Executive Summary

- Malaysia’s economy is experiencing a triple hit at the beginning of 2020: The Covid-19 pandemic; the collapse of the Pakatan Harapan government; and the crash in global oil prices

- Penang’s economy is being affected by the pandemic, with the tourism industry being the hardest hit

- The prospect for Penang’s manufacturing industries in 2020 remains mixed. The manufacturing sector is expected to gain from the lofty capital investment approved last year, as well as the demand for medical devices. However, some supply chain disruptions are to be expected

- The construction sector should remain lacklustre. In a health crisis, the ‘wait-and-see’ attitude tends to prevail, and consumers prefer to spend on non-durable essential goods rather than on durable goods like properties

Three Critical Events

The year 2020 will be a very bumpy one for the world’s economy, due mainly to the Novel Coronavirus 2019 (Covid-19) pandemic. No treatment for the viral infection is as yet available, and the disruptions it has wrought on economies throughout the world have been unprecedented in living memory.

For Malaysia, the situation is worsened by at least two other factors, namely the political uncertainty brought about by a sudden change in government at the federal level in late February, and the recent sharp fall in oil prices. The pandemic alone already poses huge challenges in a country where governance in the best of times has been loosely managed.

With Covid-19 and the Movement Control Order (MCO) imposed from 18 March to 14 April, huge segments of the economy have been badly hit. Tourism-related services ranging from air travel, tours, events, cruises, hotels, restaurants and retails came to a standstill almost immediately. Manufacturing activities that rely on materials from China have also experienced serious disruptions. This bodes ill because these two sectors are responsible for over 90% of the state’s economy.

The employment situation is expected to take a hit as well, and the income of small traders and businesses has also been vastly reduced. Despite the cushioning effects of fiscal stimulus packages and monetary measures, the overall effect will be a substantial slowdown in GDP growth.

The sudden fall of the Pakatan Harapan government had already been swaying business and market sentiments. Although the political crisis was quickly contained, the fragile formation of the new Perikatan Nasional ruling coalition under Prime Minister Tan Sri Muhyiddin Yassin remains of critical concern in the face of spreading pandemic. So far, close coordination and collaboration between ministries in tackling the Covid-19 pandemic has been sorely lacking.

In the meantime, global oil prices have fallen greatly, and this will reduce the federal government’s revenue to a level far below what the preceding government had budgeted for. As a net oil exporting country, Malaysia is now expected to grapple with higher double-digit deficits in both its current and fiscal accounts. With the government needing to mobilise fiscal resources to support the job situation and to ease societal pressures, the effect of the oil price war between Saudi Arabia and Russia will be sorely felt in Malaysia.

This situation is worsened further by the depreciation of Ringgit Malaysia. Imports of goods will rise in price and eventually increase the deficit in the national current account further.

Penang Sensitive to Headwinds but Quick to Recover

Where Penang’s economy is concerned, the change in government at the federal level, and the drop in global oil prices have limited impact, at least in the short term. But beyond that, how the advanced economies fare will hold deep significance for the state’s economy.

However, Penang has a reputation for rebounding economically from crises. For example, the US financial crisis of 2008 clearly weakened Penang’s economic growth. It suffered a double-digit contraction of 10.4% in its GDP already the following year; Penang’s economy being highly export-oriented, that downturn caused some manufacturing facilities to temporarily shut down. Consequently, Penang’s total trade value shrank by 8.7% in 2009.

Although Penang is relatively vulnerable to global headwinds, having a solid industrial base that has existed healthily for more than 40 years allows for swift recoveries. The state recorded a double-digit GDP rate of 10% – above the national growth rate of 7.4% – to RM46.5 billion already in 2010, while the unemployment rate improved from 2.5% to 2.2% over the same period. Total approved manufacturing investments surged to RM12.2 billion in 2010 – the highest amount ever received since 1980. Total trade value grew at 11.7% in 2010, with export and import growing at 7.4% and 18% respectively.

Penang’s manufacturing sector’s growth potential has been primarily driven by US offshore companies, and it has generally been exporting electronic consumer products to the advanced economies. In recent years, the US-China trade war had ironically been imparting considerable positive benefits to the state’s manufacturing sector. Penang has been deservedly known as the Silicon Valley of the East, and in the fluid situation precipitated by the trade war, the state received numerous enquiries from Chinese manufacturers and US companies interested in expanding their existing facilities or in relocating their operations to the region, or to Malaysia (Harry, 2020).

The question now is: Will Penang be able to bounce back and will it be able to retain the attention of global investors in the wake of the Covid-19 pandemic?

Strong Going into the Covid-19 Cloud; Still Strong Emerging from it?

Taking the Covid-19 pandemic into account, this section gives an overview of Penang’s present economic performance and considers its outlook for 2020 by comparing key economic indicators within the state with those of other states, and with Malaysia as a whole.

