Executive Summary

- Chinese investments in Southern Johor have split the property development into a high-end market with excess supply targeted at foreigners as buyers, and a lower-tier market driven by local developers targeting mostly local buyers

- The largest Chinese investor, Country Garden PacificView (Country Garden), has huge projects, most notably Forest City and Danga Bay. There are at least five other Chinese developers investing into the property market in the area

- Most units in the gigantic projects remain unsold. There are important local implications if this is to continue. Beijing’s recent crackdown on capital outflows has raised questions as to whether Forest City, for example, will turn into a ‘ghost city’

- Huge numbers of unsold units and of absentee owners will make the collection of maintenance fees a difficult problem which will seriously affect the upkeep of public amenities and private-owned facilities

- Furthermore, the import of Chinese workers to carry out construction work eats into job opportunities for locals, including the skilled workforce. These foreign workers are also susceptible to being cheated by unscrupulous agents

INTRODUCTION

There’s probably not been a property development project in Malaysia that has received more media scrutiny, both local and foreign, and that is as ambitious in scale and scope as the Forest City[2] development in Southern Johor. Built on reclaimed land off the coast of Johor Bahru,this US$100bil project covering 14 square kilometres on four artificial islands is supposed to eventually house as many as 700,000 people with a planned capacity of 160,000 housing units.[3] Country Garden, one of the largest developers in China, is the majority owner of this project and is no stranger to building mega cities.[4]

Many concerns have been raised with regards to this project including the environmental impact on the surrounding areas, the impact on local housing developers and the sustainability of such a massive project targeted at a mostly foreign clientele. The recent crackdown by Beijing on capital outflows has left many wondering if Forest City will turn into another Chinese ‘ghost city’.[5]

To date, there have not been many reports showing detailed figures on (i) the sale of properties in Forest City; (ii) the sale of properties for other Chinese developers in the Johor Bahru (JB) district; and (iii) the impact on the Malaysian property development projects in JB. The National Property Information Centre (NAPIC) publishes data on residential and commercial property but does not give any breakdown of the performance of individual property developments.

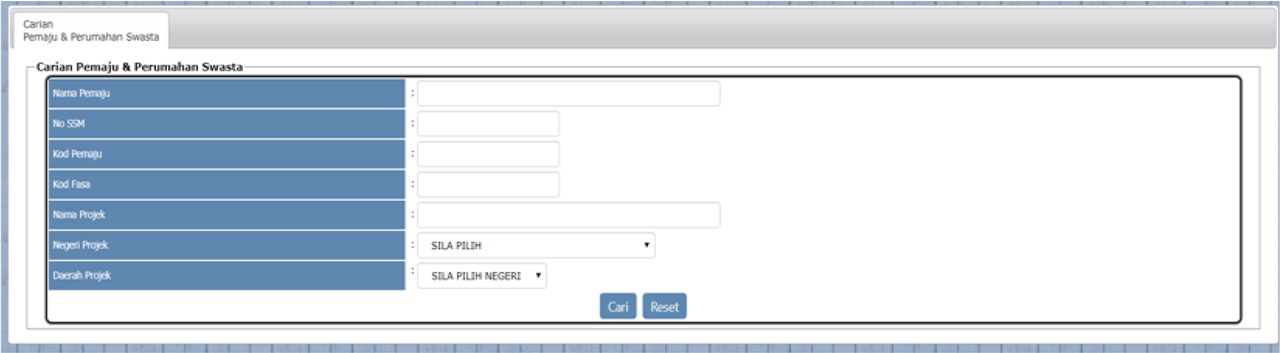

Information on each property development for this article is actually collected by the National Housing Department under the Ministry of Housing, Local Government and Urban Well-Being (KPKT) through its online electronic service database called e-pemaju.[6] Through this online database, we were able to gain access to detailed records for each property development project in JB including the name and phase of each development project, the developer code, the number of units sold to foreigners and the number of units approved, sold and unsold (See Appendix 1 for a description of the e-pemaju database). From this database, summary statistics for the property market in JB were obtained (see Table 1).

