EXECUTIVE SUMMARY

- Penang’s economy is led by manufacturing and tourism-related activities. Both these sectors have experienced bullish growth since the easing of pandemic health rules.

- However, a higher inflation rate shows the upside risks including strengthened domestic demand and global input shortage.

- The manufacturing sector saw a strong positive growth in output value, supported by improved external demand and realised domestic and foreign investments.

- Growth in the agriculture sector is predicted to be moderate owing to labour shortage and high production costs resulting from the current geopolitical crisis.

- While the tourism industry was hit the hardest by the pandemic, accommodation, retail trade, tour and travel, medical tourism and other tourism-related services have seen a strong rebound in the last six months.

- Labour market conditions are improving, as seen in a higher labour force participation rate, a lower unemployment rate and a lower number of employee retrenchment.

- However, high turnover rate, high demand for workers, talent shortage and demand for remote work remain critical issues in the post-pandemic period.

Introduction

As businesses recover from the pandemic, they are being hit by headwinds worldwide. The global economic recovery has mired, a situation exacerbated by Russia’s invasion of Ukraine and US-China trade tensions. The geopolitical uncertainties are hurdles to economic recovery, alongside a slowdown in China stemming from its zero-Covid policy, the tightening of financial conditions against higher-than-expected inflation, energy shortages, and even stagflation.

As projected by the International Monetary Fund (IMF) in July 2022, the world output is estimated to grow moderately in 2022 at 3.2%, predominantly driven by the slowdown in two giant economies, i.e. China and the US, while Japan’s is expected to flatten. The emerging economies on the other hand are projected to grow faster at a rate of 5.3% in 2022 compared to a year before, when it was at 3.4%.

Given that Penang’s economy is deeply rooted in the global manufacturing supply chain, how global political and economic headwinds fare in the near future will have some impact on the state, with special focus being on China, the US and Taiwan, which are Malaysia’s important trade partners for electronics products.

Penang’s economic landscape

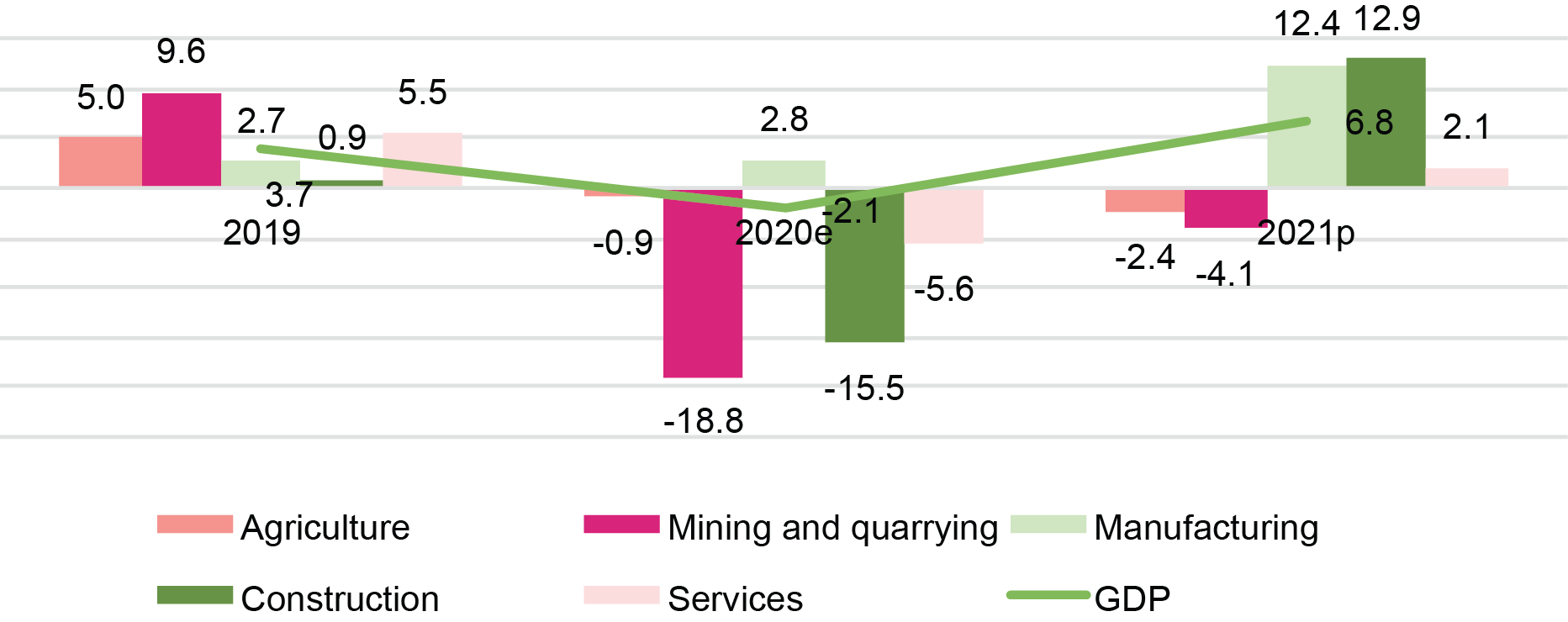

In 2021, Penang’s economy achieved the highest growth rate among Malaysian states, at 6.8%, with its contribution to the national Gross Domestic Product (GDP) rising to 7.1% — a rate that is higher than the pre-pandemic level of 6.6% in 2019. The growth was primarily supported by a strong rebound in the manufacturing and construction sectors respectively at 12.4% and 12.9%.

