate as usual, the limited supply of raw materials, labour and market access, along with logistical constraints, adversely affected the food supply system. According to the Department of Agriculture (DOA) Penang, a number of issues occurred under the MCO including the limited availability of fertilizers, pesticides, seeds, machinery spare parts, and farm equipment. Moreover, farmers have had trouble marketing their products. Perishable and fresh produce such as vegetables were more affected, resulting in increased levels of post-harvest lost (PHL) and food waste. The sector has also been affected by reduced agricultural labour, especially where labour-intensive crops are concerned.

According to the Ministry of Agriculture and Food Industry (MOA), current local rice stock at the factory, wholesale and retail levels stands at about 523,000 metric tonnes. This does not take into account existing locally produced and imported rice. Currently, the country’s rice imports are not affected by the pandemic and are running as usual. Apart from Vietnam[3], Malaysia is still importing rice from Thailand, Pakistan, Myanmar, India, Cambodia and others. More than 100,000 metric tonnes of rice are on the way to Malaysia. In addition, there are 150,000 metric tonnes in emergency stockpiles, which are managed by BERNAS, spread throughout Malaysia at secret locations. Malaysians consume about 200,000 metric tonnes of rice a month. Yet, country’s rice self-sufficiency level (SSL) is around 70% making for a monthly average of about 140,000 metric tonnes. It indicates that Malaysia has sufficient rice to last up to six months if the coronavirus crisis persists.[4]

Penang has the second highest rice yield in the country, after Sekinchan in Selangor, and currently producing about 70% of its total rice consumption.