Table 1: Total Properties in Johor Bahru Sold and Unsold, by Race and Nationality

Unfortunately, the e-pemaju database does not have any dates associated with these projects. We assume that the projects listed are ongoing and available for sale, and also been approved by the local authority but have yet to be launched. (Our data collection was done on July 17, 2017)[7]

According to the summary statistics, a total of 344,977 property units have been approved [8] , out of which215,319 have been sold(62.4%)and 112,759 units remain unsold(32.7%).[9] Of the 215,319 already sold, 23,196 were sold to foreigners. This represents 10.8% of total sales. It is important to note that not all the foreigners who bought property in JB are from China. Singaporeans comprise a large target market among property developers in JB especially those selling high-end units.

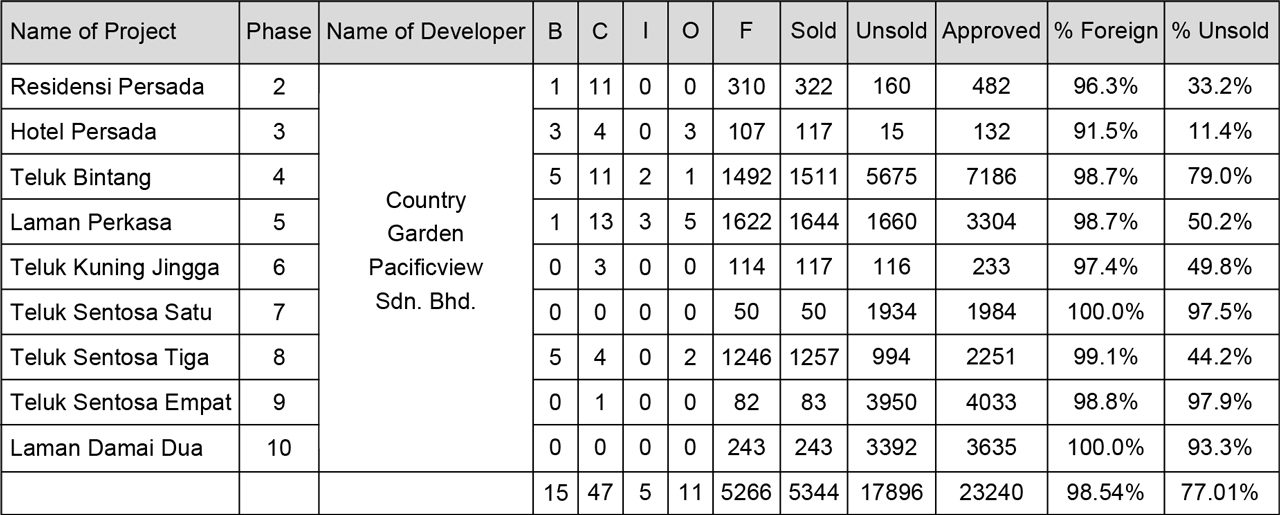

How do these general figures for JB compare to the figures for the Forest City Project? Table 2 below is interesting in this regard. Country Garden PacificView[10] , which is the master developer for Forest City, has a total of 23,240 units approved in the Forest City development spread over nine phases (Phase Two to 10 since information for Phase One was not available). 98.54% of the units sold were to foreigners. One can presume, given Country Garden’s marketing strategy that most of the foreigners who bought units in Forest City were buyers from China and to a lesser extent, from Singapore.

Another point of note is the fact that five out of nine phases had sold less than 50% of its units approved.

To provide a sense of the scale of Country Garden’s Forest City project, consider that the total number of completed residential units in the whole of Johor for 2016 was 9,497, according to NAPIC’s residential Q4 2016 property stock report. Forest City alone will provide more than twice this figure, albeit over a longer time frame.

The other large property development by the Country Garden group is called Country Garden Danga Bay, located 30km to the northeast of Forest City, within a stone’s throw of Johor Bahru City Centre. This project started in mid-2013, about two years earlier than Forest City. Although far smaller in scale compared to Forest City, the Country Garden Danga Bay project, which comprises 9,475 unit high-end condos built over five phases, still shocks the JB property market due to its sheer scale and ambition.