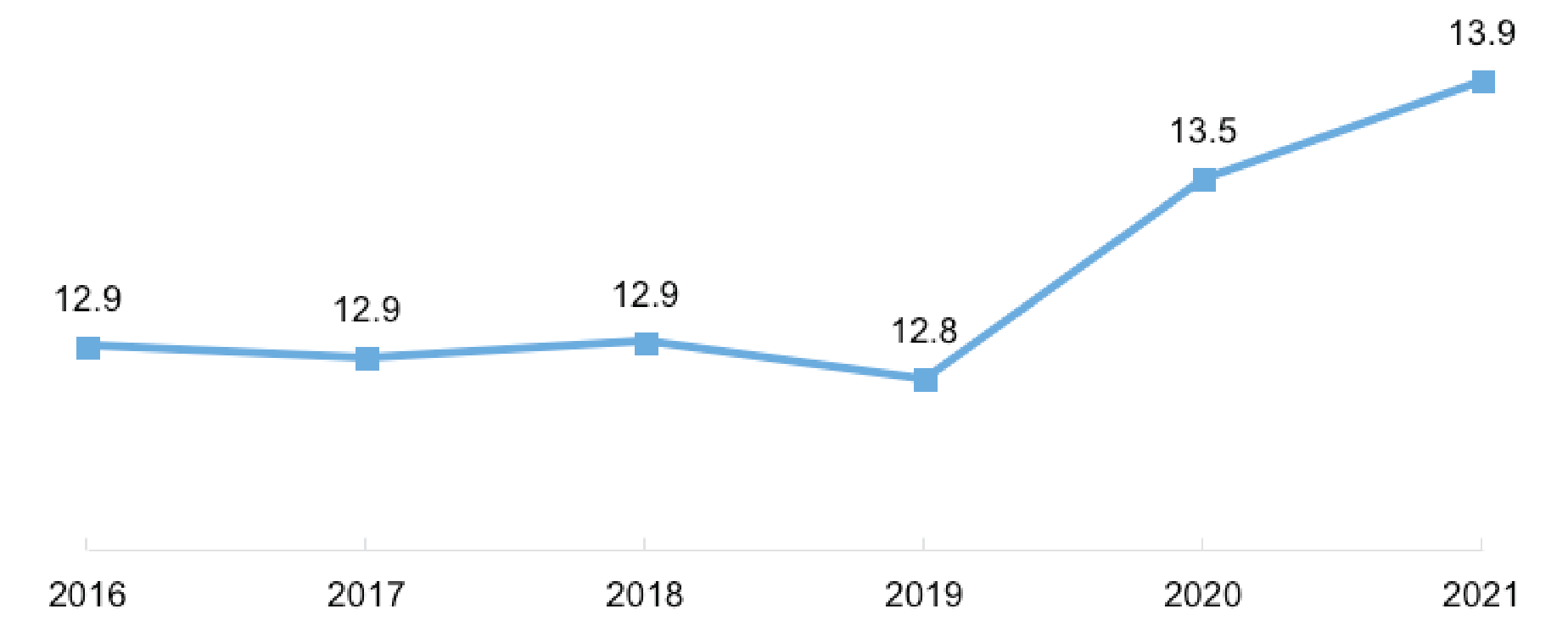

The manufacturing output expanded significantly to 47.3% in 2021 from 42.8% in 2019, sharing the same pie with the services sector. In light of the growing importance of the sector in Malaysia (Figure 2), its electrical & electronics (E&E) products made up 33.6% of Penang’s GDP, and it is the state’s largest GDP contributor.

Figure 1: Growth rate of Penang’s GDP, 2019-2021 (%)

Note: e refers to estimate; p refers to preliminary.

Source: Department of Statistics Malaysia (DOSM).

Figure 2: The percentage share of Penang’s manufacturing contribution to the national GDP (%)

Source: Department of Statistics Malaysia.

As the country’s second-largest manufacturing state, the investment climate in Penang remains robust. Last year, a new record in manufacturing capital investments was approved, benefitting from the US-China trade conflicts and the weak Ringgit. Solid industrial foundation and talents are the pull factors for continued inflow of investments, along with strong demand for electronics that are vital for remote working and learning in the post-pandemic period.

