Executive Summary

- ESG disclosures reflect the extent to which companies integrate environmental, social and governance impact into their core business strategy. It assists companies in revealing their accountability and transparency to investors and other stakeholders.

- Lack of ESG disclosure by companies may lead to poorly-made investments, especially in high-risk sectors such as those with higher levels of environmental pollution or employee discrimination.

- The overall ESG disclosure level among public-listed companies (PLCs) based in Penang shows that a majority of them are performing well in governance reporting.

- Of the four sectors studied, technology companies perform best, especially with regard to environmental and social aspects of ESG reporting.

- Moving forward, it is increasingly important for companies to formulate their ESG-related business strategies, and enhance their transparency via increased disclosures if they are to thrive.

1. Introduction

In recent years, environmental, social and governance (ESG) reporting has become an important and ideal indicator of risk management, non-financial performance and management competencies (Friede et al., 2015). In the past two decades, an increasing number of companies across the world have adopted sustainability reporting or ESG reporting in response to rising demand from investors, customers and employees for accountability and transparency in corporate governance, as well as environmental and social responsibility. According to the KPMG Survey of Sustainability Reporting in 2022, about 96% of the world’s biggest 250 companies by revenue (the G250) and 79% of the top 100 businesses in 58 countries (the N100) reported on sustainability or ESG (GRI, 2022). Lack of ESG disclosure by companies may lead to poorly-made investments, especially in high-risk sectors such as those with higher levels of environmental pollution or employee discrimination (Mohammad and Wasiuzzaman, 2021). In other words, incorporating ESG into a company’s investment decision can help investors make decisions based on the firm’s overall performance and not only its financial performance.

In 2006, the government of Malaysia announced that all public listed companies (PLCs) in Bursa Malaysia are required to disclose their sustainability practices in their company annual reports from the financial year ending December 31, 2007. However, the contents of disclosure remained voluntary. In 2015, Bursa Malaysia issued the sustainability reporting guide and amended its listing requirements (Loh et al., 2018). Based on the Bursa Malaysia sustainability reporting guide, companies with clear sustainability commitments have better access to financing or investments, and those who do not adopt the practice may face enforcement actions by Bursa Malaysia, which includes potential delisting (BNM, 2022).

According to a study conducted by the Centre for Governance, Institutions and Organisations (CGIO) and the National University of Singapore (NUS) in 2018, among five ASEAN countries, namely Indonesia, Malaysia, Philippines, Singapore and Thailand, Malaysia (64.5%) took the lead in the level of sustainability reporting, followed by Singapore (61.7%) and Thailand (60%) (Loh et al., 2018). This can be due to the increase in government requirements and regulations regarding sustainability issues.

Stakeholder expectations are increasing across several sustainability matters such as health and safety, data governance and privacy, human rights and climate action, among others (MCCG, 2021). Hence,

it is important for companies to be more holistic in their disclosures to address material sustainability matters and areas of concern raised by their investors and stakeholders in order for them to be resilient and maintain confidence among their stakeholders.

The aim of this study is to investigate the ESG disclosure level among PLCs in Penang. It also identifies areas with high disclosures and shortcomings in current reporting.