Table 2: % of Country Garden’s Forest City Sold to Foreigners and % Unsold, by Phase

For Country Garden Danga Bay, the customer base is relatively more diversified with ‘only’ 24.8% of its total units sold being bought by foreigners. But it is experiencing a similar rate of unsold units as Forest City, with 78% of approved units yet to be sold (See Table 3 below). The figure on the e-pemaju website somehow contradicted figures revealed to the press by the developer. In October 2016, the Edge Property reported that 7,000 units or about 78% were already sold, according to their interview with a representative from Country Garden.[11]

Table 3: % of Country Garden Danga Bay Sold to Foreigners and % Unsold, by Phase

The other large project being built by a Chinese developer is R&F Tanjung Puteri. Smaller in scale compared to Country Garden’s Forest City and Country Garden Danga Bay, this project has obtained approval for the construction of 3,534 units. Thus far, 66.5% of its sold units are to foreign buyers, while 2,572 out of 3,534 or 72.8% units are yet to be sold (See Table 4 below).

Table 4: % of R&F Tanjung Puteri Sold to Foreigners and % Unsold, by Phase

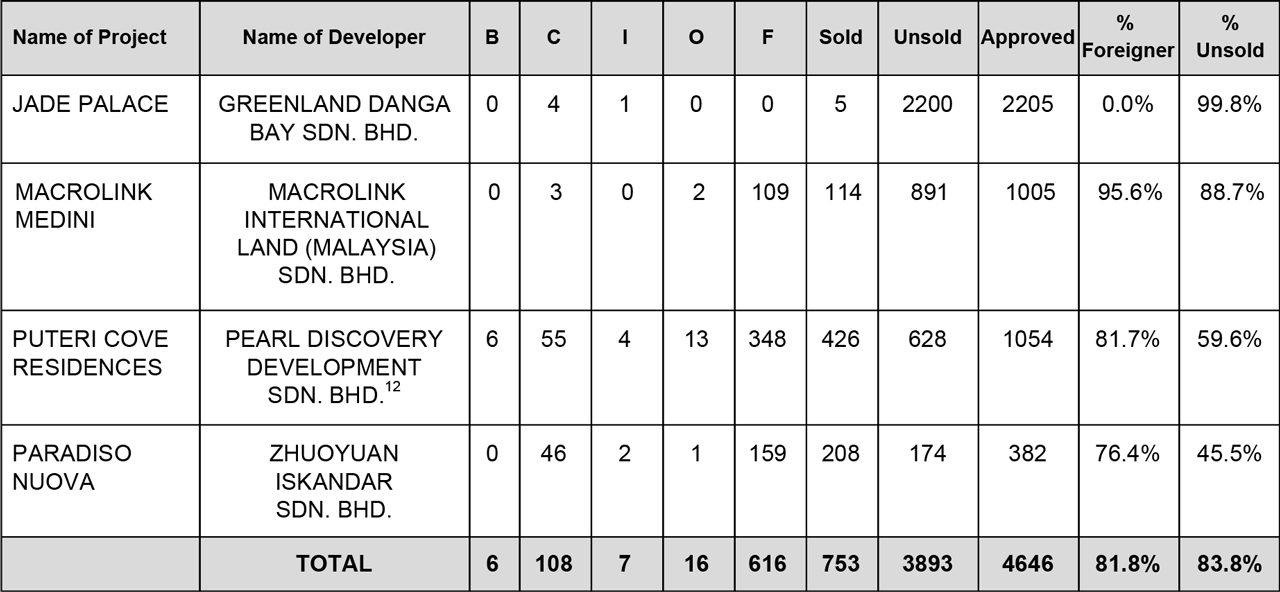

There are at least four other projects (at the time of writing) in the Johor Bahru area which are linked to Chinese developers. These are Jade Palace developed by the Greenland group, Macrolink Medini developed by the Macrolink group, Puteri Cove Residences where a majority stake was recently acquired by the Longcheer group and Paradiso Nouva by the Zhuoyuan group. All these are one-phase projects. The largest of these projects, by the Greenland group, with 2,205 approved units has only sold five units, all to Malaysians. The Puteri Cove Residences project, with 1,054 approved units has sold 426 units out of which 81.7% were sold to foreigners, and 59.6% remain unsold. The Macrolink Medini project, with 1,005 approved units, has sold 114 units out of which 109 or 95.6% were sold to foreigners, with 88.7% staying unsold. The final project, Paradiso Nuova, with 382 approved units, has only sold 208 units (45.5% unsold) out of which 174 (76.4%) were sold to foreigners (See Table 5).