The services sector shrank to 47.4% in 2021 compared to 51.4% in 2019, with wholesale and retail trade, food and beverage and accommodation contracting by 1.7% in 2021. However, this sector is predicted to recover steeply in 2022, strengthened by the booming of tourism activities in the past six months.

Nationally, distributive trade sales registered solid growth (+26.3% in Q2 2022) while retail spending, wholesale trade and motor vehicle sales recorded double-digit growth rates.

The construction sector, which is primarily driven by its residential and non-residential buildings, is the third-largest contributor to Penang’s economy. This sub-sector made up 78.3% of the total value of work done in Penang as of Q2 2022, followed by civil engineering and special trades activities.

Meanwhile, output from the agriculture sector shrank by 2.4% in 2021 due to lower production caused by the labour shortage and the rise of other input costs.

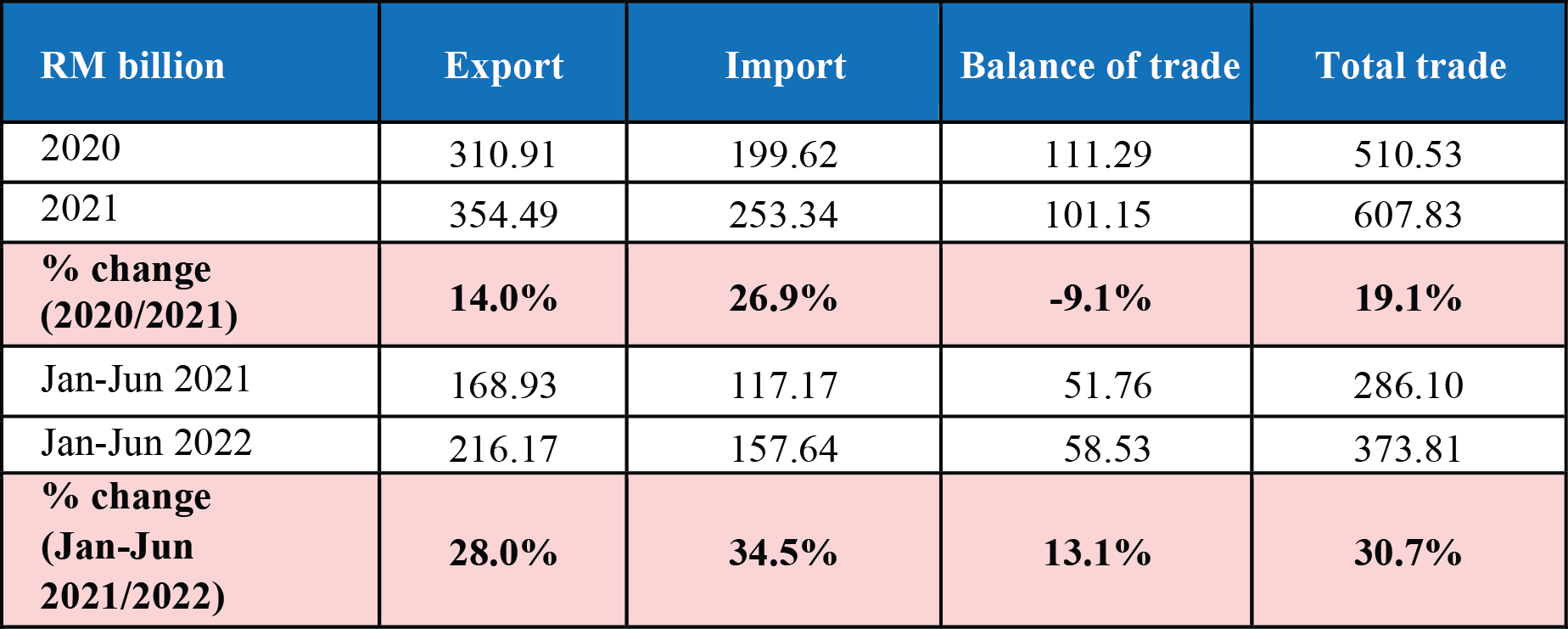

In terms of international trade, Penang continues to be the most important contributor to Malaysia’s trade. Both exports and imports grew at double-digit rates in the first half of 2022 (Table 1).

Table 1: External trade in Penang

Source: Department of Statistics Malaysia.

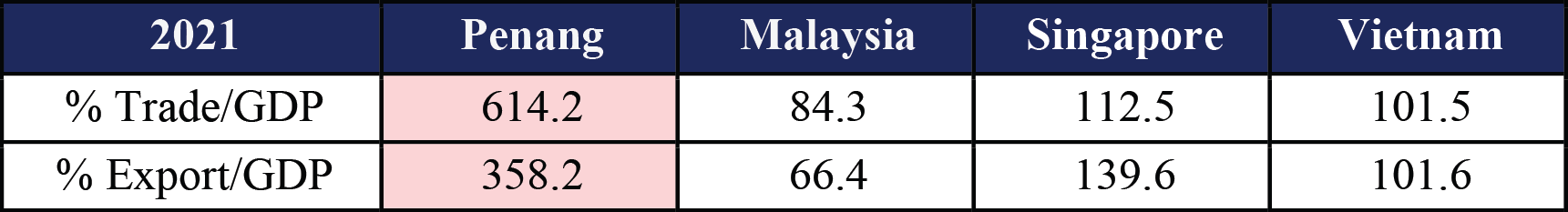

Penang’s exports constituted 29.2% of the country’s exports, with Penang International Airport being the largest export channel in Malaysia. The growth momentum of its imports continue, likely boosted by the effects of the weakening Ringgit. These imports are largely intermediate goods needed to support export-oriented industries, as shown in the substantial value of the exports-to-GDP ratio (Table 2).