2. Methodology

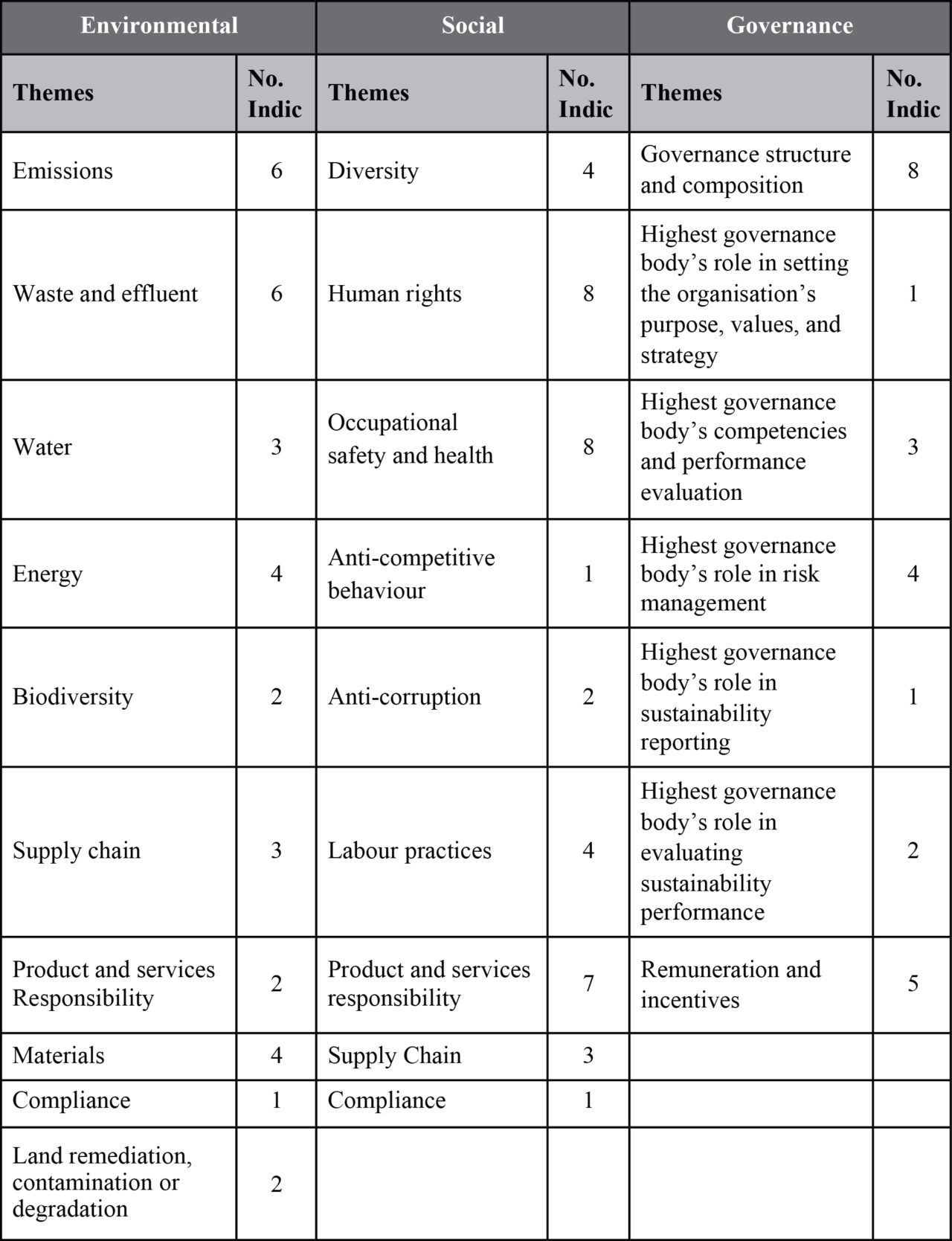

The study examined 66 PLCs[1] based in Penang from 4 different sectors, namely consumer products and services, industrial products and services, technology, and property (Table 1). About 95 ESG indicators were identified, based on the Global Reporting Initiative (GRI) reporting manual recommended by Bursa Malaysia for ESG reporting. This involves all the three major dimensions, namely environmental (10 themes and 33 indicators), social (9 themes and 38 indicators) and governance (7 themes and 24 indicators) (Table 2). Themes included in Table 2 are the major concerns of stakeholders and are those that they often expect to see in sustainability or ESG disclosures.

Content analysis was used on companies’ annual reports for year 2021. Some indicators are industry-specific and therefore not relevant to all companies and are only included in the calculations of the relevant sectors. The content of 66 annual reports is analysed, and each indicator coded between 0 and 3. The scale of 3 is awarded if an indicator is fully disclosed, while 2 scale is given if disclosure is partial. Finally, the indicator is coded 0 if there is no disclosure.