Table 5: % of Other Chinese Developments in Johor Bahru Sold to Foreigners and % Unsold

Table 6 below shows the summary statistics of ALL development projects run by Chinese companies in Johor Bahru. A total of 40,895 units have been approved, a total of 9,140 units have been sold and 31,755 are still unsold (77.7%). Of the sold units, 77.0% went to foreigners.

Table 6: % of ALL Chinese Developments in Johor Bahru Sold to Foreigners and % Unsold

The trend from these figures is clear. With the exception of the Country Garden Danga Bay project, all projects by Chinese developers have seen more than 50% of their sold units going to foreigners. Given the many reports on the aggressive marketing strategies employed by the Chinese developers to sell to buyers from China, it is likely that a large percentage of the units listed as being sold to foreigners were sold to buyers from China. A smaller percentage would be buyers from Singapore. According to a recent report, 70% of the sales by Country Garden PacificView are to buyers from China.[13]

The other trend apparent from these projects is that a large percentage of units remain unsold. All of the projects, with the exception of Paradiso Nuova by Zhuoyuan, has more than 50% of its units unsold. There is no question that there is an oversupply of these mostly high-end properties being built and sold by these Chinese developers. The numbers presented here corroborate many of the newspaper reports on this subject[14] (See Appendix 2 for a summary of units in Chinese property projects, built and sold/unsold).

It is unlikely that this oversupply situation will be rectified in the near future especially since the crackdown by Chinese authorities on capital outflows, including for the purchase of foreign property purchases, is likely to continue.[15]

The entry of these Chinese developers into Southern Johor, drawn by the promises of Iskandar Malaysia, had the greatest impact on those competing in the same market, namely high-end residential projects (landed and apartments) which were targeting rich Malaysians with an eye on the Singapore market.[16] According to a report in the Edge Markets, the best performing property projects in Johor were mostly selling properties below RM500,000.[17] In effect, the property market has bifurcated into a high-end market with excess supply, largely driven by the ambitious Chinese developers, and a middle-to-lower-tier market with more affordable homes catering mostly to local Malaysian buyers. Ironically, the entry of Chinese players into the high-end market have caused many local developers to reassess their plans and restructure their projects into ones with more residential units in the RM500,000-and-below range.

There are important local implications if Forest City were to turn into a ‘ghost city’[18]. Firstly, Forest City’s public areas, including roads and lighting, are handed over and maintained by the local authority. Usually, the maintenance costs will be paid for via assessment taxes by the owners of Forest City properties. But if the majority of the owners are foreigners who do not reside full-time in Forest City or if the majority of units remain unsold, the amount of assessment collected by the Johor Bahru Tengah Municipal Council (MPJBT) will not be sufficient to cover maintenance costs.

Furthermore, the low number of full-time residents and the high number of unsold units may also affect the monthly maintenance fees paid to the Joint Management Body (JMB) of the Forest City development. Failure by many of the buyers to pay the maintenance fees may lead to the facilities falling into disrepair.[19] For developments with a smaller number of units, the developer maybe able to bear these maintenance costs out-of-pocket. This would not be financially sustainable for a massive project like Forest City.

Given the massive scale of the Forest City project and given the speed at which these projects are constructed by Chinese developers, it is not surprising to learn that a large number of Chinese workers have to be ‘imported’ to carry out the construction. The dependence on Chinese workers takes away job opportunities from Malaysian workers, including skilled workers such as engineers and architects. Moreover, importing such large numbers of Chinese workers (as many as 4,000) has also led to accusations and reports of Chinese workers being deceived by unscrupulous agents who promise them high wages, but in the end force them to work illegally, at lower wages than initially promised.[20]

The massive scale of the Forest City project highlights the detrimental impact such projects have on other development projects in the same area, and on the surrounding environment. Financial sustainability remains an issue.

