EXECUTIVE SUMMARY

Introduction

From 2018 to 2023, China and the US experienced a period of tension over issues such as trade, the COVID-19 pandemic, intellectual property protection, technology competition, conflict in the Taiwan Strait and the South China Sea, and the Russia-Ukraine war. The initial tensions were sparked in 2018 during the Trump administration with a series of unilateral tariffs on Chinese imports ranging from medical devices to electric vehicles and aircraft components, which induced unprecedented changes in US trade policy in relation to China. In response, China imposed retaliatory measures on a range of US products such as aluminium and agricultural products.

The trade war had several consequences on the global economy. The recalibration of global supply chains is one of them. For instance, companies, especially those in the technology and manufacturing sectors, diversified their supply sources to reduce the impact of tariffs and trade uncertainties. This resulted in a reconfiguration of production networks, affecting US and Chinese businesses as well as those in other countries. In addition, the trade war caused market uncertainty, as well as changes in business strategies, government policies and international trade relations (Sabadosa et al., 2024).

In 2020, the “Phase One” trade agreement was signed; however, the agreement maintained most tariffs. That same year, US-China tensions escalated amid the COVID-19 pandemic. In 2021, during Biden’s presidency, tariffs on Chinese imports stayed unchanged and the ban on American investments in Chinese firms with ties to the military was expanded. In 2022, tensions between the two countries flared over growing friction in the Taiwan Strait and the Ukraine-Russia war. Additionally, the US imposed export controls on advanced semiconductor chips from US manufacturers to China. This was partly intended to hinder China’s ability to produce high-tech military systems.

Following the November 2023 Asia-Pacific Economic Cooperation (APEC) Summit in San Francisco, where China President Xi Jinping met with US President Joe Biden, positive developments in the relationship were expected. The two leaders made progress on some matters including resuming military-to-military communication as well as limiting the export of chemicals used in fentanyl production. Yet, several unsettled issues remained between the two countries. With Donald Trump winning the 2024 presidential election, it is possible that the trade war with China will intensify. Trump has already future tariff hikes planned.

Increasing existing tariffs and imposing new ones can result in long-term disruption of the global trading system.

2. The impact of US-China trade relations on Penang’s economy

Being an open trade-oriented economy, Malaysia’s and Penang’s economic growth is highly dependent on the external environment. So far, Malaysia has maintained positive ties with both the US and China; this leaves possibilities open for trade and investments from both countries. Yet, souring trade relations between the US and China have the potential to affect Malaysia’s and Penang’s economy detrimentally, as both countries are their major trading partners. Penang’s economy can be influenced by worsening US-China trade relations in two main ways. The first is an impact from overall changes (increase or reduction) in world trade as well as heightened global uncertainty. The state’s economy is highly dependent on trade.

Many large companies and some Small and Medium Enterprises (SMEs) in Penang participate in global value chains. Hence, any shifts in global trading demand and supply chains can have a significant impact on the state’s economic activities. The second impact is in investment. The imposition of tariffs can result in importers looking elsewhere for alternative investment destinations. Exporters in the region might benefit from this. For instance, the first two rounds of US tariffs on Chinese goods entering the US significantly concentrated on electrical and electronic (E&E) products, giving Penang comparative advantages in exporting them.

2.1 Impact on Penang’s E&E Industry

2.1.1 Exports of E&E products

Penang is the main contributor to Malaysia’s trade. Amid global uncertainties, in 2023, the state dominated Malaysia’s exports and was the second largest importer in the country, with a share of 30.5% and 23.5%, respectively. Most of Penang’s traded commodities are intermediate goods, with E&E products taking the biggest share. The state’s trade is highly dependent on China, with about RM138 billion in total trade in 2023, making it Penang’s largest trading partner. China represented 17.8% (RM79.7 billion) of Penang’s exports and 23.3% (RM58.2 billion) of its imports.

The US is Penang’s second-largest trading partner with a total trade of about RM99.3 billion in 2023 – accounted for 17% of Penang’s total exports (RM76 billion) and 9.3% of its imports (RM23.3 billion). E&E products are the top Penang exports to China and the US.

