By Dr Negin Vaghefi (Visiting Senior Researcher) | Posted on 23 January 2025

Executive Summary

1. Introduction

According to the latest World Economic Outlook report published by the International Monetary Fund (IMF), the global economy remains significantly resilient, with growth for 2024 and 2025 holding steady around 3.2%, despite challenges such as the ongoing Russia-Ukraine war, the conflict in the Middle East, supply chain disruptions, a surge in inflation, extreme weather events, and a globally synchronized monetary policy tightening. Although price pressures persist in some countries, global inflation is expected to decline from an annual average of 6.7% in 2023 to 5.8% in 2024 and 4.3% in 2025, supported by tight monetary policy in most countries and improvements in supply disruption. The advanced economies are expected to return to their inflation targets sooner than emerging market and developing economies (International Monetary Fund, 2024). Uneven outlook across regions has been reported, with slower growth in the Middle East, Central Asia and sub-Saharan Africa as a result of disruptions to production and shipping of commodities, conflicts, civil unrest, and extreme weather events, and faster growth in emerging Asia [1] mostly due to surging demand for semiconductors and electronics.

In Malaysia, economic growth slowed in 2023 due to weaker external demand and declining commodity prices. In addition, inflation eased, supported by the continuation of government subsidies and price controls introduced in 2022. During the first nine months of 2024 (January to September), Malaysia’s economy expanded by 5.2%, an improvement from the 3.8% growth recorded during the same period in 2023 (DOSM, 2024). The pace of growth can be limited in the last quarter of 2024 by weak domestic demand and external uncertainty, including potential protectionist trade policies and ongoing geopolitical tensions (MIDF, 2025). Yet, growth is anticipated to rebound in 2025, driven by a recovery in global trade and the technology sector, as well as strong domestic spending. Inflation is expected to rise modestly, influenced mostly by higher taxes and reduced fuel subsidies.

2. Penang’s Macroeconomic Performance

Output Performance: Growth was hindered by the challenging external environment

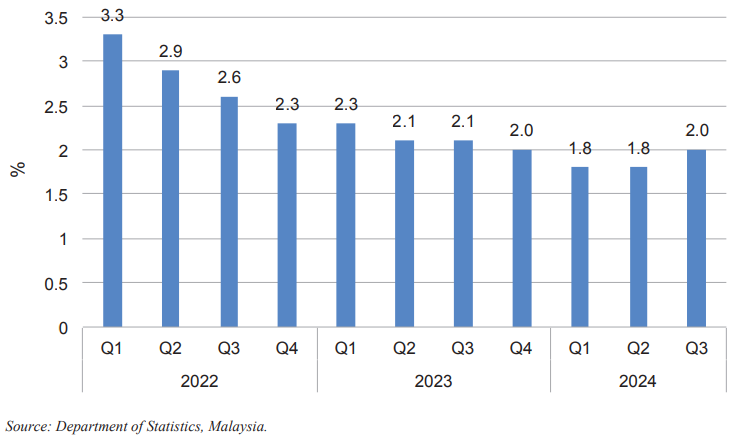

In 2023, Penang’s GDP growth rate dropped sharply to 3.3% from 13.3% in 2022, driven by significant slowdowns in the manufacturing (-0.5%) and services (6%) sectors (Figure 1). The state recorded the fifth highest growth among states, after Selangor, Pahang, Johor, and Kuala Lumpur.

(Figure 2). Penang’s economy is predominantly centred around manufacturing and services, with the manufacturing sector contributing 46.5% of the state’s GDP and the services sector accounting for 48%. In contrast, the construction (2.9%), agriculture (1.9%), and mining and quarrying (0.1%) sectors play a relatively minor role, collectively making up less than 5% of Penang’s GDP. On the whole, manufacturing, services, and agriculture remain key economic pillars and a primary focus of the State Government’s efforts to boost growth.