Table 1: ESG dimensions, themes and number of indicators

3. Assessment of the ESG Disclosure Level

3.1. Disclosure on Overall ESG Dimensions

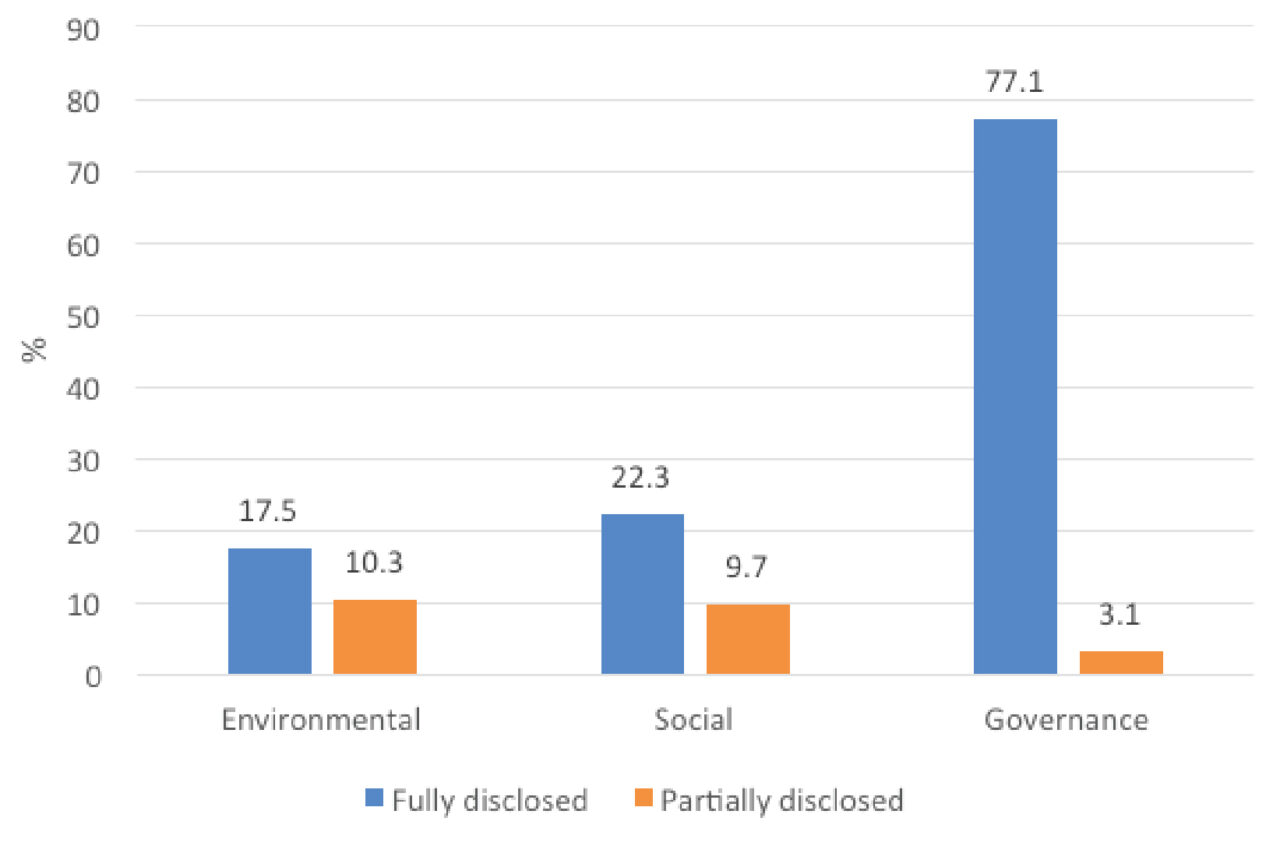

The overall ESG disclosure level among PLCs based in Penang is high, and a majority of companies has performed well in governance reporting (77.1% fully disclosed) (Figure 1). Yet, only 22.3% and 17.5% of companies fully disclosed social and environmental indicators, respectively. One of the main reasons could be the complexity of environmental and social data. For instance, quantifying social impact can be quite a challenge. The ESG Global Survey 2021 conducted by BNP Paribas indicated that almost half of investors surveyed found the social dimension of EGS to be difficult to analyse and incorporate into investment strategies. Additionally, the survey found that social data are harder to obtain and there is a lack of social metrics standardisation (BNP Paribas, 2021).

Environmental systems also have a complex and systematic nature which are not easy to measure. For example, impacts on biodiversity and habitat are hard to capture as the causal relationship is more complex. Furthermore, measuring and reporting environmental performance can be costly and requires extra time and expertise.

Being the oldest of the three dimensions of ESG investing, many governance indicators cover data and information that are readily available and can be already included in corporate disclosures. This makes it easier for companies to report on governance dimension.

Figure 1: Overall EGS disclosure level among PLCs based in Penang

Note: Weighted average was used to calculate the overall ESG disclosure.

3.2. Disclosure on Environmental Dimension

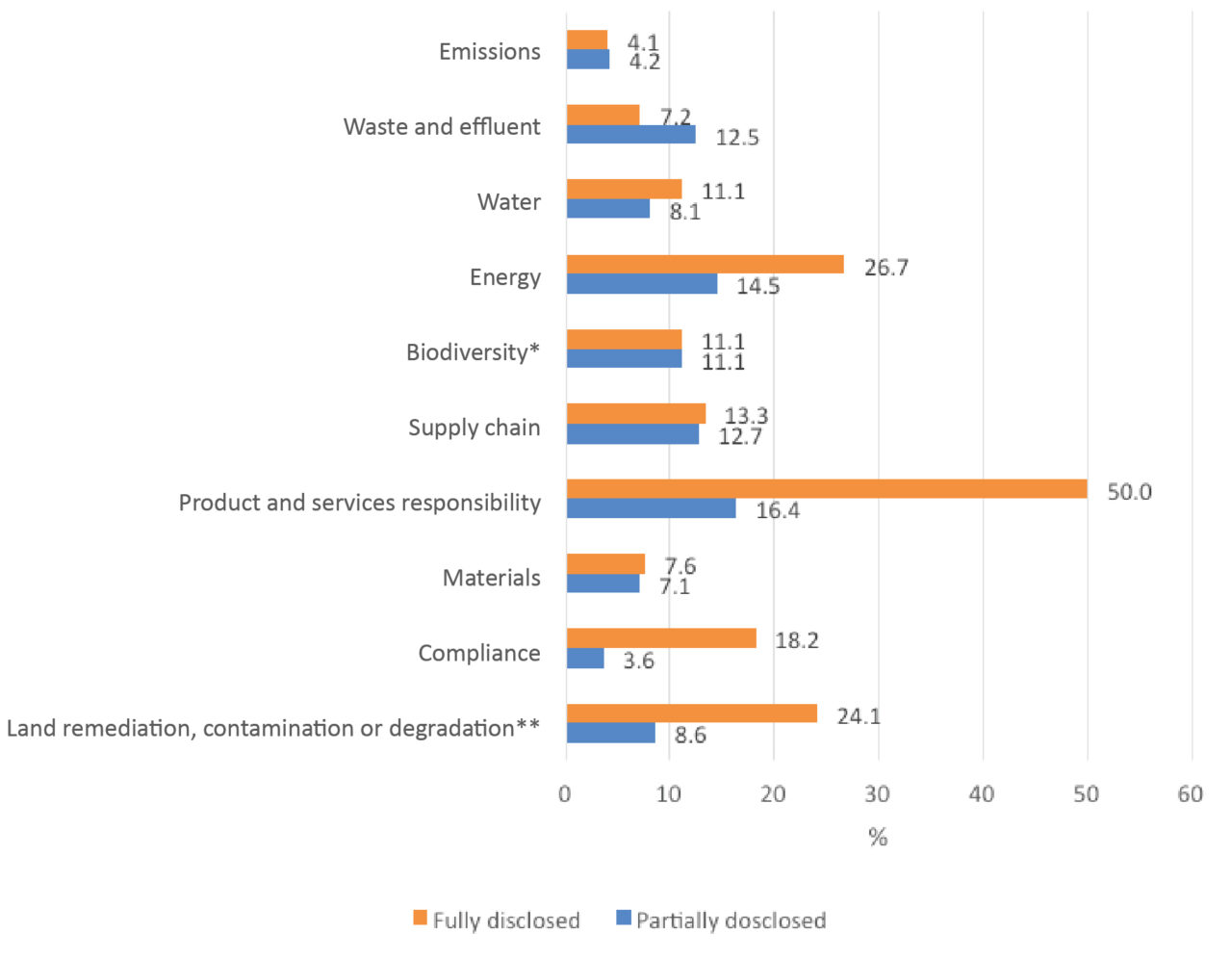

Since pollution (air and water) and waste management are the main environmental issues of concern in Penang, the lower level of environmental disclosure among PLCs in the state is a big concern. Among environmental themes, disclosures on emissions are the lowest (Figure 2).

