EXECUTIVE SUMMARY

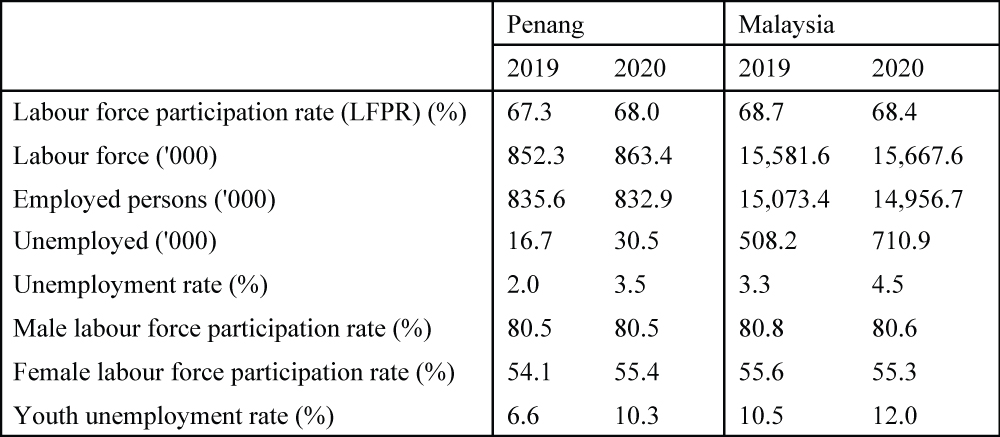

- In 2020, Penang’s labour force participation rate (LFPR) increased moderately by 0.7 percentage point to 68%, primarily due to an increase in women participation in the workforce, significantly in the 30-44 age group.

- At the same time, the state’s unemployment rate rose to a 30-year high of 3.5% in 2020, lingering below the national unemployment rate of 4.5%. Youth unemployment was markedly more alarming, rising from 6.6% in 2019 to 10.3% in 2020.

- The size of employment in Penang fell marginally by 2,700 persons, down from 835,600 persons in 2019 to 832,900 persons in 2020. By economic sector, demand for workers increased in agriculture, mining and quarrying, and services. Conversely, the employment size in the construction sector and the manufacturing shrank by 15.1% and 3.4% respectively.

- Employment among high digital- and technological-based manufacturers was less affected by the pandemic than that among low-tech manufacturers. Heavy and non-essential manufacturers were badly hit, leading to partial or full closure of operations.

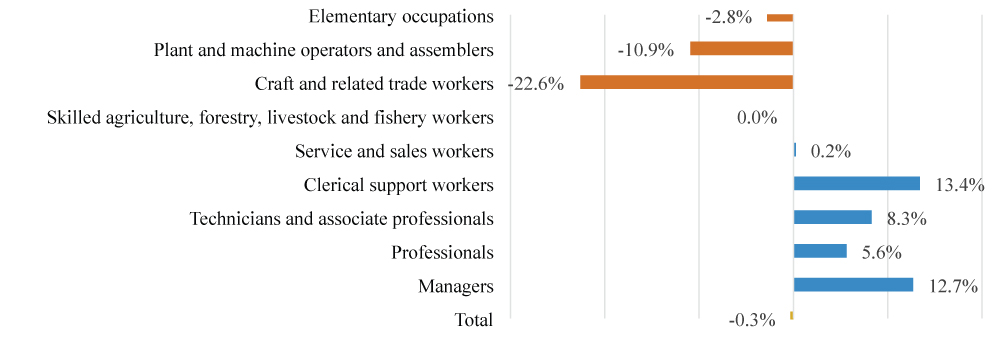

- The number of employed persons in mid-skill and low-skill occupations declined by 4.6% and 2.8% respectively in 2020, while those in high-skill occupations rose by a considerable 7.9%. While skill-related underemployment remained low, hospitality workers are expected to face challenges getting back into the job market in the near future, even into related industries.

- More work-life flexibility is expected, and disruptive technologies will continue to enhance job opportunities in computer science and engineering. The need for industries in Penang to upgrade and leverage on digital innovations will only grow stronger.

- A comprehensive and targeted recovery plan for Penang, aligned to the National Recovery Plan is needed. Short-term courses to assist the underemployed and the unemployed need to be made available.

INTRODUCTION

The Covid-19 pandemic continues to threaten the labour market in Penang, notwithstanding certain opportunities in specific sectors. Given that the state’s economy is primarily driven by the services and manufacturing sectors, the unprecedented and continued implementation of movement control orders by the federal government have diminished tourism activities and services-related activities such as retail trades, business services, engineering services, real estate services and social services. While essential and export-oriented activities have been allowed to operate under the Full Movement Control Order (FMCO), shorter working hours and supply chains disruptions continue to render losses in business revenue and lead to employment cuts, as was experienced during MCO 1.0 in early 2020 (Penang Institute, 2020).