Table 2: Exports-to-GDP and trade-to-GDP ratios

Note: Data refers to merchandised trade only.

Source: World Bank and DOSM.

Penang’s trade-to-GDP ratio expanded, indicating the openness of the state to international trade, and benefitting from the US-China trade tension (Table 2).

Product-wise, machinery and transport equipment are among the top exporting products. These are largely contributed by medium and high-tech industries such as automation, aerospace, and electronic manufacturing services.

The bread and butter of inflation

Global supply chain disruptions (following the Russian invasion of Ukraine) is not the sole reason for the rapid increase in prices of goods. Domestic policy measures such as the hike of the minimum wage and reduced foreign labour exert upward pressure on costs of production, which has lowered a production rate that was already weakened by supply shortfalls stemming from the pandemic.

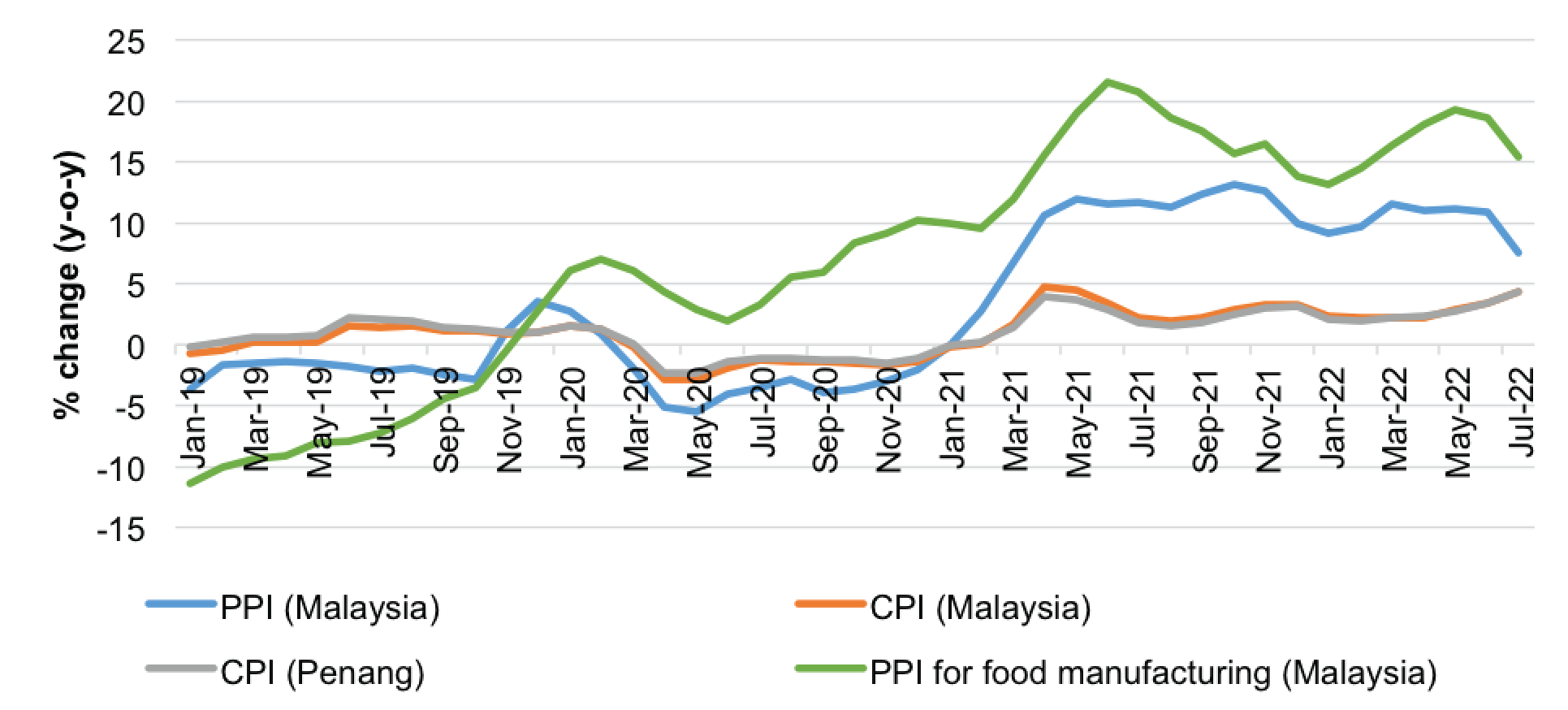

Compared to the first seven months of 2021, Malaysia’s producer price index (PPI) swelled by 10.2% for the same period of 2022.[1] PPI in the manufacturing sector[2] expanded the most at 9.1%, with the cost of food manufacturing – the second-largest component in the PPI[3] – increasing at 16.5%.