This can be mostly due to difficulty in gathering quality data and measurements. For instance, none of the companies fully disclosed their scope 3 emissions and only 7% and 10.6% fully disclosed on their scope 1 and scope 2 emissions, respectively. Additionally, less than 2% reported on their NOX and SOX emissions. This limited disclosure poses a challenge, especially for investors who assess these companies via different reporting standards and initiatives that are becoming more important as the country shifts towards becoming a net zero greenhouse gas (GHG) emissions nation by as early as 2050 (BNM, 2022).

Figure 2: Environmental Disclosure by Theme

Note: *Biodiversity theme is only applicable to property companies.

**Land remediation, contamination or degradation are only applicable to property, and industrial products and services sectors.

The second lowest environmental disclosure is on waste and effluent. This theme is designed to help investors and other stakeholders better understand a company’s waste-related impacts, and how it manages these impacts. The disclosures need information on how much waste (hazardous and non-hazardous) the company produces, how the company mitigates its waste generation, and how it manages waste that cannot be mitigated. Results reveal that about 12.5% of companies partially reported on their waste and effluent indicators (mainly on strategies they apply to mitigate the waste and effluent), and only 7.2% fully disclosed on this indicator (including weight or volume of waste generated).

Disclosed information around the materials theme was also found to be poor, with only 7.6% fully disclosed and 7.1% partially disclosed. ‘Materials’ refers to components used as inputs in the production of goods. It includes the sourcing and composition of materials applied in the production system, as well as packaging. This theme provides information on the company’s sustainable practice and commitment to responsible sourcing and management of materials. Disclosing information on sourcing of raw materials would positively impact on company’s brand and reputation (Bursa Malaysia, 2015).

Results indicate that the companies performed better in product and services responsibility reporting (50% fully disclosed; 16.4% partially disclosed). Investors and other stakeholders are interested to know the environmental impact of products and services as well as information about product innovation to reduce impacts, such as eco-friendly products and less chemicals/toxic substances. Companies that take more proactive approaches to assess and improve the environmental impacts of their products and services might have a better chance in attracting investors. In addition, incorporating environmental considerations into product and service design might assist in identifying new business opportunities and stimulate innovation in technology. In addition, this might reduce the risk of incompatibility with future environmental legislation, and improve the company’s reputation.

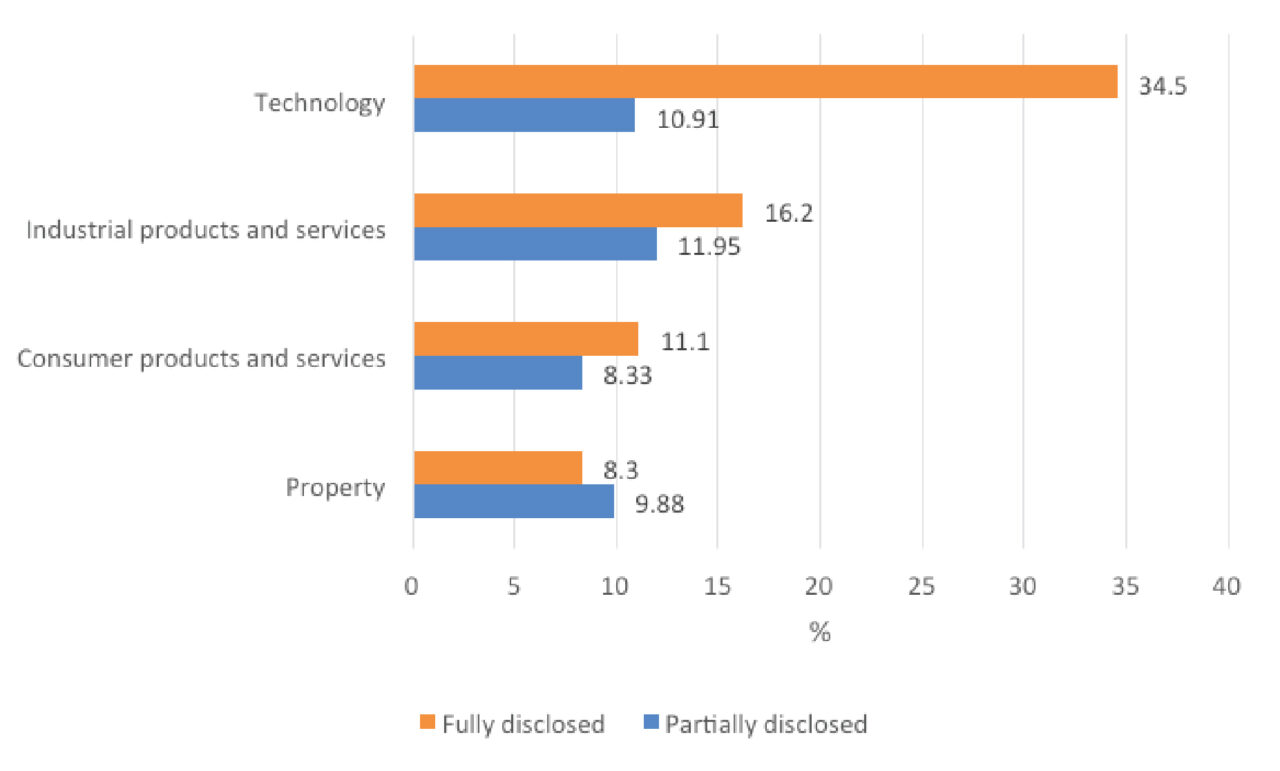

By sector, technology companies show a better performance than other industries when it comes to the environmental aspects of ESG reporting (Figure 3). Technology companies outperform others especially in disclosure of energy, water, waste and effluent, and emissions indicators. More than 60% of technology companies report on their energy consumption and nearly 50% of them report on Scope 2 of emissions[2]. More than half of these companies have reduced their energy consumption through conservation and energy efficiency initiatives. Their emission reporting and energy-reduction effort indicate that technology companies recognise GHG emission and high consumption of energy as a risk to their businesses.