Gross Domestic Product (GDP): The Slowest Growth Rate Worldwide

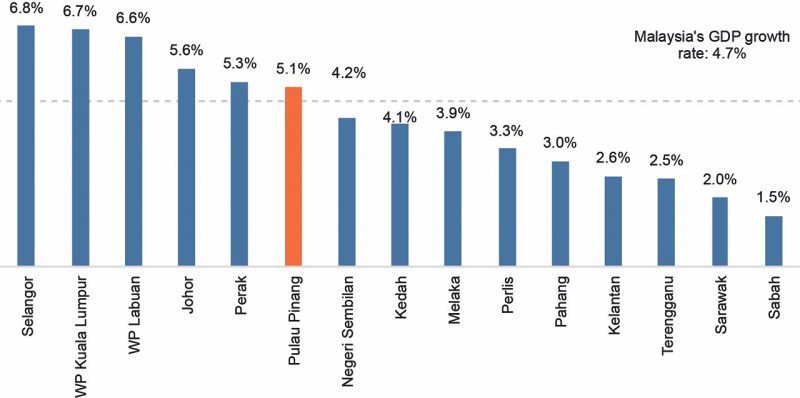

Though one of Malaysia’s smallest states, Penang has been able to boast a buoyant economy over the last decade. Since 2006, the state’s annual GDP has grown steadily above 5% – except in 2009 and 2012 due to subdued growth in the US and Europe. According to recent data from Department of Statistics Malaysia (DOSM), its GDP grew steadily at 5.1% in 2018, outpacing the national growth rate of 4.7% (Figure 1).

Figure 1: GDP growth rate by state, 2018 (at 2015 constant prices)

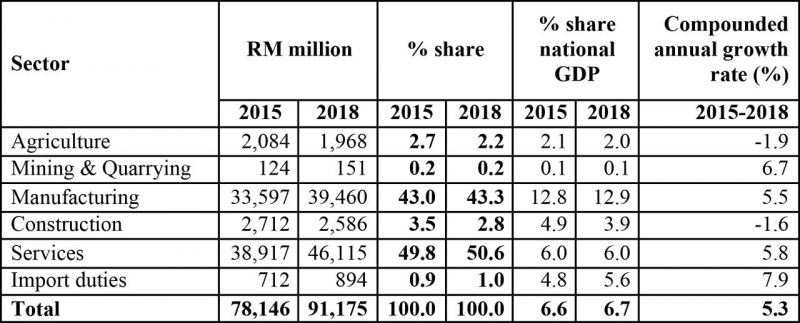

Penang’s economy accounts for 6.7% of the national GDP, and 90% of it is driven by the manufacturing and services sectors. The services sector accounts for half of Penang’s economy while the manufacturing sector contributes 43.3% to state GDP in 2018 (Table 1). The third largest sector is the construction sector whose output makes up 2.8% of state GDP, followed by the agriculture sector (2.2%) and mining and quarrying (0.2%).

Looking at the past three years, all sectors experienced positive growth, except the agriculture and construction sectors. The state’s GDP grew by 5.3% annually in 2015-2018, with the services and manufacturing sectors expanding at 5.8% and 5.5% respectively.

Penang’s GDP contribution to Malaysia’s output has therefore been relatively significant. Since 2010, Penang’s manufacturing sector in particular has been accounting for about 13% of the sector’s national GDP – second only to Selangor (at 29.9%). At the same time, the services sector has consistently accounted for about 6% of the sector’s national output. Not only are these two sectors strong, they are also relatively stable, supported as they are by Penang’s established tourism and industrial environment.

In contrast, the share that Penang’s construction sector has been contributing to the national output has been declining since 2010, and is expected to fall further. Its share of national output plunged to 3.9% in 2018, down from 5.3% in 2010.

Table 1: GDP in Penang, 2015 and 2018 (at 2015 constant prices)

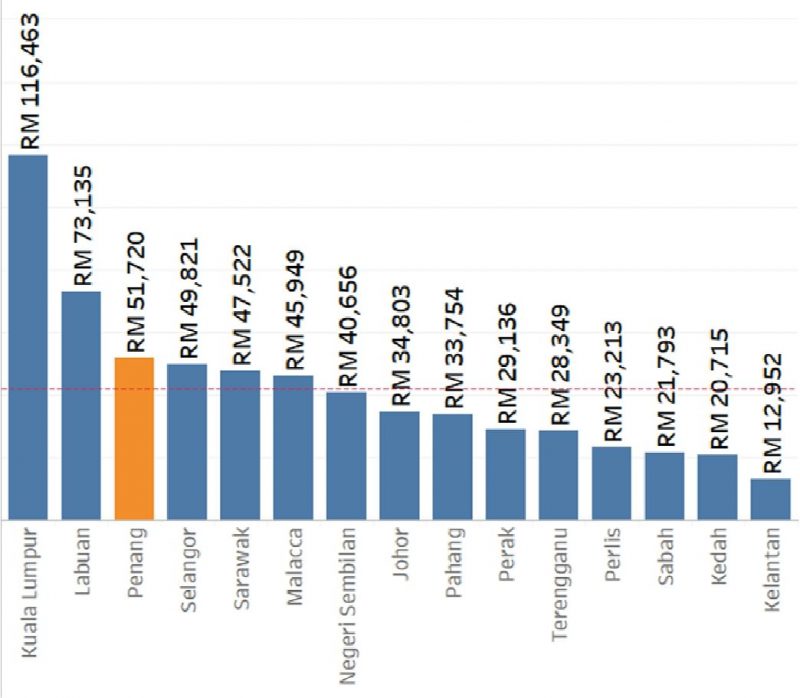

Among Malaysia’s 13 states, Penang has been topping in real GDP per capita since 2014. Its real GDP per capita expanded at about 4% annually from 2015 to 2018, amounting to approximately RM52,000 in 2018, up from RM46,000 in 2015. Figure 2 shows Penang’s real GDP per capita just trailing behind the two federal territories – Kuala Lumpur[1] and Labuan[2]. Penang has a notably higher standard of living compared to Selangor and Johor – the two other highly industrialised states in Malaysia.