Non-essential services, especially SMEs with no presence of digital business, have been severely affected by the total lockdown.

This article studies how sectors and professions have been impacted by the pandemic and the lockdown, while considering the state of underemployment and the opportunities that exist. It concludes with some policy recommendations.

The impact of coronavirus on employment

In 2020, Penang’s labour force participation rate (LFPR) increased moderately by 0.7 percentage points to 68%, primarily due to increased women participation. While male LFPR remained unchanged at 80.5%, female LFPR surprisingly rose by 1.3 percentage points to 55.4%. The increase is significant among females aged 30-44 years old. This trend is contrast to the general falling trend for male and female LFPR in the country as a whole.

Penang’s unemployment rate rose to a 30-year high, at 3.5% in 2020, up from 2.0% in 2019, lingering below the national unemployment rate (4.5%). In absolute terms, the number of unemployed persons almost doubled in 2020 from 16,700 in 2019 to 30,500 in 2020. Youth unemployment was especially

alarming, rising significantly from 6.6% in 2019 to 10.3% in 2020.

Table 1: Principal labour force statistics, Penang, 2019 and 2020

A workforce with a lower level of education is more likely to be unemployed during the pandemic. Although all levels of education within the workforce saw an increase in unemployment rate, the tertiary-educated workforce experienced the lowest increase across all education levels. It expanded by 1% to reach 3%, while the increase for the workforce without tertiary education was 1.8%, up to 3.8%. This suggests that work-from-home protocols during the lockdown worked better for knowledge workers with higher education. For jobs not suited for remote work, employers tended to render some workers redundant.

Economic sectors

In 2020, the size of employment in Penang reduced marginally, dropping by 2,700 persons to 832,900 persons from 835,600 persons in 2019. This drop is primarily attributed to the decrease in the number of self-employed. Self-employment, which comprises employers, own-account workers (including gig workers) and unpaid family workers respectively, dropped by 12.6%, 11.5% and 17%.

By economic sector, demand for workers increased in the agriculture, mining and quarrying, and experienced a double-digit growth of nearly 20%. These are attributed to the increased demand for agricultural products and to greater quarrying activities. Employment in the services sector also expanded, but only by 4.7% in 2020. This rise was primarily driven by information and communication technology (36.3%), human health and social work (30.3%), administrative and support services (29.4%) and real estate activities (23.7%). This increase offset the decrease in employments in arts, entertainment and recreation (22.9%), electricity, gas, steam and air-conditioning supply (20.8%), accommodation and food service activities (13.3%) and professional, scientific and technical activities (10%) (see Appendix).

In contrast, the employment size in the manufacturing and construction sectors shrank in 2020. The number of employed persons in the construction and the manufacturing sectors respectively reduced by 15.1% and 3.4%. Subdued demand for properties, stop-work orders due to lockdown and fewer development projects all slowed property construction, and in fact, employment in the construction sector had been on a downward trend even before 2020.

Meanwhile, the reduced employment in the manufacturing sector covers two trends. First, some non-essential manufacturers in textile and apparel, steel, metal and plastics, motor vehicles, sawmill and refrigeration were not able to weather through. Esquel and Pen Apparel announced closure due to increased material and labour costs, and to contraction in garments consumption (Loone, 2020). Heavy industries players such as Nippon EGalv Steel, E2E Technology, Suzuki Assemblers, Fujikura Federal Cables, etc., due to low demand of products and reduced profit, imposed permanent closure of parts or all of their manufacturing operations. For the first three months of 2021, nearly 50 factories also closed temporarily due to Covid-19 (The Edge Markets, 2021).

Second, as global demand for E&E products remains strong, employment in manufacturing and related supply-chain activities are expected to be less affected. In Penang, some semiconductor companies who have already leveraged Industry 4.0 technologies and solutions before the pandemic started, are able to ease out of the pandemic much quicker than those who began digitalisation later, as can be observed in the net profit gains in some large local companies such as Mi Technovation, Greatech, Pentamaster, UWC and ViTrox (Shankar, 2020; Huong, 2021).

Remote working was enhanced by automation, and by cloud computing and system integration being installed in manufacturing processes (Lee and Ong, 2020). This also means that employment among high digital and technological-based manufacturers remains less affected by the pandemic than among low-tech manufacturers. This appears to be the way forward, with flexible work arrangements being mobilised through automation and digital technology.

Occupations

In terms of professions, low- and mid-skill occupations were more impacted by the pandemic than the high-skill occupations. The number of employed persons in mid-skill and low-skill occupations respectively declined by 4.6% and 2.8% in 2020 while those held high-skill occupations rose instead, and by a considerable and impressive 7.9%.

