Executive Summary

- FDI is crucial for sustainable growth and development, evidenced in Malaysia and Penang experiencing steady growth due to huge FDI net inflows.

- Investment facilitation measures simplify processes for investors and complement promotion efforts by creating a conducive environment for investment.

- International cooperation in investment facilitation has gained attention for developing common standards and best practices. Initiatives such as the WTO’s IFD Agreement aim to streamline global investment facilitation measures, fostering transparency and expediting procedures.

- Malaysia performs well in most aspects of investment facilitation but needs improvement in temporary entry provisions and online business registration. A one-stop service centre, like the Invest Malaysia Facilitation Centre (IMFC), would streamline processes, enhance efficiency, and consolidate services for investors.

- Established by MIDA, the IMFC expedites approval processes, builds trust, and offers a whole-of-government approach to support investors. It focuses on streamlined processes, enhanced confidence, and collaboration between ministries and agencies.

- We recommend that MIDA expand the IMFC to Penang to harness the region’s strong FDI momentum and further stimulate economic growth. Penang’s strategic location, robust industrial base, and skilled workforce make it an ideal candidate for hosting an IMFC.

- As a key contact point for investors, IMFC can ensure the timely integration of administrative procedures with international frameworks and agreements. As a signatory to various bilateral and multilateral trade agreements, Malaysia should adhere to international best practices and regulatory requirements to facilitate smoother transactions for investors.

Introduction

Foreign Direct Investments (FDIs) are not just important, they are central to sustainable growth and development. Under the right conditions, FDI spurs growth via increased export capacity, productivity, job creation, innovation, and knowledge transfer (OECD, 2002). The scale of global FDI net inflows, amounting to US$ 1.76 trillion in 2022, or 1.7% of global GDP (World Bank, n.d.), and the steady growth of FDI net inflows into Malaysia from US$10.89 billion in 2010 to US$14.73 billion in 2022, representing around 3.6% of GDP (World Bank, n.d.), underscore the urgent need in Malaysia for effective investment facilitation measures.

In 2023, manufacturing FDI to Penang amounted to RM60.1 billion, representing 47% of Malaysia’s total (Malaysiakini, 2024). This went mostly into the electronics and semiconductor sectors. Multinational Enterprises (MNEs) such as Intel and Micron Technology from the United States, and Infineon from Germany all expanded their semiconductor operations in Penang.

A key strategy in the pursuit of FDI is investment facilitation. Measures to reduce barriers and create a more favourable investment environment eases the process for foreign investors to establish and expand their investments and manage their daily operations (UNCTAD, 2017). These measures can include enhancing transparency, providing better information to investors, streamlining administrative procedures, and ensuring a more predictable and stable policy environment(UNCTAD, 2017).

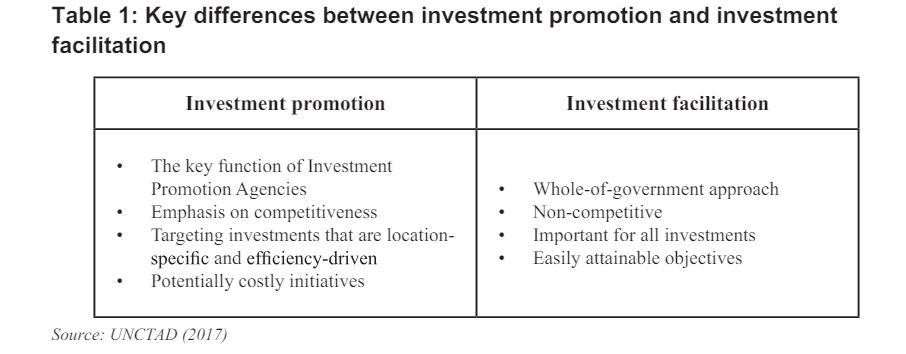

Unlike investment promotion, which focuses on marketing a specific location to attract investment through incentives and marketing efforts, investment facilitation is a collaborative effort. It aims at creating a conducive environment for investment across multiple jurisdictions, emphasising cooperation between stakeholders rather than competition. This approach sets investment facilitation apart as a more comprehensive and effective strategy for driving foreign investments.