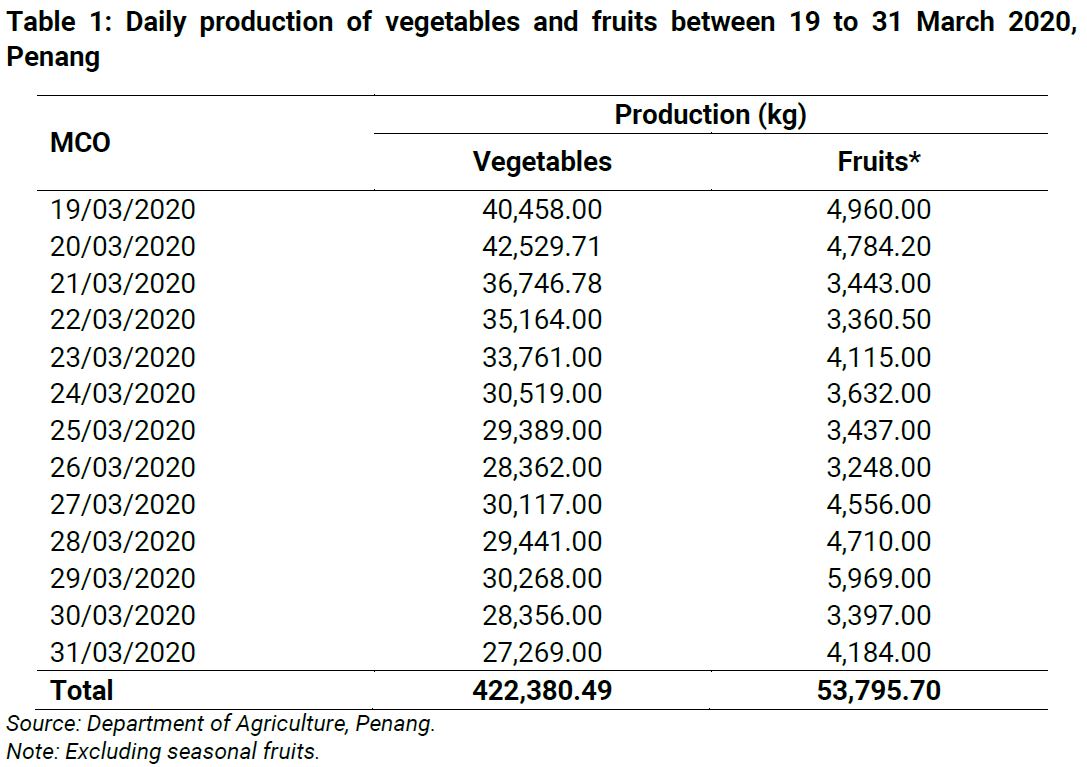

As a whole, Malaysia relies heavily on imported vegetables and fruits to feed its population. In 2018, the SSL for vegetables and fruits were about 46.6% and 78.4%, respectively.[5] The DOA has been closely monitoring the daily production of fresh produces during the crisis. During the first phase of the MCO, vegetables and fruits production in Penang dropped at an average daily rate of 3% and 1.3%, respectively (Table 1).

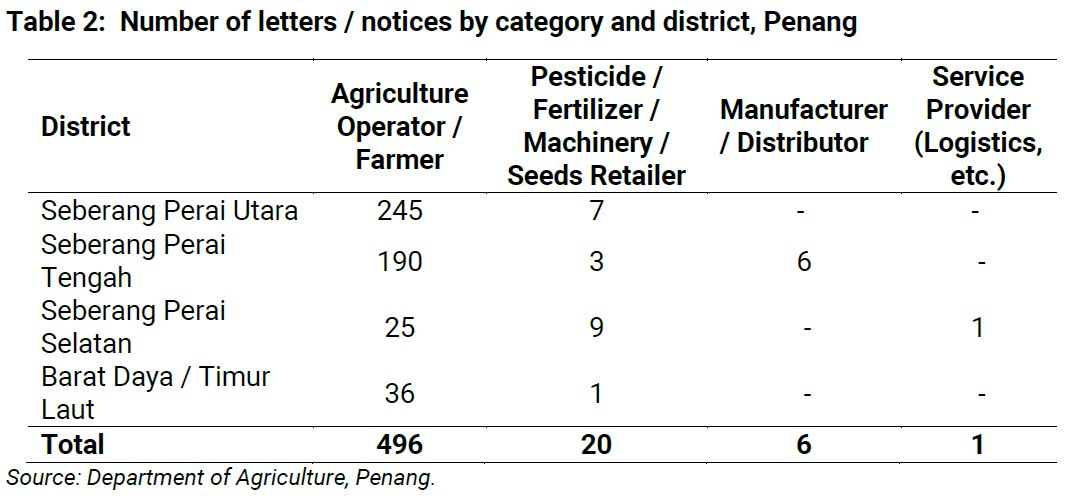

The MOA has outlined guidelines to ensure that industry players in the agriculture sector can continue their operations so that the food supply chain can be kept undisrupted. During the MCO period, MOA has agreed to issue a letter of authorization and notice of operation of the premises to the food supply and marketing industry players. The DOA in Penang has begun implementing these guidelines by issuing letters of approval and notices of operation to companies, entrepreneurs and farmers (Table 2).