Figure 1: GDP growth rate by sector in Penang, 2022-2023 (%)

The manufacturing sector is a vital driver of Penang’s economic growth, with the Electronics and Electrical (E&E) and optical products industries accounting for 74% of its manufacturing output. In 2023, the sector’s growth rate declined, largely due to a 0.8% reduction in the E&E and optical products segment, driven by weaker external demand, particularly in the technology industry. Beyond its significant contribution to GDP, the manufacturing sector plays a crucial role in external trade, job creation, and in fostering innovation and competitiveness. In 2023, approved manufacturing investments resulted in approximately 17,623 new jobs, with foreign investments serving as the primary catalyst. E&E products remained the top investment choice for both domestic and foreign companies. Despite challenges in the global market and sluggish demand for electronic components, 86% of the total approved manufacturing investments in 2023 were related to E&E products, underscoring the sector’s resilience and importance.

In 2023, the services sector emerged as the largest contributor to Penang’s GDP. The wholesale and retail trade, along with the food & beverage and accommodation sub-sectors, accounted for the highest share, contributing 15.5% of the sector’s GDP. Over the past three years, the tourism sub-sector has been on a recovery trajectory following domestic and international borders reopening. However, after recording robust growth of 11.5% in 2022, the services sector’s growth rate declined sharply to 6% in 2023. This downturn was primarily driven by a significant drop in the wholesale and retail trade, food & beverage, and accommodation sub-sectors, which fell by about 10 percentage points compared to the previous year.

Given Penang’s highly industrialised economy and limited land area, agriculture contributes only a small share of the state’s GDP. However, it plays a vital role in supporting overall economic growth by supplying raw materials to resource-based industries like food manufacturing. The sector is also a significant component of the economy, providing employment for thousands and contributing to food security. In 2023, Penang’s agriculture sector experienced a sustainable growth of 6.5%, up from 4.7% in 2022, with the fisheries sub-sector being the largest contributor (40%), followed by crops (33%) and livestock (27%). This shows a positive trend in the sector’s performance leading up to 2024.

The construction sector showed a strong growth in 2023, expanding by 23.6% compared to 7.9% in 2022. This growth was supported by robust performance in specialised construction activities (37%) and building construction (24%). The construction sector in Penang is set for significant growth, driven by major projects such as the Penang Light Rail Transit (LRT), Silicon Island, and Gurney Bay development. The LRT, part of the Penang Transport Master Plan (PTMP), aims to improve connectivity, reduce congestion, promote sustainability, and boost the local economy. Silicon Island, under the Penang South Islands (PSI) project, will focus on industrial, residential, and commercial development, enhancing Penang’s status as a technology hub. The Gurney Bay development is expected to boost tourism and attract investments in hospitality, retail, and leisure industries. These projects will drive economic growth, create jobs, and diversify the construction sector.

External Trade: Penang’s trade recorded sustained growth

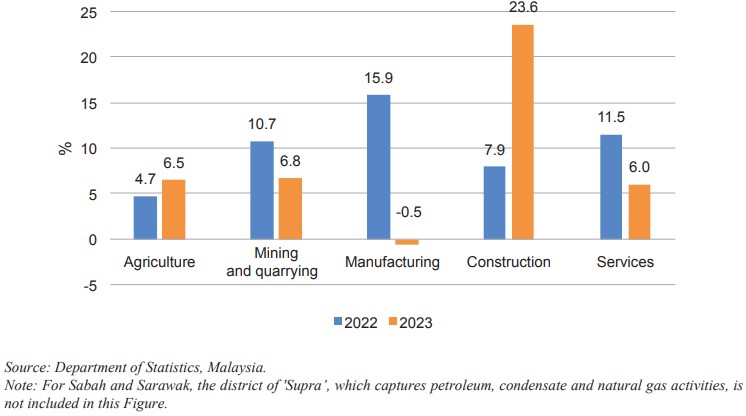

Penang plays a pivotal role in Malaysia’s trade landscape. Despite global uncertainties, the state led the country in exports in 2024 and ranked as the third-largest importer, contributing 31.2% to Malaysia’s exports and 23.8% to its imports[2]. Penang’s trade demonstrated steady growth from January to October 2024, highlighting strong trading activity (Figure 3). Total trade during this period rose by 10.8% (RM64.5 billion), reaching RM659.4 billion compared to RM554.9 billion in the same period in 2023. Total exports grew by 7.2%, while imports saw a significant rise of 16.5%. Nevertheless, the trade surplus contracted by 9.7% compared to the same period the previous year. The majority of Penang’s traded commodities consist of intermediate goods, with E&E products accounting for the largest share.