Table 1 highlights key differences between investment promotion and investment facilitation. Investment promotion is the key function of the Investment Promotion Agencies (IPAs). It focuses on competitiveness and a zero-sum hypothesis in which countries compete to gain a fixed number of investments.

Investment promotion typically targets location-specific and efficiency-driven investments. IPAs may sometimes devise costly incentives to attract anchor investors. On the other hand, investment facilitation goes beyond the scope of IPA to involve a whole-of-government approach. It is non-competitive, which minimises the risk of competitive devaluation.

Investment facilitation is important for all investments, including domestic investments. It is a low-hanging fruit that can enhance investment realisation at a relatively low cost.

This aspect of investment facilitation, its reliance on international cooperation, has gained attention as a means to enhance global investment flows. Collaborative efforts between countries can lead to the development of common standards and best practices for investment facilitation, thereby reducing investors’ uncertainties and improving the overall investment climate.

Understanding the Importance of Investment Facilitation

Investment facilitation is an evolving field with the potential to significantly impact investment inflows and economic development. As nations continue to navigate the complexities of attracting and retaining investment, understanding and implementing effective investment facilitation measures will be crucial to them in fostering a conducive environment for sustainable investment.

Investment facilitation is paramount in removing administrative barriers to domestic and foreign investment; it reduces bureaucratic hurdles, enhances predictability and increases investor confidence (Al-Thani et al., 2024). Berger et al. (2021) constructed an Investment Facilitation Index (IFI) for 86 countries that cover 117 indicators of investment facilitation across six policy areas: transparency & predictability, electronic governance, focal point & review, application process, cooperation, and outward investments. Subsequently, Berger et al. (2023) built on this framework to construct an updated IFI with six policy areas and 101 indicators. The six key policy areas under the updated index

include: (1) regulatory transparency and predictability, (2) electronic governance, (3) focal point and review, (4) application process, (5) cooperation, and (6) responsible business conduct and anti-corruption.

The study found that higher IFI scores correlate strongly with inward FDI flow and stock (Berger et al. 2021). Malaysia has a score of 1.204, above Indonesia and India but below Singapore and Thailand (Berger et al. 2023). The OECD Trade Facilitation Index highlighted Malaysia’s need for improvement in online information availability of all required documents for border procedures, information availability on bilateral or multilateral agreements between Malaysia and other countries, provision of adequate and timely information on regulatory changes, access to public-private consultations, and automation of pre-arrival processing.

A survey in ASEAN found that 94% of the businesses surveyed viewed investment facilitation as “important or very important in supporting and attracting investment” (ASEAN Secretariat 2022). The respondent places the following aspects to be most important to investment facilitation: (1) enhancing efficient logistics and infrastructure connectivity, (2) simplifying investment procedures and requirements, (3) supporting expatriate entry and visa, and (4) ensuring transparency and access to information (ASEAN Secretariat 2021).

The World Trade Organization (WTO) launched an Investment Facilitation for Development (IFD) Initiative in the spring of 2017 to establish a global agreement on IFD to enhance the investment and business climate, facilitating investment across all sectors relevant to the participating WTO members (Al-Thani at al. 2024). Following more than six years of negotiations, the 120 WTO members (including Malaysia) involved in the IFD Initiative concluded an IFD Agreement (IFDA) in November 2023 (World Trade Organization, n.d.-b). The IFDA is an agreement for improving the international business climate and making it easier for investors in all sectors to conduct business. It is intended to increase the participation of developing and least-developed WTO Members in global investment flows in order to promote sustainable economic development (World Trade Organization, n.d.-a).

The IFDA seeks to strengthen the WTO’s core objective of enhancing the rules-based multilateral trading system. It comprises several key provisions designed to streamline and standardise global investment facilitation measures; it aims to foster transparency between governments and businesses, simplify administrative processes, expedite procedures, establish a global platform for promoting best practices and offer technical assistance and capacity-building support to developing and least-developed Members for effective implementation (World Trade Organization, n.d.-a). Notably, the agreement does not address market access, investment protection, or investor-state dispute settlement, allowing parties to regulate within their territories in the public interest.