The notion of higher costs of production translating into higher consumer price inflation is true to a certain extent. Higher prices in imported goods (or the weaker exchange rate), indirect taxes and prices of crude materials may raise input prices, leading to higher output prices. In Malaysia, the pass-through effect is lower-than-expected due to the government’s price control measures and subsidies in the face of a steep rise in input costs (Figure 3).

Additionally, the consumer price index (CPI) is also a measure of goods and services demanded by individuals. The already buoyant consumer spending fueled by fiscal stimulus packages i.e. the special EPF withdrawals in Apr 2022, accelerates the CPI.

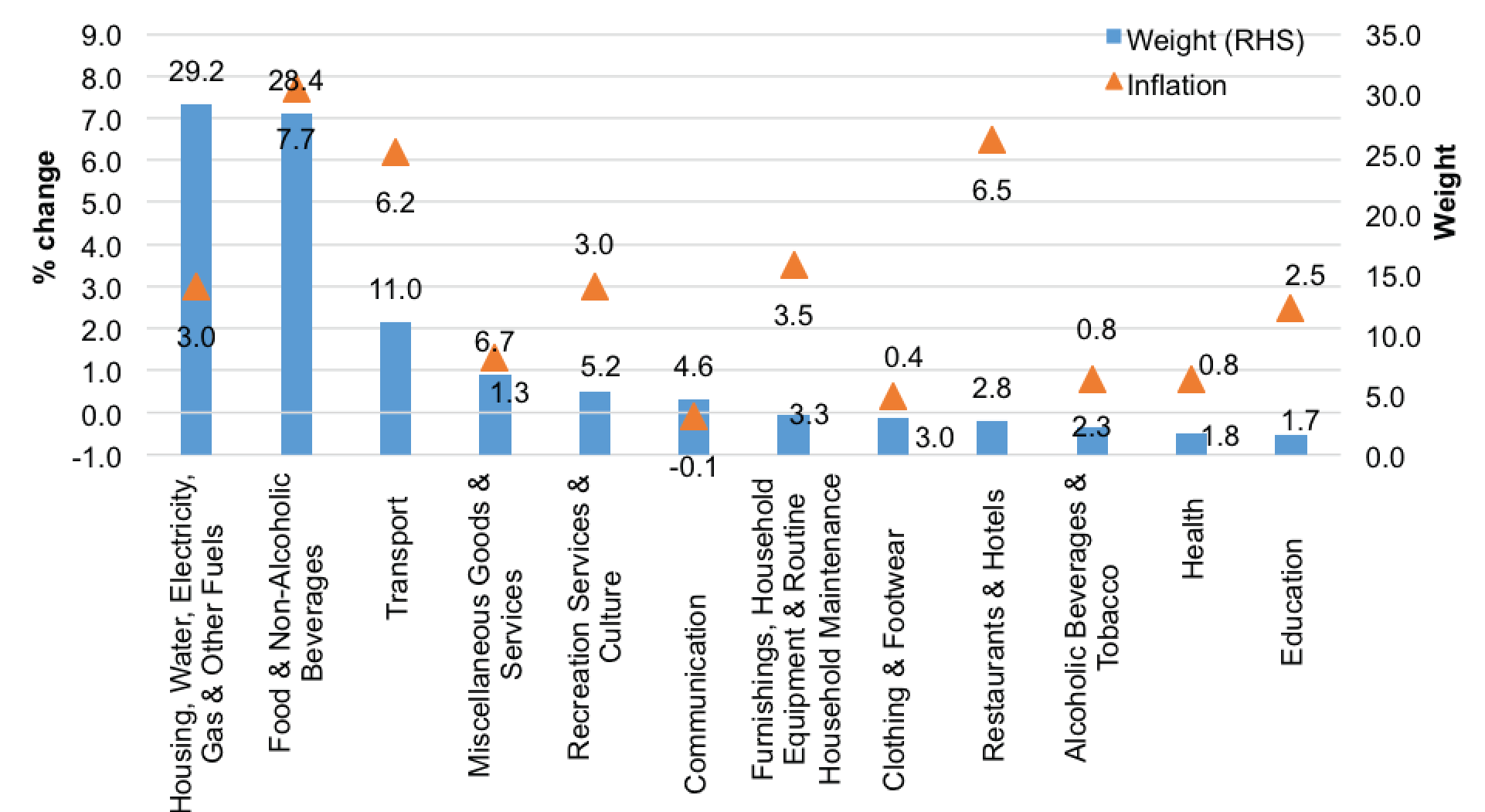

In Penang, the top three components that saw higher consumer inflation are food & non-alcoholic beverages, restaurants & hotels and transport. This indicates that the pandemic’s hardest-hit tourism activities are seeing a strong rebound.