Among the four sectors, the property sector has shown a lower level of disclosure on environmental aspects. The real estate sector drives nearly 40% of global carbon dioxide emissions. Of these emissions, about 11% are produced by manufacturing materials applied in buildings, while the rest come from buildings themselves and from the energy generation that powers buildings (Boland et al.,2022). This reveals the importance of the property sector in climate change mitigation. Hence, disclosures on particularly emissions and energy indicators by property companies are crucial.

Figure 3: Environmental Disclosure by Sector

3.3. Disclosure on Social Dimension

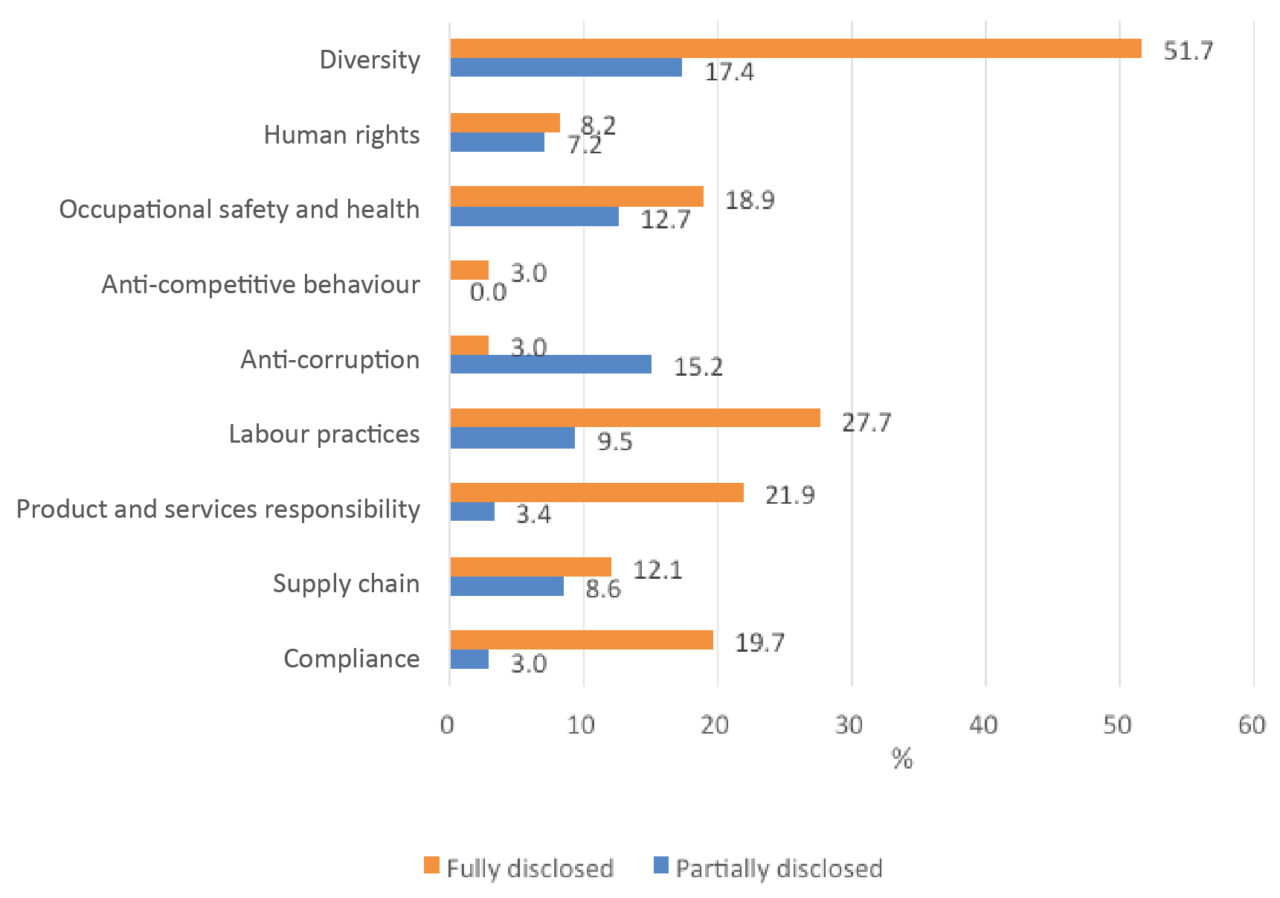

The social dimension of ESG mainly includes a company’s relationship with its workforce, consumers and the communities in which it operates. Results show that companies perform better in reporting on the diversity theme compared to other social themes (Figure 4). More than half of companies fully disclosed on diversity indicators and nearly 17.5% disclosed them partially. The diversity theme mainly focuses on diversity in the workforce, management and the board by gender, age and ethnicity, as well as employment arrangements. In fact, the level of diversity within an organisation gives information about its human capital as well as equal opportunity. In addition, information on workforce composition assists in evaluating certain issues that might be relevant to specific segments of the workforce. It is important for companies to collect, measure and report on human capital data as well as to track progress over time. This, in turn, helps companies to better communicate their commitment and progress, enhance employee engagement, manage associated risks, improve their reputation and attract more investors.