The livestock sub-sectors

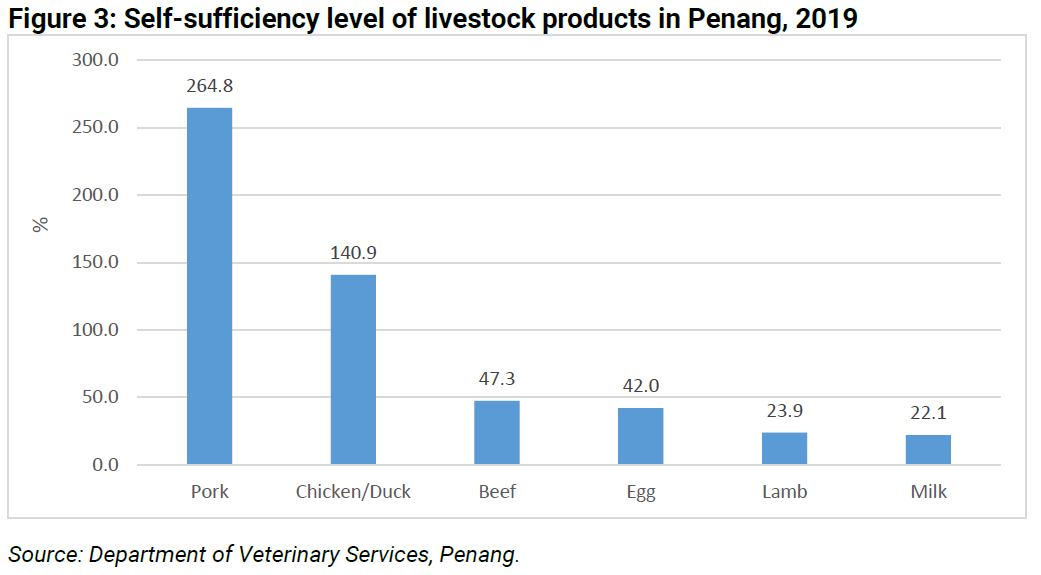

For many years, the production of poultry meat and pork in Penang has been above local demand. These two areas make up roughly 82% of the total livestock production in Penang. In 2019, the SSL of poultry meat and pork were recorded at about 141% and 265%, respectively.[6] However, the production of egg, fresh milk, cow/buffalo meat as well as goat/sheep meat, are inadequate to meet local demand (Figure 3). The excess demand for egg is met nationally, as Malaysia is more than 100% self-sufficient in egg production. Supply shortages of other livestock commodities need to be met through imports.

According to the Department of Veterinary Services (DVS) Penang, the production of chicken and duck meat in Penang is estimated to be around 8,000 metric tonnes per month, to be compared to the local consumption of 5,664 metric tonnes a month. It is also estimated that the current local beef supply of 543.4 metric tonne can be utilized for a minimum of 2 months based on an estimated 271.3 metric tonnes monthly demand. In addition, about 3,375 cattle/buffalo (421.9 Metric tonnes) was imported from January to March 2020, which can supply the state with meat for more than one month. This indicates that the local and imported meat supplies are sufficient for at least the next three months. The price of poultry and beef has remained stable during the MCO, while there has been a slight increase in egg prices. Demand for beef and eggs is expected to decline and supply might surge during the MCO period, as many eateries and retail centres reduce their operating hours. So far, livestock supply has remained stable and under control.

Although the supply of livestock products is sufficient, some sub-sectors have experienced negative impact from the Covid-19 pandemic. During the first phase of the MCO, some small-scale farmers and distributors had difficulty selling their products due to bad market access and logistical constraints. For instance, about 49 small-scale dairy farmers could not sell their milk products (approximately 1,100 litres of cow/goat milk) daily which led to an estimated total loss of RM7,000 per day. A cost of RM4,320 and RM7,393.7 per day were borne by traditional poultry and large ruminant farmers respectively. These had needed to keep the livestock for longer than normal before selling them off. Moreover, since April 1, the price of livestock feed, especially cattle feed, has increased by about 3-6% mainly due to the rising prices of molasses and Palm Kernel Expeller (PKE) by 22% and by 32-36%[7] respectively. This in fact adversely affected the total production costs, as feed accounts for more than 60% of the total costs of production. The total loss of the livestock sector has been estimated at RM18,713.68 per day (RM261,991.52 during the first two weeks of MCO).[8]

About 90% of the raw material used in Penang for livestock feed formulation is imported. During the Covid-19 pandemic, export restrictions on animal feed can be expected which would in turn negatively affect the local production, placing upward pressure on prices. In the long run, the country as a whole may suffer a food crisis if the food supply chain is not well managed well by the government.

The fishery sub-sectors

Fish and aquatic foods are important items of nourishment in Malaysia. Malaysians are among the top fish consumers in the world, imbibing about 57 kg of fish per person each year. The sector therefore plays an important role in food security. The fish market system in Penang has however been negatively affected by the Covid-19 pandemic. A disruption in fish supply chain is already happening as a result of problems in transportation, trade, and labour.

During the first phase of the MCO, some fishermen and culturists faced difficulties in selling their products as the market demand for fresh fish and aquatic products saw a sudden decline, coupled with limited sales operations due to the closure of, or the limited opening hours for the morning and night markets. Many wholesalers also stopped buying fish and aquatic products as restaurants were ordered to remain shut except for takeaways. Hence, many fishermen were reluctant to go out to the sea. The livelihood of fishermen and coastal fishing communities has therefore been affected.