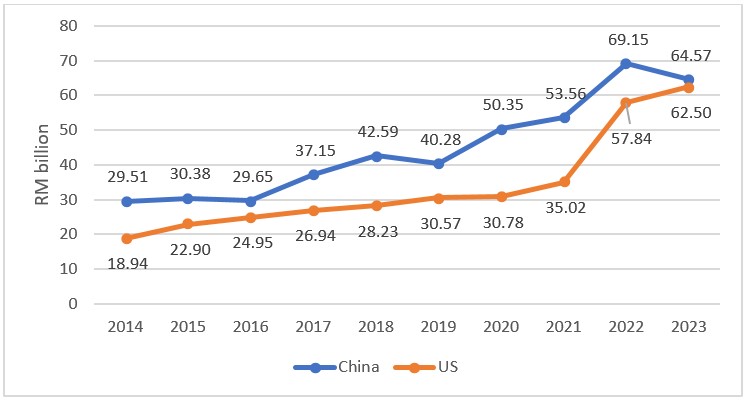

During the US-China trade conflicts (2018-2023), Penang’s export of E&E products to the US grew at a Compound Annual Growth Rate (CAGR) of 15.1% (2017 as a base) compared to 9.7% to China (Figure 1). Exports to both countries skyrocketed in 2022. This growth was mainly spurred by post-pandemic-related factors including the rebound of overall economic activity and the gradual normalisation of supply chain disruptions.

This was also partly related to the rise in global electronic product trade, which was driven by factors such as robust global demand for semiconductors, the ongoing adoption of cloud computing, fifth-generation (5G) telecommunications rollout, and the Internet of Things (IoT); these resulted in increased trade in equipment like routers, modems, computers, and data processing units. In 2023, the exports of E&E products to China dropped dramatically by 6.6%. This can be partly due to the weak momentum of the rebound in China’s economy, especially during the first half of 2023. However, about a growth in E&E exports of 8.1% was seen for the US, its highest over the past decade.

Figure 1: Penang E&E exports to China and US, 2014-2023

Source: Department of Statistics, Malaysia.

2.2. Increase in Foreign Direct Investment

Because of trade tensions between China and the US, foreign companies have been moving their manufacturing facilities out of China in order to establish production hubs in other countries. This business strategy is known as the “China Plus One” or “C+1” strategy, where companies avoid investing only in China and diversify their businesses to alternative destinations to protect their supply chain and export markets against the potential impacts of US-China trade tensions. So far, Southeast Asia has been the preferred C+1 destination, and Malaysia has benefitted from that, especially in the semiconductor and chip manufacturing sector (Chiang, 2024). The strategic geographical position of Penang as a logistics and shipping hub, the low-labour cost, the skilled labour (especially in chip packaging, assembly and testing), the quality of business-related infrastructure, and the robust ecosystem of manufacturers combined with a reputation for good governance made the state an attractive investment destination.

The C+1 strategy has contributed to increased chip investments in Malaysia, especially in Penang (Goh & Tang, 2024). Due to the US-China chip war, there has been a push to secure chip supply chains outside of China, and Penang is well-positioned to take advantage of this shift and to attract foreign investment.