Figure 2: Real GDP per capita (RM), 2018 (at 2015 constant prices)

Looking forward, the picture is more gloomy. In 2020, Penang’s GDP is expected to experience the weakest growth rate in a decade. Service activities will see the greatest slowdown due to the bearish tourism outlook, while accommodation services, restaurants, transportation services, retails and trade will be severely affected in the first half of 2020 by the Covid-19 pandemic. Growth may catch up gradually in the later part of the year, but that will depend on how the Covid-19 pandemic develops. The construction sector will slow down further in the face of the general economic recession. Buyers are expected to be extremely cautious while property developers postpone construction plans.

Penang’s manufacturing sector is predicted to grow at a slower pace, and relies strongly on a handful of companies involved in producing medical devices and medical-related accessories and components needed in hospitals. In contrast, the agriculture sector is expected to experience stable growth in 2020, attributable to a sharp increase in local demand.

External Trade: Surplus to Remain Stable

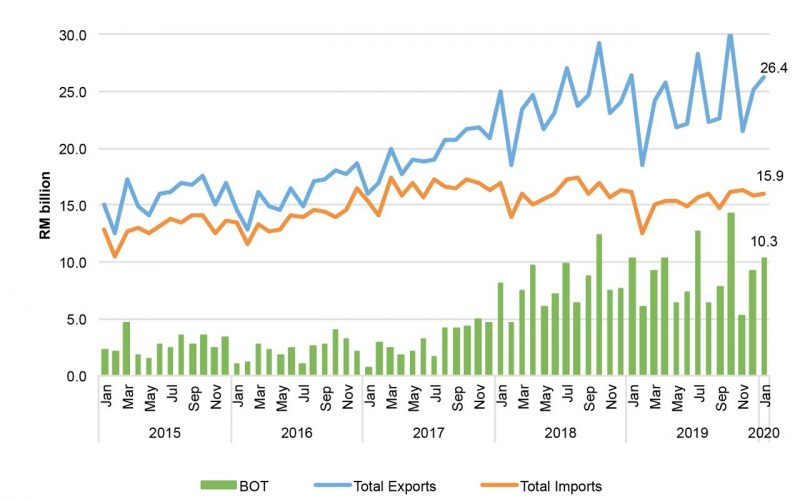

Total trade value in Penang has also been on an upward trend, showing an annual growth rate of 6.4% in 2009-2019. Despite a mild slowdown in total trade value in 2019 (-1.8%), the balance of trade (BOT) has been on an expansionary trajectory. Without taking trade transported through rail into account, the BOT expanded by 7.8% annually in 2009-2019. On year-on-year comparison, it increased handsomely by 10.3% to RM105.4 billion in 2019 from RM95.6 billion in 2018.

The spill-over effects of the US-China trade war have been evident in Penang and Malaysia at large. Penang saw a slight growth in exports for 2019 albeit that it experienced volatility in month-to-month export value throughout the year, when activities moved in accordance with the erratic development of the trade dispute. Notwithstanding that, the sizeable BOT in Penang was attributable to the relative stability of imports value. As shown in Figure 3, the value of imports has been stagnant over the last five years, hovering at an average of RM15 billion a month from Jan 2015 to Jan 2020, while the value of exports had increased to RM26.4 billion by Jan 2020.

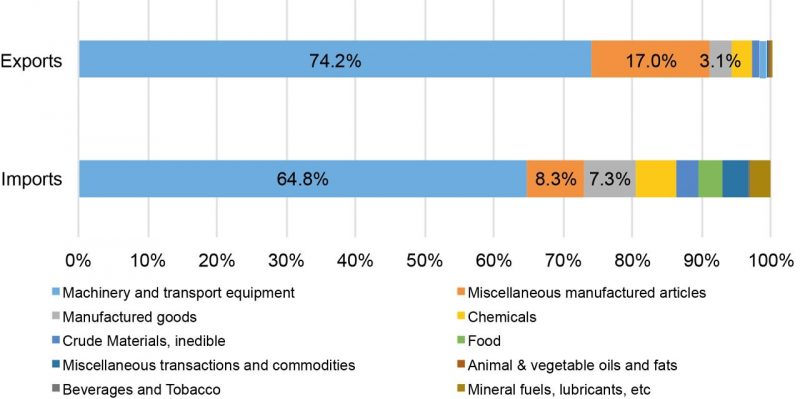

In terms of commodity sections, a majority of exported components are produced by medium- and high-tech manufacturing industries in the Greater Penang region – including goods transported from industrial zones in neighbouring states, such as the Kulim Hi-Tech Park. Machinery and transport equipment remained the top exported product for the first eleven months of 2019, making up nearly three-quarter of total exports. This was followed by miscellaneous manufactured articles (17%) and manufactured goods (3.1%). Together, these made up over 90% of overall exports from Penang (Figure 4). Interestingly, Penang imports categories of components that are similar to her exports. A large proportion of these imports are used as parts, components and apparatuses for high-tech manufacturing production, accounting for about 80% of total imports into Penang.

Figure 3: Exports, imports and balance of trade in Penang, Jan 2015-Jan 2020

Source: Department of Statistics Malaysia.

Figure 4: Percentage share of exports and imports by SITC commodity section, Jan-Nov 2019

Source: Department of Statistics Malaysia.