According to the Department of Fisheries (DOF) Penang, it is estimated that captured fish significantly declined by about 70-90% in March 2020 as compared to February 2020.

Aquaculture production also declined notably, by about 79.5% (2,960 metric tonnes valued at RM42,248,000) in March 2020 as compared to a month before, mainly due to limited access to inputs such as seed and fish food, labour shortage, as well as limited operations of seafood restaurants and hotels. Falling captured fishery and aquaculture products has resulted in lower local fish supply to markets. This is expected to push the price of fish and aquatic foods up and make them less affordable. In addition, many people employed in this sector, such as fish vendors, processors, and suppliers may lose their jobs. This trend is therefore expected to have a significant economic effect on the fishing industry and fishing communities.

PROPOSED MEASURES TO KEEP FOOD SUPPLY CHAIN ALIVE DURING THE COVID-19 PANDEMIC

1) Supporting farmers in producing and marketing food: Restrictions on movement are limiting farmers’ access to markets to buy inputs and sell products. Hence, finding ways to support farmers, especially small-scale farmers, in producing food and in remaining connected to the market is crucial. Going forward, urgent increases in food availability, especially from smallholder farmers, through providing productivity-enhancing safety nets and reducing PHL, is required. The country is currently implementing stimulus packages, albeit without clear incentives to smallholder farmers. Grants to poor small-scale farmers that have lost their income should be considered alongside with grants for restarting production. Smallholder farmers should be given access to necessary tools and technologies that will allow them to boost production. These can include high-quality seeds, fertilizers, and sufficient farming equipment. Taking measures such as safe labour practices and providing protective equipment (e.g. masks and gloves) for farmers can reduce the spread of Covid-19 and promote food production. Helping farmers adopt labour-saving practices that compensate for reduced labour availability is also important.

It is suggested that the State Government facilitate marketing of agricultural products, especially perishable commodities, by constructing cold storages and freezers in different production areas to minimize PHL. Furthermore, collection centres should be brought closer to smallholder producers. In order to link farmers to markets, artificial constrains to trade throughout the food supply chain need to be removed.

Finding alternative livestock feed sources that can be produced locally such as oil palm by-products and maize production for livestock feed should help reduce the dependency on imported feed.

2) Digital agriculture solutions: Applying digital technologies can assist farmers in adopting labour- and input-saving practices. Technologies that link farmers to buyers and logistics services can help minimise the impact of the pandemic on the supply chain. In addition, digital technologies will enable us to understand more clearly the impact of the pandemic on agricultural production, labour availability, input supply and logistics. For instance, applying remote-sensing tools combined with machine learning can help map disruptions in crop production. Data collection using mobile apps and social media can be deployed to monitor the how farmers and consumers are affected.

3) Agri-food E-commerce: Empowering e-commerce in agribusiness[9] is another path to take, as this facilitates trade, reduces transportation risks and allows access to the market. The government has allocated RM40 million to help SMEs in the agriculture sector sell their products on e-commerce platforms and reach a larger pool of consumers.[10] Smallholder farmers will need special help to market their products through e-commerce.

4) Big-data platform: It is also important that the movement of agricultural products across the country is properly monitored. Big-data platforms can link the main elements in the agricultural product supply chain to enhance circulation efficiency. Combination of big-data platforms with e-commerce will bring additional benefits.

5) Public-private partnerships: Public-private partnerships and investments in existing agricultural technology programmes can ease the management of Covid-19. The strengths of the public and private sectors can complement each other by providing information and advisory services that address the needs of key players in the food supply chain.

6) Price control: It is also important that food prices and markets are properly monitored, and information transparently disseminated. The more reliable the information about government policies and actions are concerning the food supply chain, the less the risks are for public panic and social unrest.