The IFDA has the potential to deliver up to US$1.1 trillion in value globally and a 1.73% increase in global GDP, with most gains going to low and middle-income countries (World Trade Organization, n.d.-a). The agreement’s guideline to improve investment facilitation, by extension, requires reform within the member states. Malaysia should be looking into the current facilitation mechanism and areas of improvement to benefit more strongly from this agreement.

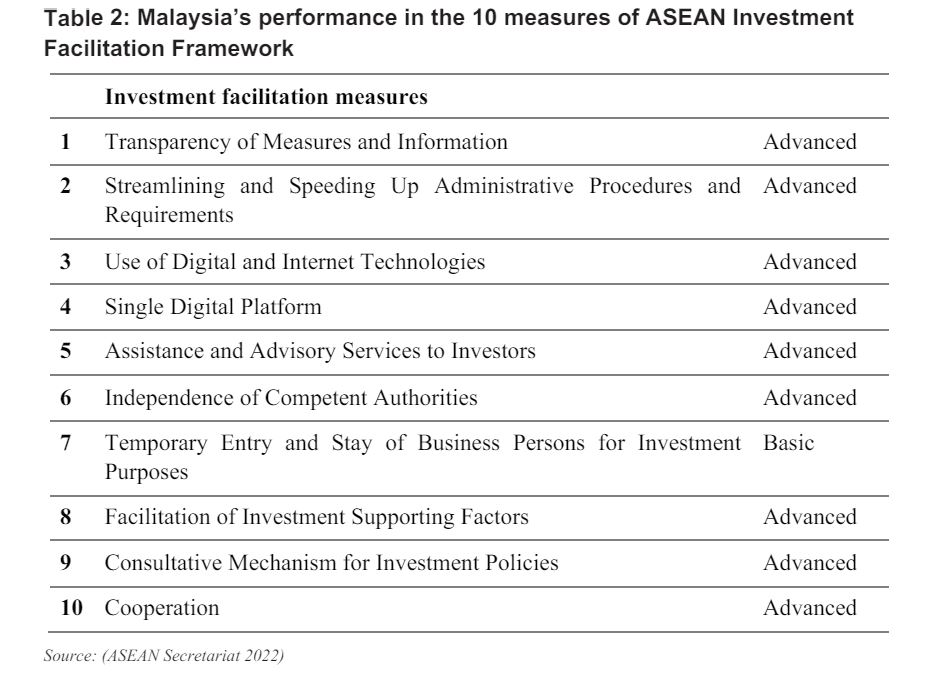

Malaysia is also part of the ASEAN Investment Facilitation Framework, which highlights the following commitments: (1) Transparency of Measures and Information; (2) Streamlining and Speeding Up Administrative Procedures and Requirements; (3) Use of Digital and Internet Technologies; (4) Single Digital Platform; (5) Assistance and Advisory Services to Investors; (6) Independence of Competent Authorities; (7) Temporary Entry and Stay of Business Persons for Investment Purposes; (8) Facilitation of Investment Supporting Factors; (9) Consultative Mechanism for Investment Policies; and (10) Cooperations (ASEAN Secretariat 2021).

Malaysia’s Current Investment Facilitation Landscape

As reported in the ASEAN Investment Facilitation Framework, Malaysia’s investment facilitation measures are considered advanced in most of the elements, except for “temporary entry and stay of business persons for investment purposes”, an area in which Malaysia’s provision for is considered basic.