Figure 3: The percentage changes of consumer price and producer price indices, Jan 2019-Jul 2022

Source: Department of Statistics Malaysia.

This rebound is not only contributed by domestic tourists but also international visitors, particularly from Singapore and Indonesia. In Q2 2022, Penang experienced two-fold passengers handled by its international airport compared to the first three months of the year.

Penang’s inflation rate marked a decade-high increase in July 2022 at 4.3% (year-on-year) – on par with Malaysia’s rate. Penangites spend nearly 30% of their expenditure on housing, followed by food (28.4%) and transport (11%); the prices of food & non-alcoholic beverages saw the highest increase at 7.7%, with the prices of restaurants & hotels and transport trailing at 6.5% and 6.2%, respectively (Figure 4).

Meanwhile, the highest increase in Malaysia has been recorded for food (+6.9%), followed by health (+5.8%) and furnishing and household equipment (+5.6%) in July 2022 (y-o-y).

Figure 4: Percentage change of CPI in Penang, Jul 2021/2022

Source: Department of Statistics Malaysia and Penang Institute (2020).

The gainers and losers of improved labour market conditions

Following the reopening of international borders and economic activities, labour market conditions have tremendously improved, with a higher labour force participation rate, a lower unemployment rate and a much lower number of workers becoming redundant. However, high turnover rate, high demand for workers, talent shortage and demand for remote work are critical issues that have arisen post-pandemic.