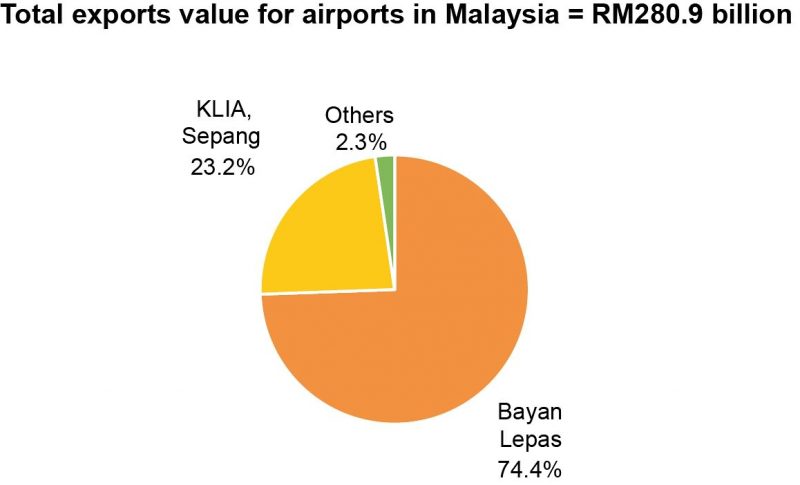

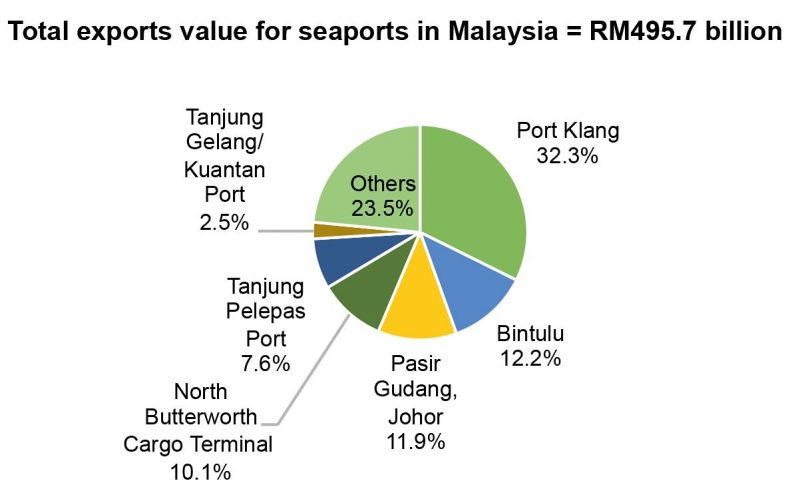

Based on data on cargo handling at Customs checkpoints, Bayan Lepas airport (Penang International Airport) handles a higher value of exports compared to the cargo handled at Penang’s seaport (North Butterworth Container Terminal). During the first eleven months of 2019, Bayan Lepas airport was Malaysia’s top trade handler. About three-quarters of Malaysia’s total export value were recorded at the airport, which thus outperformed Kuala Lumpur International Airport (KLIA) (Figure 5). Penang’s seaport ranked fourth in sea cargo handled during the same period, lingering behind Port Klang, Bintulu and Pasir Gudang (Figure 6).

Figure 5: Value of exports through airports in Malaysia, Jan-Nov 2019

Figure 6: Value of exports through seaports in Malaysia, Jan-Nov 2019

Given that the Ringgit Malaysia has continued to depreciate, Penang should gain in trade activity this year. The trade surplus should remain stable due to increased export demand fuelled by the cheaper Ringgit, and so the export value should level off. Import demand is estimated to moderate at the same time, as a result of a lower disposable income and of higher import prices.

Manufacturing Sector: Highest-ever Approved Investments

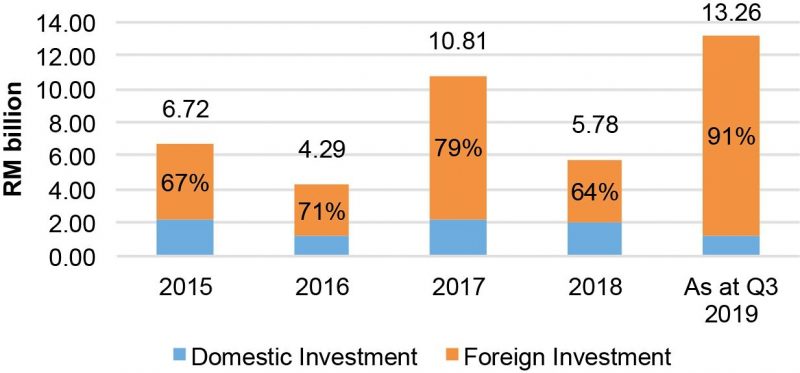

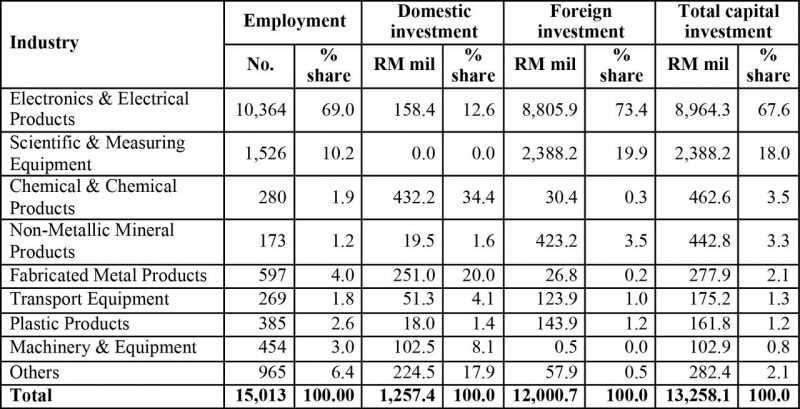

In the first nine months of 2019, a total of RM13.3 billion worth of total capital investments was registered. This was more than a doubling compared to 2018’s total approved capital investment (Figure 7), meaning that Penang’s approved manufacturing investments for 2019 set a new record for highest-ever annual capital investment since 1980. A total of 113 projects are already approved, and these are expected to create as many as 15,013 new job opportunities over the next two to three years.