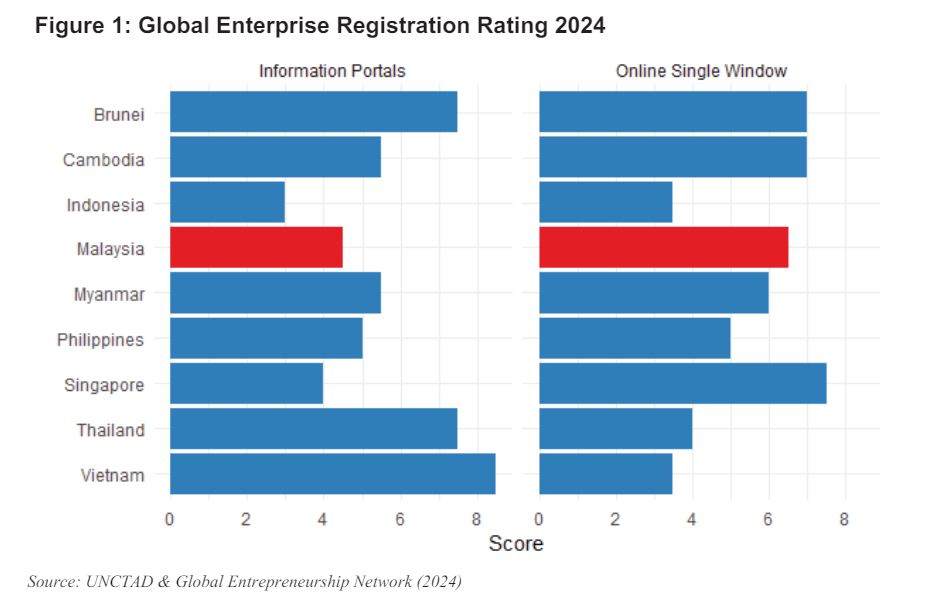

The United Nations Conference on Trade and Development (UNCTAD), the Kauffman Foundation’s Global Entrepreneurship Network (GEN), and the U.S. Department of State (DOS) launched a Global Enterprise Registration (GER) portal in October 2014 to facilitate business registrations globally by streamlining investment processes, thereby saving time and money for investors worldwide (UNCTAD & Global Entrepreneurship Network, 2024).

The GER portal also measures the global enterprise registration rating using two metrics: whether the country has well-functioning information portals and an online single window. Malaysia’s scores for these metrics are 4.5 and 6.5 out of 10, respectively, signifying that there are many areas for improvement.

Under information portals, Malaysia’s Mygovernment portal [1] scores 2/3 in the “what to do” [2] section, 2.5/5 in the “how to do it” [3] section and 0.5/2 in user orientation [4]. A score of 2/3 in the “what to do” section indicates that the government has adequately listed the mandatory steps for business registration but may lack clarity or completeness in describing the end goals of each step and their legal justifications. In the “how to do it” section, a score of 2.5/5 suggests that while there is some explanation provided on how to process mandatory registrations, his may be insufficient or unclear. The inclusion of contact information for relevant offices and details on required documentation, downloadable forms, costs, and timeframes may be present but not fully comprehensive. With a score of 0.5/2 in user orientation, the website may offer some step-by-step presentation from the user’s viewpoint, but it lacks sufficient user-friendliness, and contact information for registering complaints may be inadequate or absent.

Under online single windows, the Malaysian Investment Development Authority (MIDA)’s portal scores 3/3 in the “simultaneous request” [5] section, 2/3 in the “online payment” [6] section, 2/3 in the “online certificate” [7] section and 0/1 in the “feedback” [8] section. A score of 3/3 in the “simultaneous request” section indicates that the government has successfully implemented a web platform enabling users to apply for all mandatory registrations simultaneously through a single online form, streamlining the process and enhancing efficiency. In the “online payment” section, a score of 2/3 suggests that while users can make payments for fees through an electronic website integrated into the platform, there may be some limitations or inconveniences in the payment process. Similarly, in the “online certificate” section, a score of 2/3 indicates that users can receive all certificates documenting successful business registration online, although there may be occasional challenges or shortcomings in this aspect. However, a score of 0/1 in the “feedback” section suggests that the platform lacks a dedicated mechanism for users to provide feedback or contact a competent institution with any problems encountered during the registration process, potentially hindering user support and

resolution of issues.