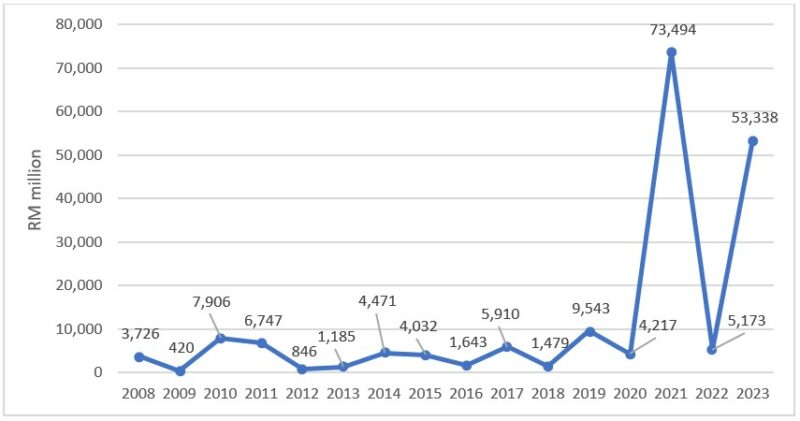

The state’s manufacturing sector has attracted remarkable sums of Foreign Direct Investment (FDI) in recent years, especially in the E&E industry, with nearly RM60.1 billion in approved foreign investments for 2023 with E&E accounting for about 88.7% of this. In 2008-2023, approved foreign investment in the E&E sector experienced an upward trend with some fluctuations. Over the trade war period (2018-2023), the approved foreign investment in E&E saw a remarkable boost from RM5.9 billion in 2017 to RM53.3 billion in 2023 (CAGR: 44.3%). The approved foreign investment in the E&E industry reached its highest value at RM73.5 billion in 2021 (Figure 2). Besides the US-China trade war and companies shifting their operations to Penang, this rush was fuelled by the weak Ringgit combined with high demand for electronic products during the Pandemic.

Yet, the foreign investment in the E&E industry dropped dramatically in 2022 to RM5.2 billion. This sharp decline can be attributed to several factors, including global supply chain disruptions, increased competition from other regions, and potential shifts in investor sentiment due to economic uncertainties. Yet, strong foreign investment activities were observed in the E&E industry in 2023. Overall, these trends partially indicate Penang benefitting from the trade war as well as the C+1 strategy.

Figure 2: Value of approved foreign investment in the E&E industry, Penang, 2008-2023

Source: Department of Statistics, Malaysia.

3. Impact of Trump’s second presidency on the trade war

Trump’s re-election is expected to affect the ongoing dynamics of the US-China trade war in various ways.

i) Continuation of tariffs and increasing trade barriers

Trump might reinstate or expand tariffs on Chinese goods, especially in sectors like semiconductors, technology, or green energy, where competition has intensified. Trump’s administration might also push for additional non-tariff barriers, such as stricter regulatory measures, export restrictions, or import quotas. These could result in further disruptions in global supply chains. Many multinational companies depend on Chinese factories or components, and new tariffs and trade restrictions might increase production costs, slow down delivery times, or force companies to find alternative sources, which could be expensive and less efficient.

ii) Decoupling

Trump has previously advocated for the US to “decouple” from China economically, a process that could intensify during a second term as the US seeks to reduce dependence on Chinese manufacturing and supply chains, especially in key industries like technology and semiconductors. This would also cause supply chain disruption, as companies diversify away from Chinese manufacturing and vice versa, resulting in inefficiencies and higher costs in the global market.

iii) Reshoring and diversification

Trump’s emphasis on reducing reliance on China for critical industries such as manufacturing and technology could push the US to invest more in domestic production or alternative trade partners. This means that the US might try to bring back supply chains to the country or diversify them to other countries in Asia or Latin America to reduce China’s economic leverage.

iv) Increasing global uncertainty

The impact of a prolonged trade war would ripple far beyond the US and China, affecting global trade and financial market, destabilising supply chains, hurting international businesses, and raising the risk of a global economic slowdown. For countries and businesses around the world, these uncertainties would affect their long-term planning, and decisions on trade and investment.

v) China’s response

If higher tariffs and restrictions on Chinese goods are imposed, China might respond with its own countermeasures, most likely ramping up its retaliatory tariffs, diversifying its trade relationships, or pursuing more aggressive industrial policies to mitigate US pressure.

3.1. Opportunities and Challenges for Penang’s E&E industry

A tougher US stance on China could create both opportunities and challenges for Malaysia and Penang. Malaysia and Penang have already benefitted from the C+1 strategy by companies to relocate their operations and diversify their supply chains to avoid US tariffs. During Trump’s second presidency, Penang could still benefit from companies seeking to diversify their manufacturing away from China because of the US tariffs and the uncertainty surrounding the trade war. This might lead to increased investment in Penang’s E&E sector. Additionally, companies might begin sourcing components from countries other than China, increasing the demand for manufacturing services in Penang, especially components in the E&E industry such as semiconductors.

However, Penang might be affected by supply chain disruptions. Its E&E industry relies on the global supply chain. This includes the supply of Chinese-made raw materials and components. More aggressive US tariffs on China can disrupt the flow of these components, and therefore companies in Penang might face higher input costs, which could in turn impact their pricing and profit margins. If the trade war leads to a more severe decoupling of US-China technological ties, Penang could also face challenges in accessing US technology or markets for its semiconductor exports.