Figure 7: Approved manufacturing investment in Penang, 2015-Q3 2019

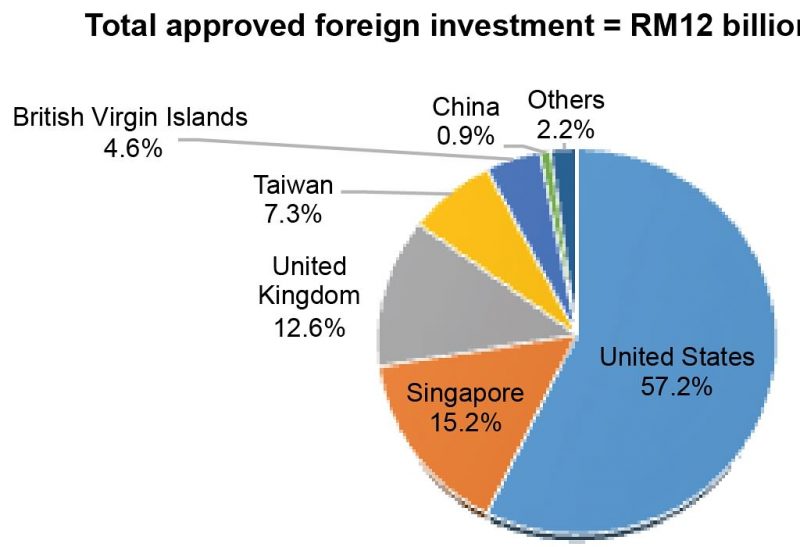

This placed Penang second after Selangor. About 91% of the approved investments were foreign; more than half of which were invested by US companies. These were largely reinvestments in existing manufacturing facilities by Jabil Circuit, National Instrument and Micron Technology, for example (Figure 8). Singapore and the United Kingdom are the next major investment countries that invested in Penang during the first three quarters of 2019, respectively contributed 15.2% and 12.6% to the overall capital investment into the state.

In terms of industry, Electronics and Electrical (E&E) products remain the largest investment industry in Penang. It is responsible for about two-thirds of total approved investment and more than 10,000 new jobs; followed by Scientific & Measuring Equipment (18%) and Chemical and Chemical products (3.5%) (Table 2).

Given its well-established ecosystem, good infrastructure, talent pool and accumulated experience in industrialisation, Penang can easily continue bringing in high quality and high technological-oriented investment, with higher value-added jobs for the industry.[3]

Penang firms on average recorded a larger value-added than Selangor did, despite the fact that the latter produced the highest total sum of value added in Malaysia, and given the similar nature of industries. Among the 4,526 establishments responding to the 2017 Survey of Manufacturing Industries conducted by the Department of Statistics Malaysia, an average of RM9bil generated by each manufacturing firm within Penang, compared to RM7.9bil created by each firm from a total of 10,432 firms in Selangor.

Be that as it may, prospects for Penang’s manufacturing industries in 2020 remain mixed. The manufacturing investments approved last year may take a long time to materialise due to global uncertainties resulted from the Covid-19 pandemic. The Covid-19 situation will also disrupt the manufacturing supply chains, which will eventually affect final production.

On the bright side, Penang has a handful of local and foreign manufacturing firms involved in producing medical devices, life-sciences products and medical-related instruments and components. This segment is predicted to be critical to the strengthening of the performance of the manufacturing sector in 2020.