To sum up, Malaysia excels in most elements of investment facilitation according to the ASEAN Investment Facilitation Framework, particularly in transparency, administrative streamlining, digital technology utilisation, and consultative mechanisms. However, areas for improvement include enhancing provisions for temporary entry and stay of business persons and addressing deficiencies in online business registration portals, such as clarity in instructions, user-friendliness, and the provision of comprehensive support and feedback mechanisms.

What is a One-Stop Centre and Why is it Useful for Investment Facilitation?

A one-stop service centre, commonly known as OSS, is a single point of access to government services. Its ideation can be traced back to 2000, when it first started in the European Union as part of e-government integration (Wimmer 2002). OSS consolidates the government’s functions into a single platform, either physically or digitally, to ease the government’s processes, typically in licensing, permits, identification documents and other e-government processes.

Malaysia’s Urban Transformation Centre (UTC) is a form of OSS. UTCs were set up across the whole of Malaysia and incorporated services from ten government departments, including the National Immigration Department (JIM), National Registration Department (JPN), Road Transport Department Malaysia (JPJ), Inland Revenue Board of Malaysia (LHDN), House of Insurance (HOI), National Higher Education Fund (PTPTN), Companies Commission of Malaysia (SSM), People’s Trust Council (MARA), Department of Islamic Development Malaysia (JAKIM), and the Ministry of Women, Family and Community Development (KPWKM).

In the realm of investment facilitation, a one-stop centre would be tremendously helpful to improve Malaysia’s ease of doing business, from setting up the company to day-to-day operations. An interview conducted by the ASEAN Secretariat with multinational enterprises (MNEs) emphasised the value of an OSS in enhancing efficiency and the facilitation of investment processes (ASEAN Secretariat 2022). Regular updates on regulatory matters and consistent communication with Investment Promotion Agencies (IPAs) were frequently highlighted as beneficial practices. Employing online systems and digitising services not only enhances efficiency but also saves time and expenses, a sentiment strongly endorsed by the interviewed firms (ASEAN Secretariat 2022).

Currently, facilitation is sparse. After an investment is pledged, there are many steps leading to its realisation, including identifying potential business premises, registering and applying for business licenses and permits, aligning the company’s operations with local jurisdictions, applying for business visas for foreign workers, linking supply chain globally and with domestic firms etc. Currently, companies that plan to set up a business in Malaysia need to correspondent with different agencies for each of these processes. For instance, companies need to correspond with Malaysia’s customs department on business visas and the Companies Commission of Malaysia (SSM) for business registration. From the conversation the Penang Institute team had with the MIDA Penang branch in March 2024, MIDA Penang and InvestPenang, who are facilitating most of the investments into Penang, have to connect businesses with the government departments relevant in the processes.

Since these processes are done sparsely and across different agencies, Malaysia would gain tremendously from a one-stop service centre for investment facilitation. Such a centre would streamline processes and improve the ease of doing business, from company setup to daily operations. Similar to the UTC model, which consolidates services from various government departments, an investment facilitation one-stop centre would integrate functions related to business setup, licensing, permits, and other essential processes. This consolidation would greatly enhance efficiency and convenience for investors, as highlighted by the MNEs interviewed by the ASEAN Secretariat, who emphasised the value of such centres in improving investment processes. Currently, the fragmented facilitation process necessitates correspondence with multiple agencies for different steps, resulting in inefficiencies and delays. Establishing a one-stop centre would centralise and digitise services, reducing the time and expenses associated with investment processes and fostering a more conducive environment for business growth and development.

In addition to conventional investment facilitation measures, digital technologies and e-government solutions should be instrumental in streamlining processes and improving transparency in investment frameworks. Leveraging digital platforms can enhance the efficiency of administrative procedures, enable online business registration, and provide more accessible information for potential investors.