Based on the Forest City experience, similar concerns should be raised for the RM43 billion Malacca Gateway project which shares many similarities, such as the reclamation of large pieces of land in the Straits of Malacca to build a massive number of commercial and residential properties, as well as the partnership with Chinese companies to build and possibly finance this project.[21]

Country Garden’s projects in Forest City and to a lesser extent, in Danga Bay, should be contrasted with Country Garden’s project in Semenyih in the Hulu Langat district in the state of Selangor. The project in question, DiamondCity,[22] is a joint venture between Country Garden and Mayland, a local developer.

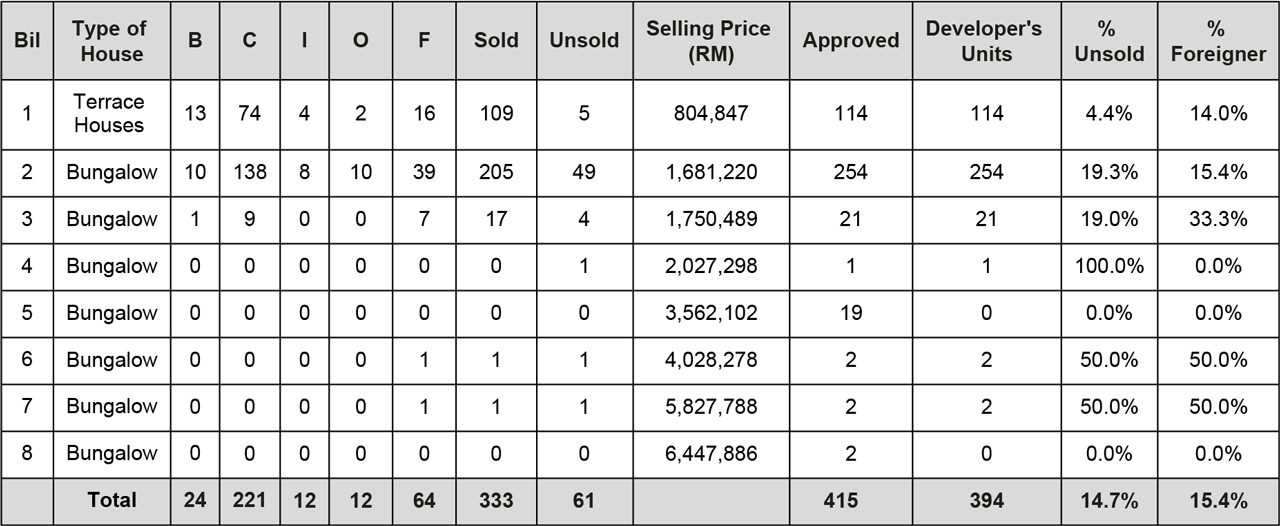

Based on data from the e-pemaju website, the Country Garden Diamond City project in Selangor demonstrates two main differences from the Forest City project in Johor Bahru. According to Table 7 below, a total of 333 out of 394 units built by the developer have been sold (85.3%). Of the units sold, only 64 units or 15.4%, were sold to foreigners. The scale of the development is relatively small, approximately 400 units in Phase One compared to the units sold in the thousands in the key phases of the Forest City project.

Table 7: % of Country Garden Diamond City (Semenyih, Hulu Langat, Selangor), Phase One, Sold to Foreigners and % Unsold

Country Garden’s Diamond City project is much more in line with the size and scope of projects launched by other reputable Malaysian developers in Semenyih, including SP Setia, UEM-Sunrise, Sunway and Eco World. The number of units are in the hundreds, rather than in the thousands, and are launched in phases over one or two years. Furthermore, the primary target market is made up of Malaysian locals rather than foreigners. This development model is more sustainable in the long term and is likely the model which Country Garden will use, moving forward, as part of its ‘localisation’ strategy. If successful, it will be able to compete against other local developers on a level playing field, through projects that are more ‘normal’ in scale and scope.

In summary, one should not adopt a blanket approach in valuing all projects linked to Chinese developers. One should be rightly concerned with the massive projects that are overly dependent on the foreign buyers’ market and are priced beyond the means of the majority of buyers in the local market. However, property development projects linked to Chinese developers, that are more ‘localised’ (smaller in size and scale and are priced for the local market) should be viewed in the same light as projects launched by major Malaysian property players.