The most undisclosed theme is anti-competitive behaviour which refers to ethical business practices without affecting consumer choice, pricing, and market efficiency. Based on the GRI standards, the anti-competitive behaviour disclosure is related to legal actions introduced under national or international laws which are mainly designed to regulate anti-competitive behaviour, anti-trust, or monopoly practices. These practices can in fact impact consumer choice, pricing, and other factors that are crucial to efficient markets. The results indicate that only 3% of companies fully disclosed on the number of legal actions pending or completed regarding anti-competitive behaviour.

The disclosure on anti-corruption theme has also been very low. The number of companies that partially reported on this topic have been more than those fully disclosed. Partial disclosure might give an incomplete picture to investors. As there is more demand to have responsible businesses, understanding the ways corruption[3] can happen in a company is key. Hence, training employee on the anti-corruption topic as well as assessing operations for risks related to corruption will be crucial.

The responsibility of companies to respect human rights is another important criterion that might affect investment decision and business relationship. The human rights issues include non-discrimination, child labour, freedom of association, and forced or compulsory labour, among others. The study finds that approximately 85% of companies have not reported on their human right performance. Information generated from this theme can assist the organisation in implementing its human rights policies. In fact, the human right topic has become well established in international standards and laws, which can help companies implement specialised training for their employees to address human rights. The information on the total number of employees trained in human rights policies and practices, as well as the number of human rights violations, as required by GRI, both help investors to better assess a company’s depth of knowledge about human rights.

Figure 4: Social Disclosure by Theme

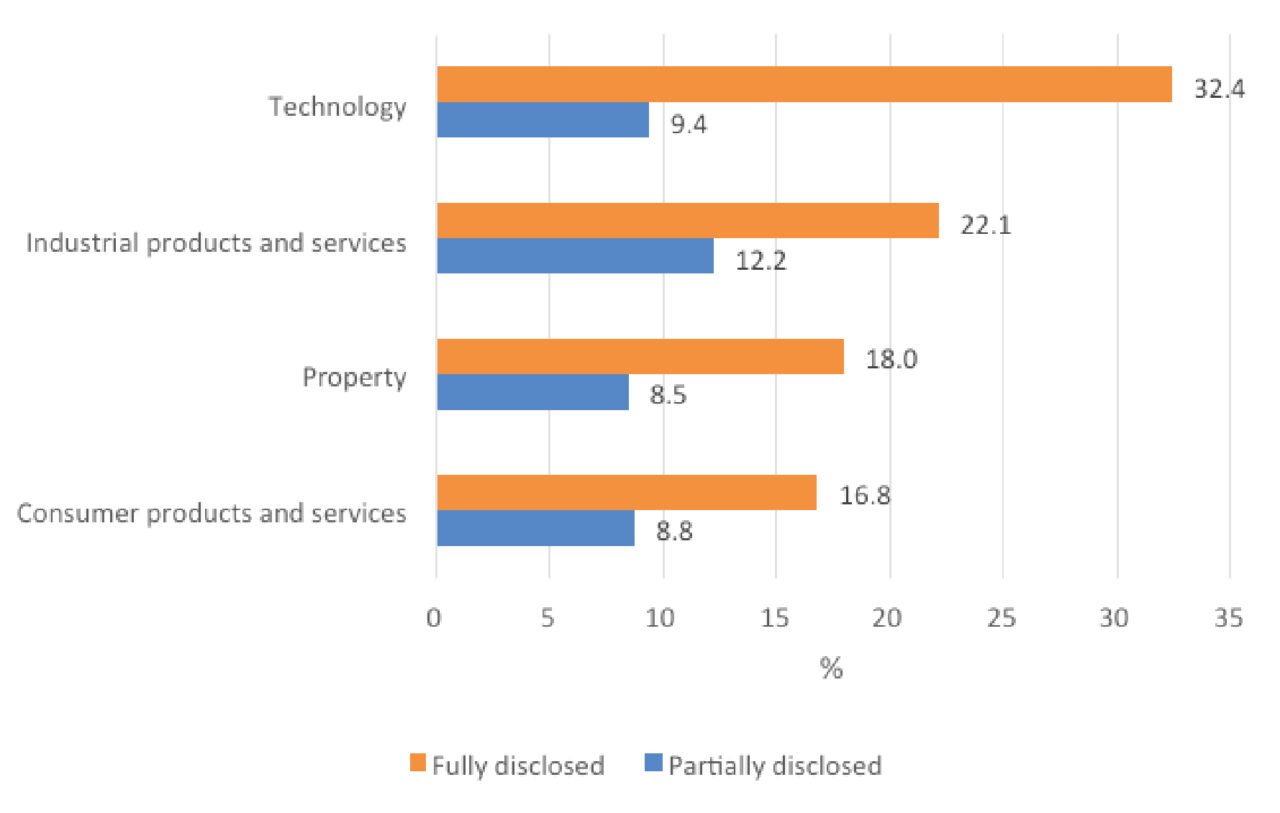

In terms of social disclosure by sector, the technology sector followed by the industrial products and services sector records the most disclosed indicators (Figure 5). Among themes disclosed the most (fully and partially) by technology and industrial products and services companies are diversity and labour practices . This indicates the importance of human capital in these sectors. This information assists stakeholders to better assess if a company has the right workforce to meet business challenges.

The consumer products and services sector shows the most undisclosed social indicators, with anti-competitive behaviour and anti-corruption having the lowest level of disclosures.