The higher export growth in 2024 compared to 2023 can be attributed to the strong global demand for semiconductors and related components. Additionally, Penang attracted significant foreign direct investment (FDI) in the manufacturing sector, particularly in high-value industries, which may have enhanced production capacity and export volume. Favourable exchange rates could have also made Penang’s exports more competitive in the global market.

Moreover, significant increase in import was likely supported by the strong domestic demand, particularly in sectors like electronics and consumer products. A relatively stable and favourable currency exchange rate may have also encouraged businesses to import goods at competitive prices.

Figure 3: Total trade in Penang, January 2023 – October 2024

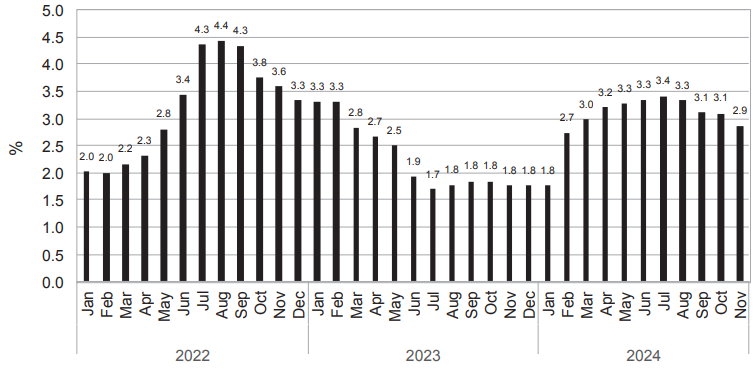

Prices: Penang’s inflation eased to 2.9% in November 2024

Penang’s overall inflation rate in 2023 was 2.3%, 0.9 percentage points lower than the previous year. This slowdown was primarily driven by moderating price increases in food, transport, and selected services, influenced by base effects and supported by government subsidies, which collectively curbed inflation growth. Overall, higher price hikes were seen in food and non-alcoholic beverages (5%), and restaurants and hotels (4.2%) groups. Yet, the communications (2.9%), clothing and footwear (1.4%), and recreation services and culture (0.8%) groups experienced lower prices in 2023. The Consumer Price Index (CPI) from January to November 2024 increased by an average rate of 3% compared to 2.3% for the same period in 2023 due to the sharp increase in cost of housing, water, electricity, gas and other fuels (6%), and recreation services and culture (4.6%). Prices of food and non-alcoholic beverages slowed to 2.7% from 5.2% during the same period (Figure 4).

Figure 4: Year-on-year percentage of change in the CPI in Penang, January 2022–November 2024

Labour market: the labour market remained stable

Penang’s labour market remained resilient in 2023, with a favourable unemployment rate at 2.2% compared to 2.7% in 2022, far below the national unemployment rate of 3.4%. The state recorded the fourth lowest unemployment rate in the country after Putrajaya (0.8%), Malacca (1.6%), and Pahang (2.0%). Total labour force participation increased by 3.4% in 2023 compared to the previous year with employed persons increasing by 4%. In terms of occupational groups, service and sales workers remained the largest employment composition, accounting for 21.1% of the total employed persons in 2023, followed by professionals (16.2%), and plant and machine operators and assemblers (16.2%). The services sector made up the largest proportion of employment, accounting for about 55.8%, followed by the manufacturing sector (35.6%). While the contribution of employment in the services sector to the total employment declined (0.9 percentage points), the share of employment in the manufacturing sector grew by 0.8 percentage point in 2023 compared to 2022.