Mid-skill occupations such as craft and related trade workers and plant and machine operators were strongly reduced in 2020, by as much as 22.6% and 10.9% respectively (Figure 1). While the former was mainly affected by the pandemic, the latter’s situation could signify ongoing advancement into industrial revolution 4.0 by Penang industrial players leading to an immense reduction in routine tasks for mid-level skills. According to OECD (2016), technological innovation and digitalisation will see an increase in demand for non-routine, high-skilled jobs, while highly routine jobs involving mid-level skills will gradually be crowding out, and become substitutable by machines and automation.

Loss of employment (LOE) data collected by the Social Security Organisation (SOCSO) show substantial impact on mid-skill occupations. Of the total of 10,465 retrenched workers reported in 2020, about 44% were mid-skill jobs and 62.6% of these were plant and machine operators and assemblers, with a majority of them being non-graduates.

The situation looked somewhat mixed for the high-skill category; nearly half of those on the LOE list involved this category, and 43.4% of them were professionals. Reemployment of retrenched workers from manufacturing with high likelihood is expected to involve those with mid-level skills, and also those from tourism-related activities. For the former, this will be due to ongoing realisation of approved manufacturing investment in the state, and highly-in-demand skills. To be sure, reemployment will be most challenging for those who have passed the prime-working age.

Figure 1: Percentage change of employed persons by occupational groups in Penang, 2020

Skill-related underemployment

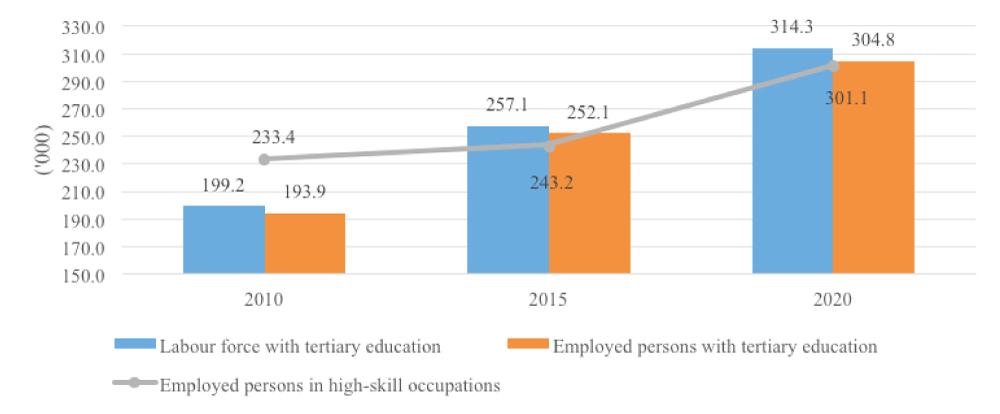

Covid-19 has exaggerated the underemployment situation for certain occupations in Penang. Inadequate employment exists can be measured in three forms: skill-related inadequate employment, income-related inadequate employment and excessive hours-related inadequate employment (Lacmanović, 2016). Where skill-related inadequate employment is concerned, despite a steep growth in high-skill employed persons, demand for high-skill employment remains lacklustre, and is lower than for tertiary-educated employed persons. In comparison with the demand pattern a decade ago, some tertiary-educated employed persons are now engaged in mid-skill occupations due to the lack of job creation (Figure 2) leading to skill-related underemployment.

Figure 2: Comparison between the high-education labour force and employed persons and high-skill employed persons in Penang, 2010, 2015 and 2020

Moreover, skill-related underemployment is dependent on the type of industry and the field of study that the workers possess. For high-tech industries, product development, manufacturing process and software design were high-in-demand jobs, and the shortage of talent in this category is widespread (Penang Institute, 2017). Workforce with IT and engineering-related educational background should be able to find jobs in Penang even during the pandemic, ceteris paribus. In contrast, the workforce who studied hospitality might face challenges securing a job even in related activities.

Graduate employability is also a critical concern during this difficult time. All types of institutes of higher learning including TVET had a higher proportion of graduates going unemployed in 2020. Of the 219,981 fresh graduates who responded to the Ministry of Education 2020’s Graduate Tracer Study, non-TVET institutions took a higher share of unemployed graduates compared to TVET institutions. Importantly, the magnitude of the Covid-19 effect on TVET graduates is more far-reaching than on non-TVET graduates. While the share of unemployed graduates from public universities increased marginally from 12.2% in 2019 to 13.3% in 2020, graduates from community colleges and polytechnics taking TVET programmes worsened by five percentage point, rising from three percent in 2019 to eight percent in 2020.

Additionally, Arts and Humanities, and Agriculture and Veterinary registered the highest percentage of graduates going unemployed upon graduation. Both programmes respectively had 18.8% of their graduates unemployed, followed by services (17.5%) and education (17%). These graduates might end up engaged in jobs that are not related to their skills, adding to skill-related underemployment.