Figure 8: Approved foreign investment by major country in Penang, Jan-Sep 2019

Table 2: Approved manufacturing investment by industry in Penang, Jan-Sep 2019

Tourism Industry: Most Challenging Year in Decades

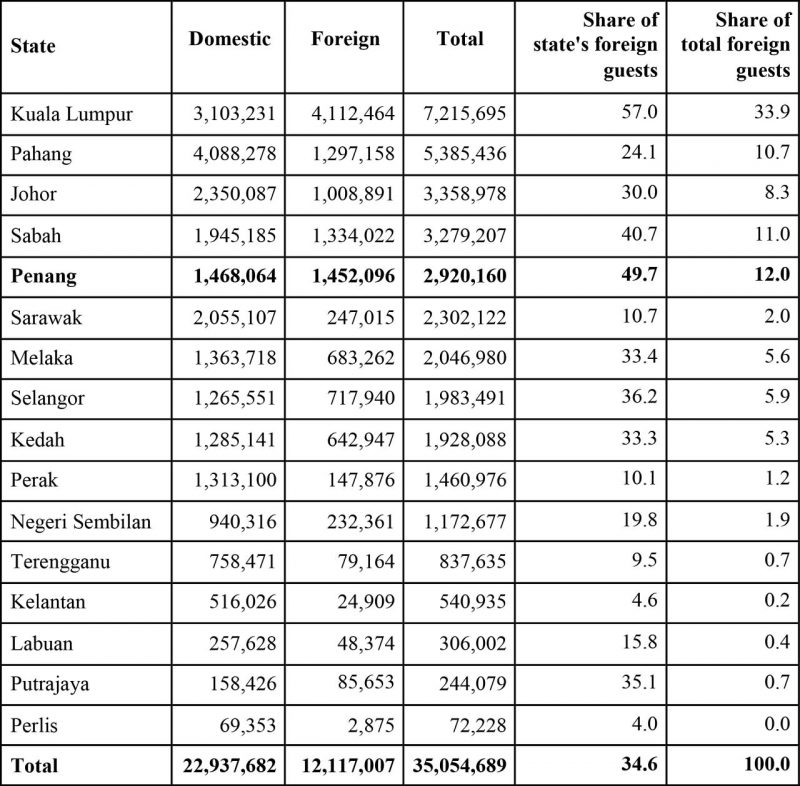

Penang remains the top Malaysian destination among domestic and foreign travellers. While it ranks fifth in number of total hotel guests received, it hosted the second largest share of the national’s foreign guests after Kuala Lumpur. Of the 2.9 million hotel guests recorded, nearly half were foreign nationals – representing about 12% of Malaysia’s foreign guests for the first half of 2019 (Table 3). In comparison with the same period last year, the total number of hotel guests increased by 3.7% from

3 million in Jan-Jun 2018. This growth rate was higher than that for Kuala Lumpur (0.24%).

Based on the 2018 Penang Tourist Survey published by Penang Global Tourism and Universiti Sains Malaysia, international tourists tend to stay more nights in Penang compared to domestic tourists. In particular, the average length of stay for international and domestic tourists are six days and three days respectively. The survey also found that experiencing local food and sightseeing in the city were must-do activities in Penang.

This pattern is also consistent with the amount of value created in Penang’s tourism industry in general, where the retail trade, and food and beverages are responsible for the highest value-added. The 2015 Economic Census also showed that the two components respectively constituted 40.8% and 26.4% – together represented two-thirds of the total value-added in 2015.

Table 3: Hotel guests by state in Malaysia, Jan-Jun 2019

Medical tourism is one of the primary purposes of visit among domestic and foreign travellers to Penang. Across the states in Malaysia, Penang dominates in foreign health tourists. In fact, over 60% of Malaysia’s health tourists come to Penang to seek health treatment. Taking the major private hospitals alone, health tourists generated a total of RM547.5 million in 2018 – about 6% of Penang’s GDP. Additionally, the 2018 Penang Tourist Survey found that tourists spend about RM1,700 per visit, and they generally intend to revisit.

In terms of nationality, anecdotal evidence indicates that Indonesians remain the largest group of health tourists to Penang. Looking at international arrivals via Penang International Airport, travellers arriving from Singapore Changi Airport continue to top (37.5%) all others, followed by those coming from Indonesian airports (31.6%) and Chinese airports (13.3%).

2020 will be a tough year for the tourism industry in Malaysia – and the world at large. The business risk is heightened with the fear of Covid-19 infections and by lockdown regulations in most countries. Hospitality services, travel operators, airline companies, restaurants and retailers are expected to suffer serious financial damage. A number of yearly events in Penang have already been cancelled up to July 2020, and more cancellations are expected should if the pandemic persists over the next three months.

Construction Sector: Lacklustre Growth Continues

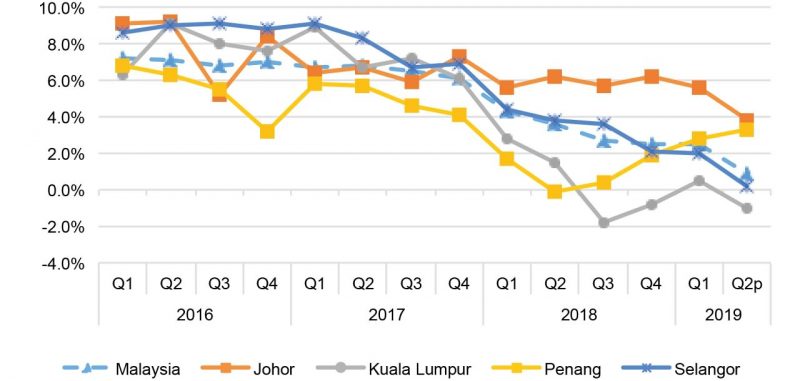

On the whole, Penang’s construction sector experienced a contraction of 3.8% in 2018, largely reflected in supply slowdown and weak demand. Figure 9 shows however, that Penang’s house prices are on a recovery trajectory after a trough registered in Q2 2018. The downward trend of house price index was most severe in Kuala Lumpur compared to Malaysian states.

Figure 9: The change in the house price index of selected states, Q1 2016-Q2 2019

Overhang residential properties remain a key concern. A large number of completed unsold residential properties are found in the higher-end category. As of Q2 2019, a total of 3,929 overhang units[4], worth RM3.26 billion, were recorded, with 58% of them valued at RM500,001 and above. In other words, as high as 42% of properties priced at RM500,000 and below remain unsold.

Timur Laut had the most number of unsold units (39.6%), followed by Barat Daya (36%) and Seberang Perai Tengah (16%). More than two-thirds of the overhang properties were condominiums and apartments, a majority of which were located in Timur Laut and Barat Daya.