Figure 5: Social disclosure by sector

3.4. Disclosure on Governance Dimension

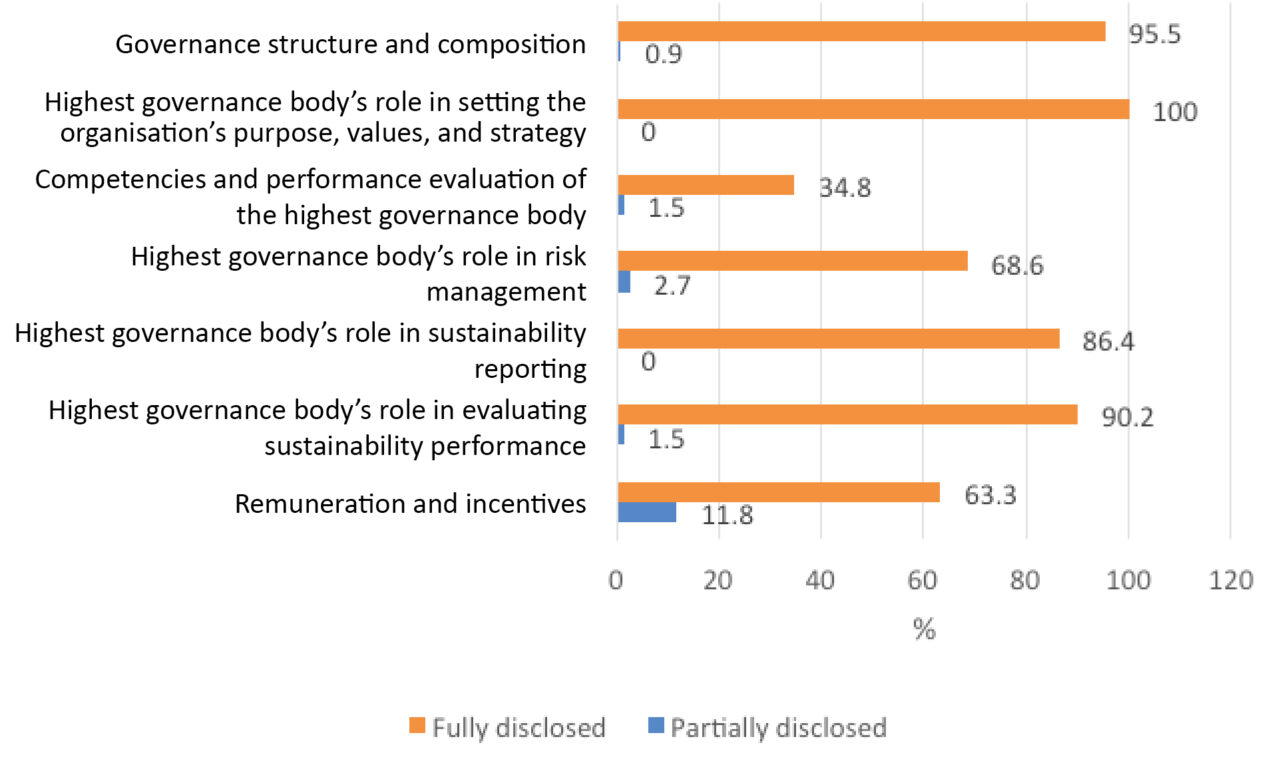

Besides being one of the main dimensions of ESG, governance is foundational to the realisation of the environmental and social dimensions. A company’s success in its environmental and social commitments depends on its leadership and on effective corporate governance. Additionally, corporate governance affects the quality of ESG disclosures, determining if ESG indicators are properly reported.

As illustrated in Figure 6, all companies fully reported on the role of the highest governance body in setting the organisation’s purpose, value or mission statements, and strategy related to sustainability impacts. A significant number of companies (95.5%) fully disclosed on governance structure and composition indicators. Transparency on the governance structure and the organisation’s composition

are in fact vital to ensure the relevant bodies’ accountability. This information basically helps stakeholders better understand how the highest governance body is structured in support of the company’s goals towards sustainability dimensions. Investors and other stakeholders often look for information explaining how board and senior executives’ composition and expertise are connected to the organisation’s business and ESG strategy. This is mainly for them to make sure that the existing corporate governance is effective when it comes to overseeing the company’s management of significant ESG risks and opportunities.

The results reveal that the majority of companies (90.2%) have fully disclosed on the role of the highest governance body in evaluating sustainability performance. However, only 34.8% of companies report on the competencies and performance evaluation of the highest governance body. Information on this theme can help stakeholders understand the highest governance bodies and senior executives’ effectiveness and capability to discuss and respond to sustainability impacts.