Job vacancy vis-à-vis job placement

Despite the Covid-19 pandemic, the demand for workers in Penang continues to be resilient and exceeds the number of retrenched workers. From June-December 2020, a total of 65,629 vacancies in Penang were posted on the job portal MYFutureJobs governed by SOCSO. Nearly one-third of them

were vacancies for elementary occupations such as factory workers, cleaners and agricultural labourers, which were expected to be filled by non-graduates or those with primary education. Next, making up 16% were vacancies to be filled by graduates; these were positions such as electronics engineers, process engineers, financial analysts and software developers. Clerical support workers, and services and sales workers respectively recorded the next highest number of vacancies advertised, at 11.8% and 11.5%. These include marketers, customer service representatives, sales assistants, administrative assistants and call centre agents.

With regards to job placement, the rate for this remained low. Only 22.5% of vacancies posted in Penang were filled in July-December 2020.1 Industries with more than 40% placement rate include agriculture, activities of households, mining and real estate activities while placement rate for manufacturing, ICT, professional, technical and scientific, and human health had 10-20% of their vacancies being filled. Occupation-wise, managers had the highest rate of placement (54.8%), followed by skilled agriculture workers (35.7%), technicians (25.3%) and craft and related trades (25%).

Policy recommendations

Major changes Penang’s labour market and recommendations in response to disruptions caused by the pandemic are listed below.

Major Change 1: The need for more automation and digital technology adoption has become more obvious.

Recommendation 1: There is an urgent need for industries to upgrade technology and leverage on digital innovation. This requires relevant authorities to continue to upgrade infrastructure, connectivity and facilitation.

Radical technology change is transforming the nature of work and the type of promising careers. The internet threatens long-term disruptions to the nature of work, making greater work-life flexibility a necessity and physical proximity less a requirement.

Additionally, job displacement can be prevalent where routine tasks, are concerned. This will largely affect mid-level skills such as machine operators and clerical workers. However, there will be an increase in demand for high-skill workers with interpersonal skills and the ability to solve unstructured problems by analysing big and new information (OECD, 2016). Skills in demand will be related to disruptive technologies such as Artificial Intelligence (AI), Big Data, the Internet-of-Things and cloud computing. Future jobs will likely be shaped by computer science and engineering (Nagaraj,2020)

As Malaysia’s most industrialised state, the extent to which Penang’s industries progresses in this direction depends on industries leveraging on automation and technology upgrade, and on strong support from the relevant authorities.

Major Change 2: Skill-related underemployment and long-term unemployment lower long-term job prospects.

Recommendation 2: Education and training institutions should provide short-term training courses for underemployed and unemployed workforce; the government needs to be supportive of this in various ways.

Covid-19 has widened the gap between graduate unemployment and skill-related underemployment. Anecdotal evidence suggests that income-related underemployment is a broad effect of the pandemic. Furthermore, there is no reliable data showing how fresh graduates are contributing to the gig economy. Although a short-term remedy, being gig workers will have long-term implications on job prospects, especially for unemployed fresh graduates. Job competition will be even fiercer if the pandemic drags on. Therefore, measures are needed to ensure that new university graduates are not left behind in the recovery.

Major Change 3: The immediate future for certain industries remains uncertain, due to the depth and length of the pandemic, and challenges to tourism-related employment remain fierce.

Recommendation 3: A recovery plan by the state government is needed, and should be aligned to the national recovery plan.

The state recovery plan for post-Covid-19 should be holistic and targeted, and reflect state-based or locality-based infectivity situation. This requires strong communication between the state government and federal authorities.

At the national level, while it is recognised that economic activities in Klang Valley are the impetus for the country’s economic growth, economic support to other parts of Malaysia remains vital. Also, states with lower cases of Covid-19 should be given higher priority for full reopening of economic activities while states with high cases for Covid-19 should continue to lock down.

To prepare for borders reopening, a post-pandemic roadmap is needed for tourism activities. This should not be limited to the upgrading of tourism products and services, but include safe-travel features such as installation of disinfection facilities and face mask-vending machines. Prior to recovery, tourism operators including tour guides and trishaw peddlers should participate in the Malaysia Vaccine Support Volunteers (MYVAC) initiative, which this should be facilitated by the state government. AirAsia and Malindo staffs, for example, are currently involved in this (AirAsia, 2021; Shaheera, 2021).2

Given the fact that the economic output of northern region of Peninsular Malaysia contributes about 16% of the national GDP, states within the region should consider quicker full reopening of the economy under strict SOP. This is particularly important if one considers the fact that Penang’s external trade makes up nearly one-third of Malaysia’s exports.

For list of references, kindly download the document to view.

Editor: Ooi Kee Beng

Editorial Team: Sheryl Teoh, Alexander Fernandez and Nur Fitriah (Designer)

Image by Remy Gieling (Unsplash)