The Role of the Invest Malaysia Facilitation Centre

MIDA Malaysia established an Invest Malaysia Facilitation Centre (IMFC) on 1st December 2023 as a one-stop centre for investment-related matters. The IMFC aims to expedite various approval processes, provide consultation and advisory services, and reduce bureaucracy in public service delivery. The core function of IMFC is to streamline and expedite the investment process, enhance confidence and collaboration amongst government and businesses, and involve a whole-of-government approach that leverages the relevant ministries to ease investment facilitation (MIDA n.d.).

Policy Recommendations

The IMFC is an important milestone in improving the landscape of investment facilitation in Malaysia. To maximise the centre’s impact, MIDA should consider the following.

1. Establishing an IMFC in Penang as Part of Broader Economic Development under NCER

Currently, the IMFC is only operating in two states: Kuala Lumpur and Johor[9]. Expanding the reach of the IMFC to Penang is crucial for enhancing investment facilitation in the region. Penang’s strategic position as a major hub for FDI makes it an ideal candidate for the establishment of the next IMFC centre. With its robust industrial base, skilled workforce, and conducive business environment, Penang consistently attracts significant FDI inflows across various sectors, particularly in electronics, manufacturing, and technology. With IMFC in Penang, the state government can further streamline investment processes, provide tailored support to investors, and bolster the region’s competitiveness on the global stage. Additionally, the presence of the IMFC in Penang would not only benefit local businesses and investors but also contribute to the broader economic development of the Northern Corridor Economic Region (NCER)

2. Streamlining the Functions of InvestPenang, MIDA Penang, and IMFC in Investment Promotion and Facilitation

Currently, InvestPenang and MIDA Penang serve as dual-purpose entities, functioning both as investor promotion agencies and coordinators for investment facilitation. Their roles extend to connecting investors with relevant government bodies for operational setups and addressing day-to-day concerns. However, there exists a lag and administrative barrier in the current system, which creates lag time and inefficiencies. IMFC would serve as a centralized hub for investment facilitation, reducing the burden of coordination now felt by MIDA Penang and InvestPenang. By consolidating various processes and services under one roof, IMFC would optimize efficiency and coherence in the investment facilitation process. This streamlined approach would allow the existing agencies to redirect their focus towards their primary objective of investment promotion, enhancing their effectiveness in attracting prospective investors.

Moreover, the transition from investment promotion to facilitation must be seamless. IMFC’s integrated approach ensures continuity, offering investors a smooth journey from initial interest to operational realization. This coherence not only enhances investor confidence but also fortifies Penang’s reputation as an investment-friendly destination.

3. Providing a Continuous Improvement and Feedback Mechanism

In line with the Action 6 in the Global Action Menu for Investment Facilitation (UNCTAD 2017), implementing a robust feedback mechanism within MIDA is essential for ensuring continuous improvement and responsiveness to the needs of investors and stakeholders. By regularly soliciting feedback from investors regarding their experiences with the IMFC’s services, MIDA can gain valuable insights into areas of strength and areas requiring enhancement. This feedback loop should be structured to encourage open communication and constructive criticism, allowing investors to express their challenges, concerns and suggestions openly. MIDA can then utilise this feedback to identify specific pain points or bottlenecks in the investment process, prioritise areas for improvement, and implement targeted interventions to address them effectively. Moreover, leveraging technology-enabled feedback platforms can streamline the feedback collection process, facilitate real-time monitoring of investor sentiment, and enable prompt action on identified issues.

4. Establishing a Comprehensive and User-friendly Digital Portal for IMFC

To modernize and optimize its services, MIDA should embark on a comprehensive digitalization initiative. By transitioning key processes to digital platforms, MIDA can streamline administrative procedures and significantly improve accessibility for investors. One pivotal aspect of this endeavour would be the development of a user-friendly online platform and mobile application dedicated to IMFC services. Through this digital interface, investors would gain seamless access to a wide range of resources, including information on investment opportunities, regulatory requirements, and application procedures, from anywhere at any time. Moreover, the digital platform could facilitate the submission of documents, real-time tracking of application statuses, and interactive communication channels for inquiries and support. By harnessing the power of technology, MIDA can transform the investment experience, making it more efficient, transparent, and user-centric, thereby fostering a more conducive environment for investment.