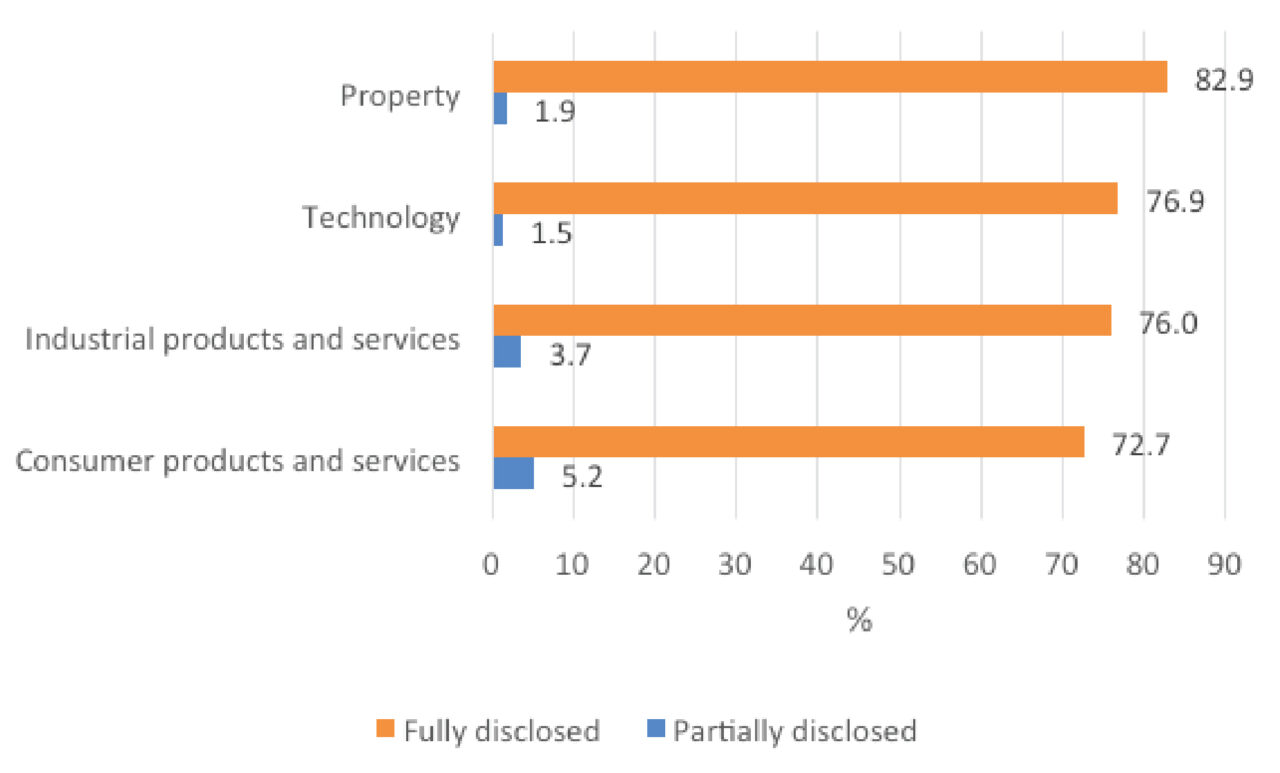

There is not much difference in governance disclosure by sector. All sectors performed relatively well, with property companies disclosing slightly more than other companies (Figure 7).

Figure 6: Governance Disclosure by Theme

Figure 7: Governance disclosure by sector

Proposed Measures to Improve ESG Reporting

For companies to continue thriving in the business world, it is increasingly important that they formulate their ESG-related business strategies and enhance their transparency via increased disclosures. Enhanced disclosures not only assist companies in improving their decision making, but also allows them to engage with stakeholders by sharing required information. Additionally, a proper ESG disclosure allows businesses to understand where they stand in relation to their competitors and peers. Following are some proposed measures to enhance ESG disclosures:

- Identify relevant material ESG issues: Companies need to consider ESG factors that are material and relevant to their organisation, instead of trying to address all ESG items. The impact, relevance and importance of ESG factors within a specific operation and within stakeholder contexts need to be evaluated. This would, in turn, help to reduce costs and regulatory interventions, as well as increase revenue growth and productivity.

- Determine ESG reporting strategy: Developing a strategy for ESG reporting is important. This strategy development should include strategic formulation, implementation planning as well as evaluation. Incorporating ESG reporting into the company’s corporate strategy is also essential to ensure sustainable ESG reporting practices. In order to identify areas for the most significant impact, the risks and opportunities of ESG strategy should be communicated clearly with stakeholders.

- Present clear and concise data and information: Availability and accuracy of data and information are main challenges in ESG reporting. Investors and other stakeholders expect to see clear, concise and valid data presentations. Gathering reliable and comprehensive ESG data can be complex, costly and time consuming, particularly environmental and social data. To get more valid information and accurate data, internal sources such as customer feedback and employee surveys, as well as external sources such as third-party assessment and industry benchmarks can be used.

- Establish an ESG reporting framework for Malaysian companies: Although international frameworks such as GRI are currently being applied for ESG reporting in Malaysia, the country needs to come up with a reporting framework of its own which is more relevant and practical for Malaysian companies. There is currently no formalised ESG reporting framework for corporations in Malaysia. However, the government is planning to introduce a framework on ESG standards by the end of 2023, aimed at assisting small and medium sized enterprises (SMEs). This would help companies, particularly SMEs, to enter export markets that require ESG compliance. This will also assist businesses ensure that they targets the most relevant and material ESG factors.

- ESG-focused incentives: Government supports in the form of tax incentives and credits would help companies to be actively engaged in ESG disclosures. For instance, tax deduction and credits for companies that are engaged in more environmentally friendly and socially beneficial behaviour might encourage them to be involved in ESG-related behaviours. This might also lead to a better ESG disclosures among businesses.

Editor: Ooi Kee Beng

Editorial Team: Alexander Fernandez and Nur Fitriah (Designer)

[1] Listed in the Bursa Malaysia.

[2] Scope 2 emissions refer to indirect GHG emissions from the consumption of purchased electricity, steam, heat, and

cooling.

[3]Different forms of corruption include bribery, extortion, fraud, undue pressure or influence, and collusion.

You might also like:

![Explaining Salaries and Wages Data: A Look through Penang’s Lens]()

Explaining Salaries and Wages Data: A Look through Penang’s Lens

![Time for Malaysian States to Introduce “Non-Constituency Seats” (NCSs)]()

Time for Malaysian States to Introduce “Non-Constituency Seats” (NCSs)

![Survey on Attitudes to Covid-19 Vaccination in Penang]()

Survey on Attitudes to Covid-19 Vaccination in Penang

![Facing Climate Change Begins at Home]()

Facing Climate Change Begins at Home

![Stuck in Traffic: Why Malaysia Does Not Have a Motorcycle Ride-hailing Sector]()

Stuck in Traffic: Why Malaysia Does Not Have a Motorcycle Ride-hailing Sector