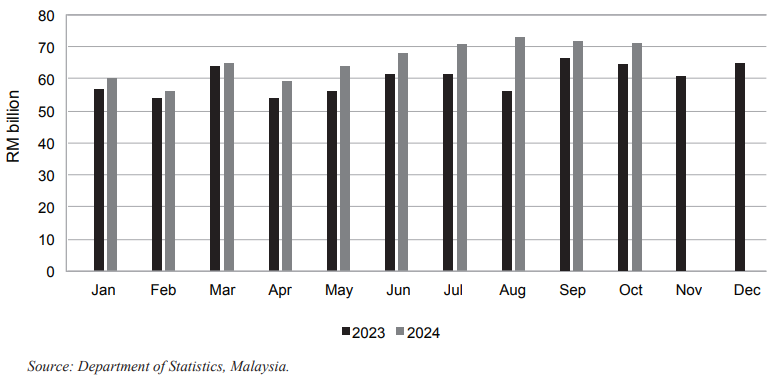

Penang’s labour market showed further improvements in 2024, with the unemployment rate dropping to 2% in the third quarter (Q3) of 2024 (Figure 5). The labour force participation rate rose to 73.1% in Q3 2024, up by 0.6 percentage points compared to Q3 2023. Additionally, the total number of employed persons increased by 1.2%, from 939,400 in Q3 2023 to 950,600 in Q3 2024, reflecting a strengthening job market.

Figure 5: Unemployment rate in Penang, first quarter 2022-third quarter 2024

The stable labour market in Penang is mostly supported by the state’s robust economic performance as well as its dynamic industrial and services sectors. In addition, significant investments in the manufacturing sector, particularly in the E&E industry, have stimulated job creation. To meet industry needs, the government of Penang and private sectors invested in workforce development programmes, emphasizing technical skills and digital literacy, which in turn led to growth in employment, especially in the manufacturing sector.

3. Prospects for 2025

Penang’s economic outlook for 2025 looks promising, despite global uncertainties. The state’s economic performance and GDP growth are expected to improve and strengthen further, driven by rising FDI mainly in its manufacturing sector, particularly the E&E industry. Penang’s strategic geographical position as a logistics and shipping hub, coupled with its competitive labour costs, skilled workforce, high-quality business infrastructure, robust manufacturing ecosystem, and strong governance, makes it a highly attractive destination for investment amid global economic shifts, such as the ongoing US-China trade tensions, which have led companies to adopt a “China Plus One” strategy.

Penang has already reaped significant benefits from this trend, particularly in the semiconductor and chip manufacturing sector (Goh & Tang, 2024). This advantage is likely to persist, due to the potential intensification of the trade war during Donald Trump’s second presidency.

could result in increased investment in Penang’s E&E sector. Furthermore, companies may diversify their supply chains by sourcing components from countries outside China, driving greater demand for manufacturing services in Penang, particularly for E&E components such as semiconductors (Vaghefi, 2024). The services sector is also expected to maintain its growth momentum, fuelled by robust household spending and tourism-related activities.

Penang’s substantial growth in external trade volume from January to October 2024 is expected to persist. As a key hub for the E&E industry, Penang’s trade position and balance are projected to remain strong, supported by robust growth in the global semiconductor market, driven primarily by AI and advanced packaging technology, throughout 2024 and 2025 (IDC, 2024).

In terms of inflation, higher CPI is expected for 2025, driven by the planned measures outlined in Budget 2025, including the implementation of RON95 gasoline subsidy reforms and the introduction of new taxes. In addition, increases in the minimum wage and civil servants’ salaries as outlined in Budget 2025, may drive inflation by boosting disposable income and consumer demand. This heightened demand could outpace the supply of goods and services, leading to demand-pull inflation and higher prices.