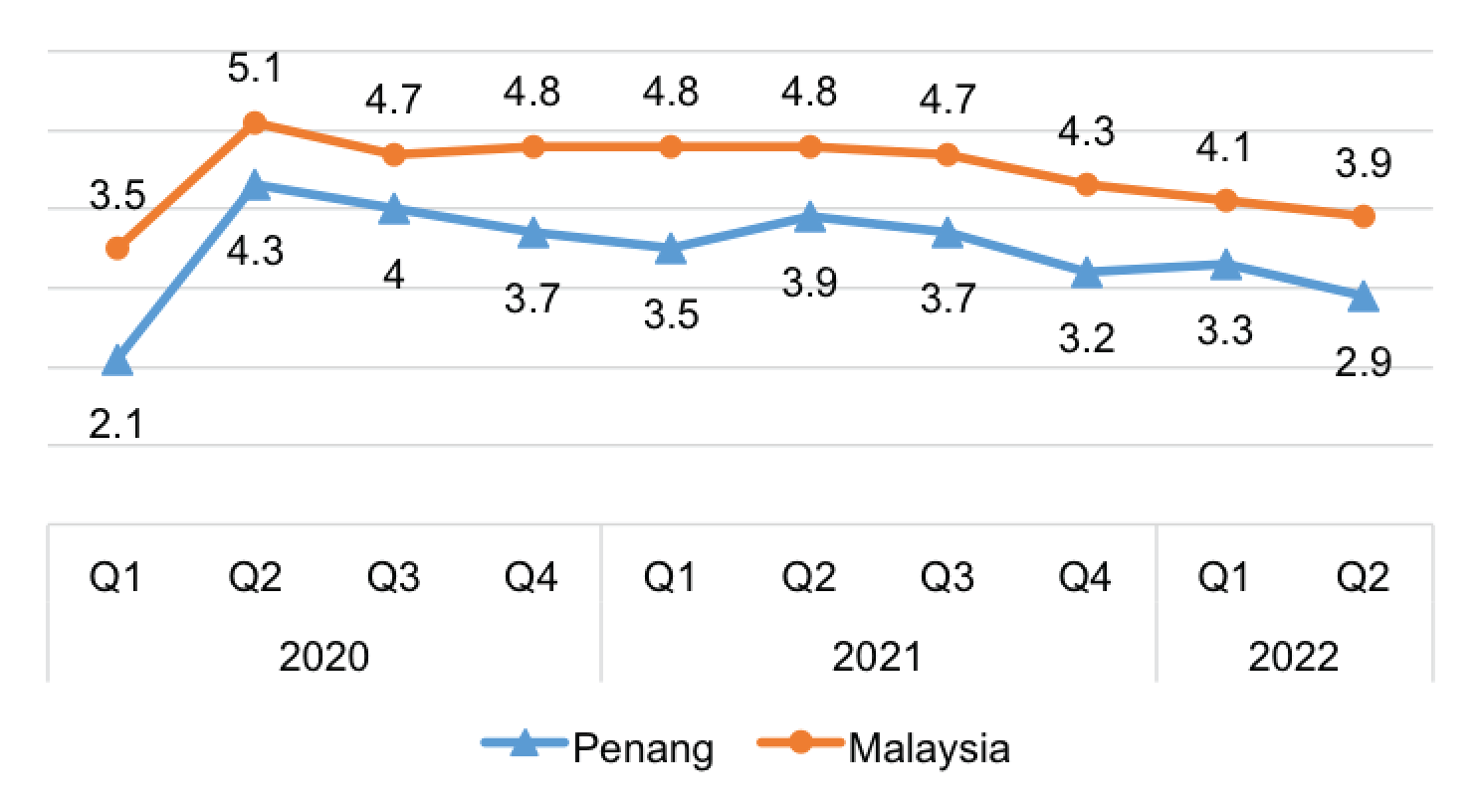

Penang’s labour force participation rate recorded a two-decade high, exceeding 70% in 2021, with the unemployment rate easing at a faster rate than at the national level (Figure 5). The reported loss of employment reduced drastically from 10,465 people in 2020 to 3,519 people in 2021, and 1,212 as of 12 August 2022.

According to PERKESO’s MYFutureJobs, the top five hiring industries in Penang are manufacturing, construction, support service, accommodation, and wholesale and retail. Meanwhile, the DOSM’s second quarter 2022 Job Market Insights shows that Malaysia’s total job vacancies surged by 27% quarter-on-quarter (q-o-q) from 159,148 in Q1 2022 to 202,102. More importantly, 72.2% of the job vacancies were of high skills.

Figure 5: Unemployment rates in Penang and Malaysia

Source: Labour Force Survey Report, Department of Statistics Malaysia.

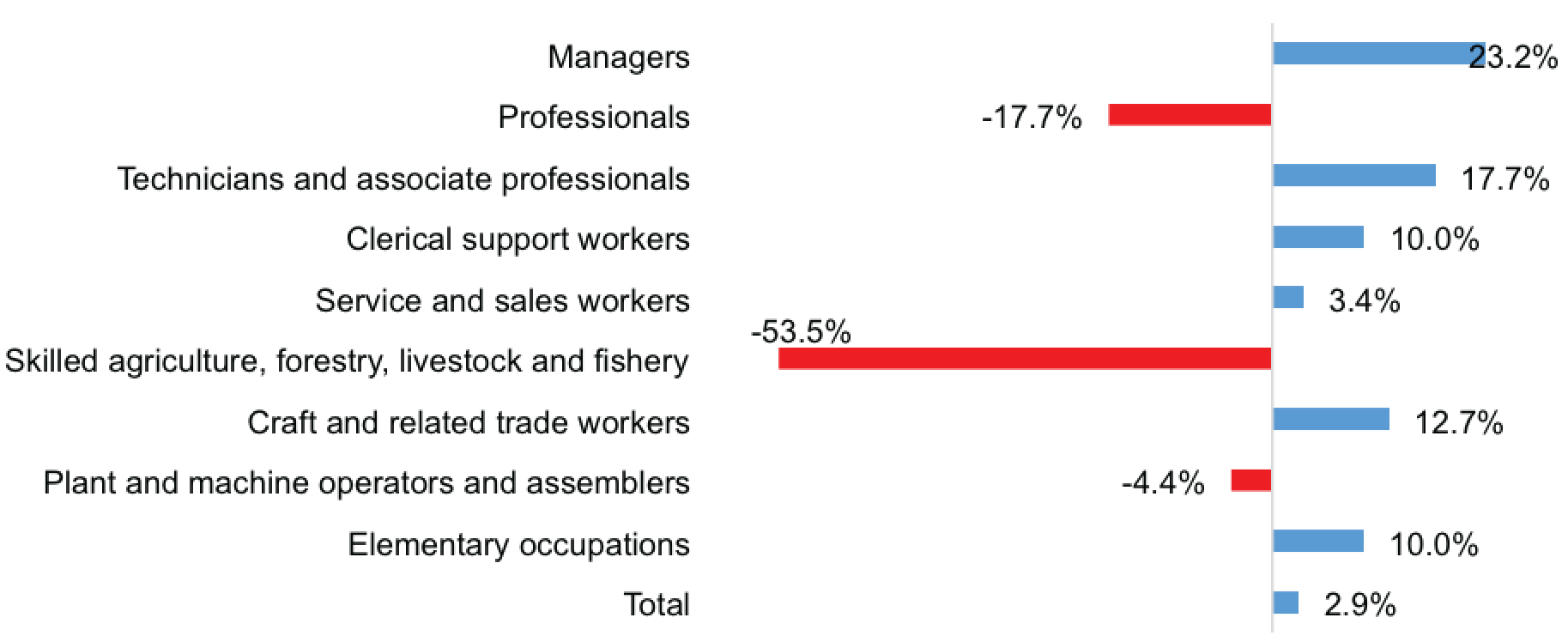

In 2021, Penang’s employment increased across all occupational groups except for skilled agriculture workers, professionals and plant operators (Figure 6).

Figure 6: Percentage change of employed persons by occupational groups in Penang, 2021

Source: Labour Force Survey Report, Department of Statistics Malaysia.