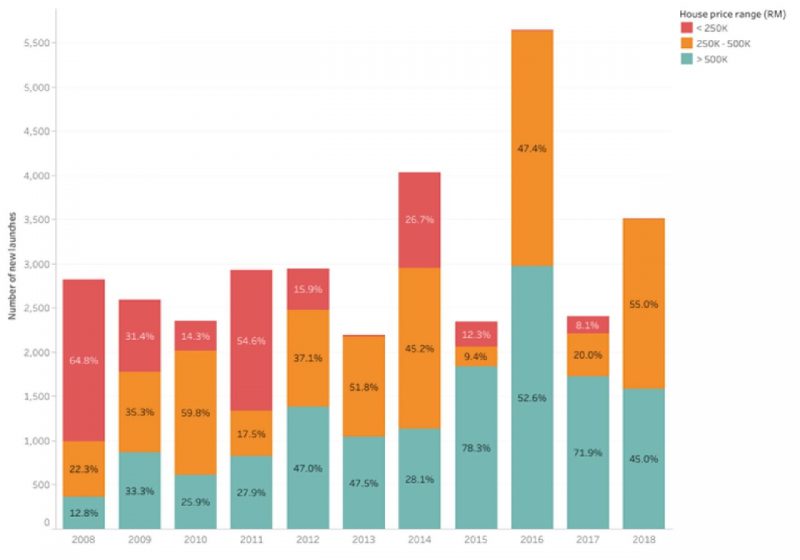

Irrespective of the increased overhang units, all of the supply of new residential units in 2018 was from the construction of houses valued at RM250,000 and above. In particular, more than half of the new launches were of residential units priced between RM250,000 and RM500,000 while the remaining 45% were priced at RM5000,000 and above (Figure 10).

Figure 10: New launches of properties by price range in Penang, 2008-2018

The construction sector is expected to experience lacklustre growth in 2020. Bank Negara Malaysia cut down its overnight policy rate twice in the first quarter of the year to boost domestic consumption amid the Covid-19 pandemic. However, consumers are likely to focus on expenditure on non-durable essential goods and services rather than durable goods like residential and commercial properties.

Agriculture Sector: Modest Growth

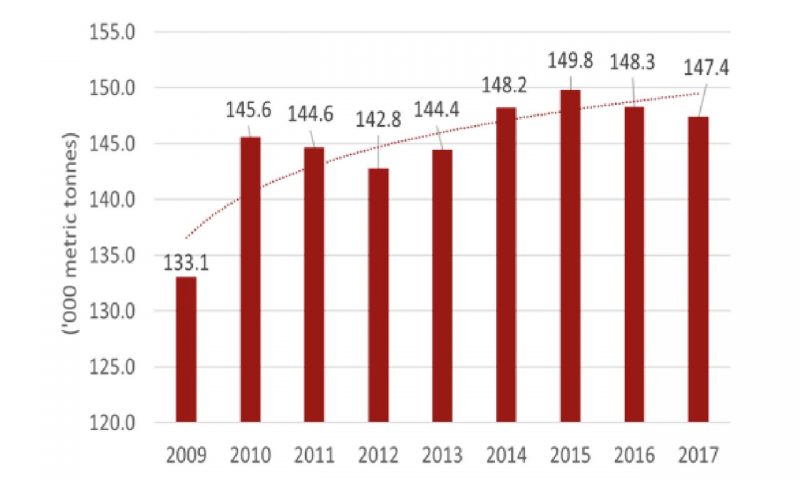

Although the agriculture sector only makes up 2.2% of Penang’s GDP, its paddy production and aquaculture fisheries are the main agricultural activities in Malaysia. Penang has the second highest rice yield in Malaysia, after Sekinchan in Selangor. This is despite a nationwide slowdown in rice yields (Figure 11).

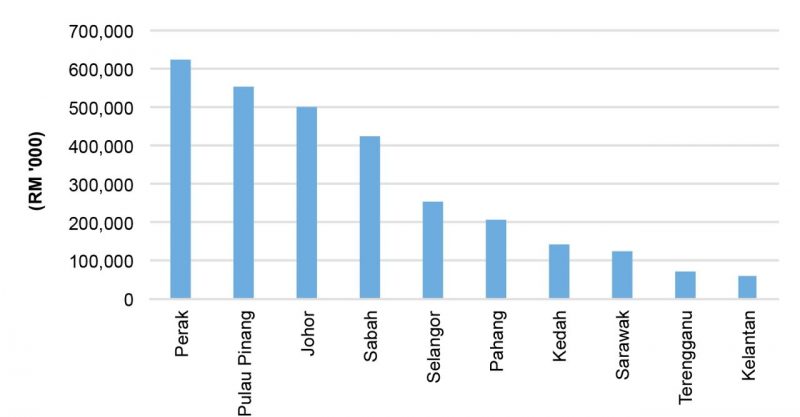

Penang ranks fourth in aquaculture production, after Sabah, Perak and Johor, but continues to rank second in total wholesale value (Figure 12). This shows that Penang is responsible for higher-value aquaculture products compared to other states in Malaysia.

Other major agricultural activities in Penang include fruit industry (durian), poultry and pig farming.

Figure 11: Paddy production in Penang, 2009-2017

Figure 12: The wholesale value of aquaculture production in Penang, 2018

In 2020, the agriculture sector is expected to grow modestly. Paddy yields are to pick up this year, and the higher-value aquaculture production that the state has been responsible for should continue. The restrictions on movement brought on by the Covid-19 pandemic will bring some transport challenges, and is something the state government will be grappling with in the coming months.