Penang’s labour market remains optimistic. As a hub for high-tech industries, particularly in E&E manufacturing, Penang is expected to continue experiencing strong demand for skilled labour, especially in semiconductor production, chip assembly, and advanced manufacturing. Moreover, the state’s robust economic growth, supported by FDI and expanding sectors such as technology and services, is expected to create more jobs, particularly in the manufacturing, services, and tech sectors.

With the growing emphasis on automation and digitalisation, workers may need to adapt to new technologies. This could lead to a shift in the types of jobs available, with more emphasis on technology-driven roles. As demand for specialised talent grows, Penang could face talent shortages in certain high-skill sectors, requiring more investments in training, and reskilling/upskilling of workers. For instance, there is an increasing demand for talents in Integrated circuit (IC) design and development, as a result of the establishment of Penang Silicon Design @5km+.

To address this demand and ensure a steady supply of highly skilled and qualified talents, the state is offering upskilling and reskilling programmes for current engineers and recent engineering graduates. These programmes, conducted under the Penang Silicon Design @5km+ initiative, are delivered through training by the Penang Chip Design Academy.

In addition, the state is committed to ensuring a sustainable STEM talent pipeline to particularly support its technology industry, as outlined in the Penang STEM Talent Blueprint. This initiative streamlines the roles of all STEM centres (i.e. Penang STEM, Penang Science Cluster, Penang Tech Dome and Penang Math Platform) by fostering collaboration with federal authorities, industry players, schools, and universities. The blueprint focuses on the long-term development of Penang’s Science, Technology, Engineering and Mathematics (STEM) workforce, aligning with the New Industrial.

Master Plan (NIMP) 2030 and the National Semiconductor Strategy (NSS). A steady supply of skilled STEM talent could strengthen Penang’s position as a global hub for high-tech industries, meeting workforce demands while advancing sustainable economic growth and technological innovation.

Footnotes

-

Emerging Asia refers to China, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam. [Back to text]

-

Based on the latest available data (up to October 2024) from DOSM at the time of writing. [Back to text]

References

- DOSM. (2024). Malaysian Economic Statistics Review – Vol. 12/2024. Department of Statistics Malaysia. Available from: https://www.dosm.gov.my/

- Goh, M., & Tang, L. (2024, April 22). More foreign companies moving manufacturing facilities from China to Malaysia amid trade tensions. CNA. Available from: https://www.channelnewsasia.com/asia/malaysia-china-companies-move-manufacturing-facilities-semiconductors-trade-war-4282471

- IDC. (2024). Global Semiconductor Market to Grow by 15% in 2025, Driven by AI. International Data Corporation. Available from: https://www.idc.com/getdoc.jsp?containerId=prAP52837624

- International Monetary Fund. (2024). World Economic Outlook: Policy Pivot, Rising Threats. Washington, DC. October. Available from: https://www.imf.org/en/Publications/WEO/Issues/2024/10/22/world-economic-outlook-october-2024

- MIDF. (2025). Economic Brief: Malaysia’s manufacturing PMI declines amid softening inflation, reduced demand. MIDF Research. Available from: https://www.midf.com.my/

- Vaghefi, N. (2024). US-China Trade Relations: Implications for Penang’s E&E Industry. ISSUES. Penang Institute. Available from: https://penanginstitute.org/publications/issues/us-china-trade-relations-implications-for-penangs-ee-industry/

You might also like:

![Can Batu Kawan Industrial Park be the Silicon Valley of the East?]()

Can Batu Kawan Industrial Park be the Silicon Valley of the East?

![Breaking Old Habits is Vital for Malaysia’s Mainstream Newspapers]()

Breaking Old Habits is Vital for Malaysia’s Mainstream Newspapers

![US-China Trade Relations: Implications for Penang's E&E Industry]()

US-China Trade Relations: Implications for Penang's E&E Industry

![Sustainable Strategies based on Penang Infrastructure Corporation's Projects]()

Sustainable Strategies based on Penang Infrastructure Corporation's Projects

![Key Changes to Development Expenditure in Malaysia’s Budget 2019]()

Key Changes to Development Expenditure in Malaysia’s Budget 2019