7) Food banks and community-based groups: Food banks are a good means for securing food, supplied or donated by different actors. The delivery of secured and protected in-kind food assistance and protection kits to the most vulnerable, such as the elderly, persons with chronic illnesses, poor, etc. should be encouraged.

POST COVID-19: RECOVERY FOR THE AGRICULTURE SECTOR

Food supply chain disruptions highlight the importance of risk management. The agriculture sector in Penang needs to be more resilient to production and market risks. On-farm and market-based risk management strategies and tools can help farmers cope with uncertainties (e.g. market price variations, climate change, disease, etc.). In the long term, the country needs to invest in disaster preparedness, especially where the food supply chain is concerned.

Covid-19 has put a renewed urgency for the general use of automation. Agriculture 4.0 and digitisation of the supply chain is the way forward. Precision farming and advanced technologies will allow farms to be more efficient, productive, profitable, safe and environmentally friendly. In this context, big data analytics, cloud computing, blockchain, and artificial intelligence can be applied to facilitate and manage farm systems as well as supplier relationships and logistics. Hence, during the post-Covid-19 recovery phase, policymakers have to pay close attention to trends in automation.

In Malaysia, fears about agricultural-labour shortages had been rising even before the Covid-19 crisis. With the pandemic, that challenge has been compounded. The sector desperately depends on foreign labour. As the pandemic forces countries to close their borders, farms face severe labour shortages. Disruptions to the supply of workers will likely cause shifts within the sector even after the pandemic ends. Applying digital technologies is a promising way to reduce labour dependency.

In light of the Covid-19 outbreak, consumers are changing their purchasing modalities and behaviour in ways that can shape future consumption patterns. The MCO has encouraged an increase in the purchase of both staple food and ready-to eat food that can be stored, increased e-commerce deliveries, and rise in consumption at home. These behavioural changes can have lingering and even permanent effects. Buying groceries online and restaurant food takeouts will become more of a norm. With this in mind, agribusinesses will need to change along with consumer trends and adjust rapidly to the changing landscape.

[1]The MCO began on 18 March 2020, and after two extensions so far, is to last until 28 April, unless another extension is announced.

[2]FAO. n.d. Market Assessment and Analysis Elasticity of Supply and Demand. Food Security Information for Action. Retrieved from: http://www.fao.org/elearning/Course/FM/en/pdf/Elasticity.pdf

[3] In March and early April 2020, Vietnam temporarily suspended new rice export contracts while undertaking a review of its stockpiles to ensure that it has enough domestic supplies to cope with the coronavirus outbreak.

[4]Aiman, A. (2020, April 3). Enough rice to last up to 6 months, says Khazanah researcher. FMT News. Retrieved from: https://www.freemalaysiatoday.com/category/nation/2020/04/03/enough-rice-to-last-up-to-6-months-says-khazanah-researcher/

[5]Department of Agriculture, Penang.

[6]Department of Veterinary Services, Penang

[7]Although both molasses and PKE (important ingredients for the formulation of animal feeds) are locally produced, the MCO and logistical constraints have led to rising prices.

[8]Department of Veterinary Services, Penang

[9]Agribusiness is the business sector encompassing farming and farming-related commercial activities.

[10]Zulkepli, F. N. (2020, April 8). Malaysia: Stimulus packages to combat the impact of COVID-19. MSI Global Alliance. Retrieved from: https://www.msiglobal.org/newsandknowledge/malaysia-stimulus-packages-to-combat-the-impact-of-covid-19/

You might also like:

Covid-19: Impact on the Tertiary Education Sector in Malaysia

Covid-19: Impact on the Tertiary Education Sector in Malaysia Transforming Tourism in Penang: Suggestions for the Short and the Long Term

Transforming Tourism in Penang: Suggestions for the Short and the Long Term Environmental Policy Lessons to Learn From the Covid-19 Pandemic

Environmental Policy Lessons to Learn From the Covid-19 Pandemic Some Suggestions Regarding Penang's Post-Covid-19 Economic Restart

Some Suggestions Regarding Penang's Post-Covid-19 Economic Restart Specifics of the Impact of Covid-19 on the Young

Specifics of the Impact of Covid-19 on the Young