In addition, Trump may extend tariffs beyond China to include other countries. Malaysia and specifically Penang have welcomed major investments by semiconductor firms and tech players in recent years. Some of these investments have been from Chinese firms looking to diversify their risks, or to avoid high tariffs that apply to goods directly shipping from China. Since the US tightened its restriction policy, nearly 40 Chinese semiconductor-related companies have set up operations in Penang (FPT, 2024). Yet, there are concerns that US tariffs could be extended to Malaysia’s and Penang’s semiconductor industry. It means that there is a possibility that some companies in Penang might be affected by more US tariffs in its trade war and technology race with China.

Additionally, Malaysia registered a trade surplus of RM72.3 billion with the US in 2023, driven heavily by E&E products, which makes it a potential candidate for tariffs.

How Penang copes with these changes will depend on its ability to remain flexible, to maintain competitive advantages, and to respond to shifts in global trade patterns. Although strong FDI inflows in Penang are promising, strategic reforms are essential to enhance its competitiveness, ensure sustainable growth, and therefore secure its status as a preferred investment destination. By focusing on innovation, high-tech industries, and advanced manufacturing, Penang can position itself as a hub for companies seeking to avoid US-China trade barriers while maintaining access to global supply chains. The state can also mitigate risks and seize opportunities by expanding its trade relationships with other countries and regions outside the US and China, such as ASEAN countries, the European Union and other emerging markets. For instance, Penang can further tap into the growing intra-regional trade within Southeast Asia. This could provide an alternative supply chain network to minimise the impact of tariffs and trade restrictions from the US and China.

Moreover, a more resilient and flexible supply chain can be built by investing in infrastructure that facilitates logistics and distribution to alternative markets, as well as strengthening its logistics capabilities to handle shifting global trade routes and maintain its competitive advantage.

References

Chiang, S. (2024, June 23). Southeast Asia is a top choice for firms diversifying supply chains amid U.S.-China tensions. CNBC. Available from: https://www.cnbc.com/2024/06/24/southeast-asia-is-the-top-choice-for-firms-diversifying-away-from-china.html

FPT. (2024, March 22). Malaysia: The Unexpected Winner Behind the US-China “Semiconductor Industry War”. FPT Semiconductor. Available from: https://fpt-semiconductor.com/malaysia-the-unexpected-winner-behind-the-us-china-semiconductor-industry-war/

Goh, M., & Tang, L. (2024, April 22). More foreign companies moving manufacturing facilities from China to Malaysia amid trade tensions. Channel News Asia, Available from: https://www.channelnewsasia.com/asia/malaysia-china-companies-move-manufacturing-facilities-semiconductors-trade-war-4282471.

Sabadosa, Z., Rengifo, M.C., Resendez, P.S., Beato, A.R., Said, E., & Styers, K. (2024). Trade Titans: The Impact of the U.S.-China Trade War on Global Economics. Cornell, SC Johnson College of Business. Available from: https://business.cornell.edu/hub/2024/06/14/trade-titans-impact-us-china-trade-war-global-economics/.

You might also like:

![Malaysia’s Northern States: Improving Competitive Advantages and Industrial Growth]()

Malaysia’s Northern States: Improving Competitive Advantages and Industrial Growth

![Stringent MM2H Requirements Mar Malaysia’s Record as Preferred Destination for Long-term Residence]()

Stringent MM2H Requirements Mar Malaysia’s Record as Preferred Destination for Long-term Residence

![Covid-19 Fuels Democratic Decline in Southeast Asia]()

Covid-19 Fuels Democratic Decline in Southeast Asia

![Malaysia in the ASEAN Chair 2025: Policy Recommendations from Penang Institute]()

Malaysia in the ASEAN Chair 2025: Policy Recommendations from Penang Institute

![Cold War 2.0 Comes Knocking at ASEAN’s Door: Choices for ASEAN, China, and US]()

Cold War 2.0 Comes Knocking at ASEAN’s Door: Choices for ASEAN, China, and US