Conclusion

In 2020, many countries – be it an advanced economy or an emerging one – will have to shut down for weeks and months, what amounts to a large part of their domestic economy. The partial and full lockdowns that are being or have been implemented have appeared the only way to contain the virus. The economic damage this does has been quickly felt and stimulus packages by governments to compensate for lost income, especially among the poorest and most vulnerable in society, Unemployment figures are expected to rise sharply, while global transport and production chains are badly hit.

Bankruptcies are to be expected, from giant airlines to coffee shops and taxi drivers. Keeping consumption going is key to saving the thinnest fabric of the domestic economy.

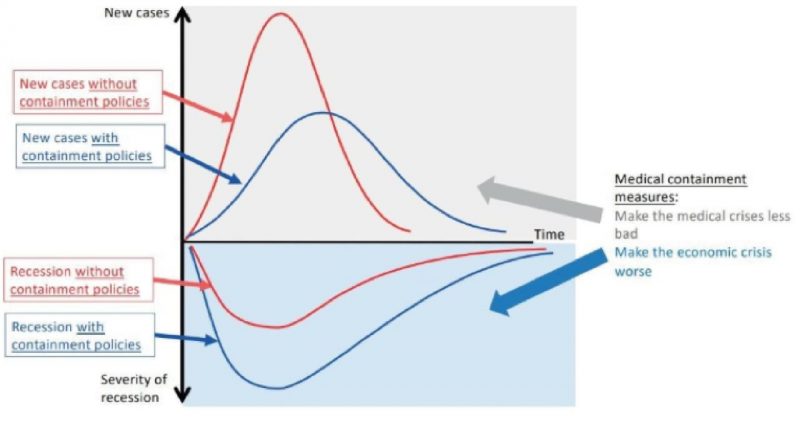

According to the World Economic Forum, although containment measures has shown some success in flattening the patient curve, this approach will in turn exaggerate the recession curve.

And this will not be a normal recession curve. Many businesses will find it hard to fight their way back, just as many unemployed will not be getting their job back – or any job for that matter. There had been discussions about the many disruptions that digital technologies would bring to shock the economic system, but few could have predicted the mega-disruption that the Covid-19 pandemic is amounting to.

For Penang, the immediate concern for the authorities is with health issues, and with measures that can prevent the collapse of the medical infrastructure. Where the economy is concerned, the historical resilience of the people will have to be counted, along with the strong industrial base and the broad tourism ecosystem. Given good communication and mutual trust between the state government and the people, Penang’s historical record of being able to bounce back after every crisis bodes well for the future beyond 2020, and beyond Covid-19.

Appendix

Figure 13: The effect of containment policies on the number of new cases, and on the economic growth rate

References

Chong, J. H. (2020, Mar 3). BNM cuts OPR to 2.5% as Covid-19 weakens global economy. The Edge Markets. Retrieved from https://www.theedgemarkets.com/article/bnm-cuts-opr-25-covid19-weakens-global-economy

Craven, M., Liu, L., Mysore, M. and Wilson, M. (2020, Mar). Covid-19: Implications for business. McKinsey & Company. Retrieved from https://assets.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business

Goh, S. K., Lim, M. H. and Tan, Y. S. (2012). The Policy Responses and Implications of the Global

Financial Crisis on Asia: A case study for Malaysia. European Research Studies. XV (1), pp. 55-70

Harry, P. (2020, Jan 31). China manufacturing exodus, US trade war tarrifs spur investment in Malaysia’s ‘Silicon Valley’. South China Morning Post. Retrieved from https://www.scmp.com/economy/china-economy/article/3048044/china-manufacturing-exodus-us-trade-war-tarif fs-spur

Hutt, R. (2020, Mar 23). ‘Act fast and do whatever it takes’ to fight the COVID-19 crisis, say leading economist. World Economic Forum. Retrieved from https://www.weforum.org/agenda/2020/03/covid-19-economic-crisis-recession-economists/

Tan, R. (2020, Mar 11). M’sia to lose RM12b in revenue if price drops to US$20. The Star Online. Retrieved from https://www.thestar.com.my/business/business-news/2020/03/11/msia-to-lose-rm12b-in-revenue-if-price-drops-to-us20

[1] Kuala Lumpur is the national capital with about 1.78 million in population. The majority of the workforce lives in Selangor, with a total population of 6.5million people.

[2] Labuan is an offshore financial hub and known for its business services. It is also a support hub for deep water oil and gas activities in the region. Labuan’s population was at 99,300 in 2019.

[3] Audrey, D. (2019, Dec 3). Penang’s Jan-Sept approved RM13.3 billion manufacturing investments, second highest in Malaysia. New Straits Times. Retrieved from https://www.nst.com.my/business/2019/12/544363/penangs-jan- sept- approved-rm133-billion-manufacturing-investments-second

[4] Overhang property means property that are remained unsold more than nine months after completion.

Managing Editor: Ooi Kee Beng, Editorial Team: Alexander Fernandez and Nur Fitriah (designer)

You might also like:

Penang: Becoming A Smart State

Can Batu Kawan Industrial Park be the Silicon Valley of the East?

Economic Success Requires Foresighted Demographic Measures

Performance Sustained during Covid-19 Highlights Strong Fundamentals in Penang’s Trade in Goods

Cut the Queue: A Basket of Solutions for Malaysian Hospitals