While the decline in skilled agriculture and plant operators may be due to the lack of foreign workers, the shrinkage in professionals’ employment may be attributed to labour turnover. Anecdotal evidence suggests that the tax, accounting and construction sectors saw active resignation due to the lifting of international travel borders.

A study by Penang Institute done in 2021 also found that a small number of engineering and accounting & finance graduates with excellent academic grades planned to explore job opportunities in Singapore.[4]

Hiring and employee retention difficulties are prevalent, partly driven by positive business recovery and solid consumer demand. Job opportunities accelerated by business investment make recruitment policies more progressive domestically and internationally. This has inevitably led to a tug of war between wage inflation and high levels of resignation.

While technology addresses talent challenges, businesses are struggling with the shorter-term repercussions of the pandemic, and are often unable to fulfil the demand for talent. Based on JobStreet’s Job Outlook Report released in June 2022, job vacancies in manufacturing, computer/IT and retail/trade were the hardest-filled industries in Malaysia.

Salary mismatch is a concern for both employees and employers. The great job boom is benefitting employees and job seekers as there is room to negotiate for better roles and terms of employment, while employers wrestle with a great talent crunch.

With increasing inflation in the price of goods and services, salary adjustment is needed to reflect the actual economic progress. Employers who are unable to raise salaries immediately to compensate for rising prices are likely to lose out in the talent war.

Under normal circumstances, salaries rise fastest in in-demand jobs and industries that have the lowest unemployment. According to JobStreet Malaysia’s Salary Report 2022, managerial positions in the science and technology industry commanded the top pay rises, with a median y-o-y salary growth of 17.2%. At the same time, entry-level jobs for E&E industries registered a significant median salary growth of 15.4%.

Other initiatives to enhance employee retention and attract talents include improved compensation packages, greater opportunities for career growth, forward-thinking management and leadership, and a positive work environment.

To be sure, the so-called artificial salary bubble is another worry hampered by the longstanding mismatch of skills and competencies. Therefore, active communication and collaboration between universities, policymakers and industries are necessary to prepare graduates with solid fundamental skills and with the competencies that are needed by the market.

Post-pandemic economic prospects 2022/2023

On Aug 12, Bank Negara Malaysia announced that Malaysia recorded a high growth of 8.9% y-o-y in Q2 2022, supported by strengthened domestic demand, its reopening of international borders, and strong demand for E&E products. On the contrary, besides the risks to the global outlook that seems to be tilted downside due to the global political-economic events, Malaysia’s economy is also grappling with a weakened Ringgit and rising production costs.

Penang’s economic growth is estimated to normalise in 2022/2023, thanks to its high-base effect.

The geopolitical fragmentation between the economic giants may cause disruptions to the global supply chain, and since Penang tops in Malaysia’s trade, higher prices on imported raw materials caused by the weakening Ringgit will have a negative impact on its manufacturing production despite greater export growth.

Whichever the case, the labour crunch is predicted to normalise across pandemic-boomed industries such as food delivery services, e-hailing services, and glove and mask makers; workers may have to adjust their work habits back to those of pre-pandemic times.

One piece of good news is that the relaxation on the hiring of foreign workers will ease the labour crunch in manufacturing production and agro-food. The relevant authorities are urged to table a simple and transparent application process in the upcoming budget to eliminate middlemen and to enhance public service delivery.

While the agriculture and manufacturing sectors will see some redistribution of output due to the global economic headwinds, domestic tourism, health tourism, and hotel and travel services are regaining their growth momentum. Despite this, the pandemic also called for the urgent need for transformation in agriculture and manufacturing activities through automation as a means of replacing foreign workers, and increasing efficiency and productivity.

Moving forward, innovation, design and research and development are the higher value-added activities will constitute the next leap in the country’s development. Tax incentives should be considered in the Malaysia Budget 2023 for companies involved in these activities. On the talent crunch, implementing flexible employment policies for hiring talents from other countries or foreign talents who are already in the country can help fill the gap more immediately.

[1] Most notably, the prices of crude materials for further processing at factory rose steeply at 15.8%, while the producer prices for intermediate materials, supplies and components grew by 12.4%.

[2] The manufacturing sector makes up 81.6% of the PPI.

[3] This component contributes about 14.5% of the PPI, trailing manufacture of computer, electronic and optical products (18.8%).

[4] See https://penanginstitute.org/publications/reports-and-papers/reports/a-study-of-graduate-employability-in-penangs-labour-market/

Image by Wan San Yip (Unsplash)

You might also like:

Trend of Investments in Batu Kawan Industrial Park

Picking the Brains of GLC Heads: Policy Priorities for Penang in the Coming Decade

Podcasts: Challenges and Opportunities for Media Practitioners, Policymakers and Individuals

On the Many Non-Economic Benefits of Flexible Work Arrangements

Eradicating Child Marriages in Southeast Asia: Protecting Children, Challenging Cultural Exceptional...