5. Timely Integration of Administrative Procedures with International Framework and Agreements

As an integral player in the international trade system, Malaysia has forged numerous bilateral and multilateral trade agreements with various countries, alongside being a signatory to multiple trade and investment-related agreements, such as the ASEAN Customs Transit System and Investment Facilitation for Development. Given this extensive involvement, Malaysia should prioritise the proper and timely integration of administrative procedures and legal terms from these international frameworks and agreements into the IMFC. Timely and thorough incorporation of these provisions into the centre’s operations is essential to ensure alignment with global standards and to facilitate smoother transactions for investors engaging with Malaysia’s investment landscape.

Footnotes

[1] https://www.malaysia.gov.my/portal/category/1522.

References

Al-Thani et al. 2024. “Investment Facilitation’s Trillion-Dollar Promise.” World Economic Forum. 18 January 2024. https://www.weforum.org/agenda/2024/01/the-investment-facilitation-s-trillion-dollar-promise/.

ASEAN Secretariat. 2021. “ASEAN Investment Facilitation Framework.” https://asean.org/wp-content/uploads/2021/11/ASEAN-Investment-Facilitation-Framework-AIFF-Final-Text.pdf.

________________. 2022. “ASEAN Investment Report 2022: Pandemic Recovery and Investment Facilitation.” https://asean.org/wp-content/uploads/2022/10/AIR2022-Web-Online-Final-211022.pdf

Berger et al. 2023. “The Updated Investment Facilitation Index.” German Institute of Development and Sustainability, 2 August 2023. https://zenodo.org/records/7755522.

Berger et al. 2021. “Quantifying Investment Facilitation at Country Level: Introducing a New Index.”

https://doi.org/10.23661/dp23.2021.

Malaysiakini. 2024. “Penang records country’s highest investment inflow in 2023.” Malaysiakini, 15 May 2024, https://www.malaysiakini.com/news/699503?utm_source=dlvr.it.

MIDA. n.d. “Invest Malaysia Facilitation Centre (IMFC): Reducing Bureaucracy, Enhancing Efficiency, and Propelling Economic Growth”. https://www.mida.gov.my/invest-malaysiafacilitation-centre-imfc-reducing-bureaucracy-enhancing-efficiency-andpropelling-economic-growth/.

UNCTAD. 2017. “Global Action Menu for Investment Facilitation.” https://investmentpolicy.unctad.org/uploaded-files/document/Action%20Menu%2023-05-2017_7pm_web.pdf.

UNCTAD and Global Entrepreneurshiip Network. 2024. “Global Enterprise Registration.” https://ger.digitalgovernment.world/.

Wimmer, Maria A. 2002. “Integrated Service Modelling for Online One-Stop Government.” Electronic Markets 12 (3): 149–56.

World Trade Organization. n.d.(a). “Information on Investment Facilitation for Development – IFD.” IFD toolkit. https://www.wto.org/english/tratop_e/invfac_public_e/ifd_toolkit_e.pdf.

_____________________. n.d.(b). “Investment Facilitation for Development.”. https://www.wto.org/english/tratop_e/invfac_public_e/invfac_e.htm.

You might also like:

![Strong Public Support for Revitalising Penang’s Iconic Ferry Vessels]()

Strong Public Support for Revitalising Penang’s Iconic Ferry Vessels

![Deconstructing Trump’s Tariffs: The Impact on Penang’s Trade and Economic Resilience]()

Deconstructing Trump’s Tariffs: The Impact on Penang’s Trade and Economic Resilience

![A Proposal for Carbon Price-and-Rebate (CPR) in Malaysia]()

A Proposal for Carbon Price-and-Rebate (CPR) in Malaysia

![Covid-19 Fuels Democratic Decline in Southeast Asia]()

Covid-19 Fuels Democratic Decline in Southeast Asia

![Automation and the Future of Work in Agriculture]()

Automation and the Future of Work in Agriculture