Appendix 1: Data Collection Methodology

The Ministry of Housing, Local Government and Urban Well-Being (KPKT) maintains a database with details of housing developers sorted according to developer name, developer registration number, developer code, phase number, name of project, state and the district in which the project is located: (http://idaman2.kpkt.gov.my:8888/idv5/98_eHome/carianPemaju.cfm). (See Figure 1 below)

All 1,100 valid property projects (each phase is listed as a separate project) in the district of Johor Bahru were found using this website.

Figure 1: Search by Developer (Name, Company Registration Number, Code, Phase of Project, Name of Project, State and District of Project)

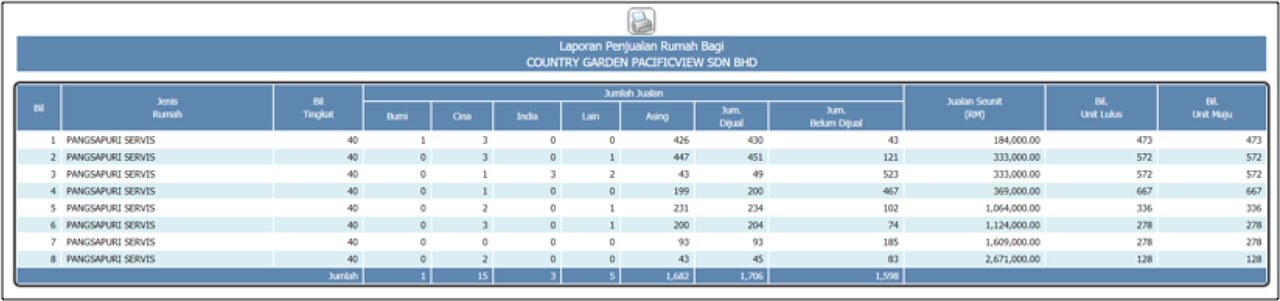

In addition, the same website also has details of buyers including racial breakdown and also the number of foreign buyers. The average price of each unit of each project is also listed, as is the total number of units approved for building. See Figure 2 for a sample of Phase Five of the Country Garden PacificView or Forest City project.

Figure 2: Breakdown of Buyers, Units Sold and Approved, Pricing of Each Unit Type for Phase Five of Country Garden PacificView Project i.e. Forest City in Johor Bahru

Data for other housing projects in Johor Bahru were obtained by changing the developer’s code, the phase number and the name of the project based on the e-pemaju link below: http://idaman2.kpkt.gov.my:8888/idv5/98_eHome/laporanJualanRumah.cfm?pmju_Kod=14188 &proj_Kod_Fasa=5&proj_Nama=COUNTRY%20GARDEN%20PACIFICVIEW%20SDN%20BHD

Some caveats are in order for this data:

- On the website, no indication is given as to when the data was collected. This data was collected on the July 24, 2017.

- Not all of the projects listed have been launched which means that their units may not be available for sale yet.

- It is assumed that the data provided by the developers are accurate.

- It is assumed that the price of the units provided by the developers is accurate.

Appendix 2: A summary of Units in Chinese Property Projects in Southern Johor, Built and Sold/Unsold:

- A total of 23,240 units have been approved over nine phases for Country Garden’s Forest City project. 5,344 units have been sold with 5,266 units (98.5%) being sold to foreign buyers. 77% or 17,896 units remain unsold.

- A total of 9,475 units have been approved over five phases for Country Garden’s Danga Bay project. 2,081 units have been sold with 516 units (24.8%) being sold to foreign buyers. 78% or 7,394 units remain unsold.

- A total of 3,534 units have been approved over four phases for R&F Tanjung Puteri project. 962 units have been sold with 640 units (66.5%) being sold to foreign buyers. 72.8% or 2,572 units remain unsold.

- A total of 4,646 units have been approved for four projects linked with four other Chinese developers. 753 units have been sold with 616 units (81.8%) being sold to foreign buyers. 83.8% or 3,893 units remain unsold.

- In summary, a total of 40,895 units have been approved for seven projects linked with Chinese developers. 9,140 units have been sold with 7,038 units (77%) being sold to foreign buyers. 77.7% or 31,755 units remain unsold.

- In contrast, a total of 394 units have been built in Phase One of Country Garden’s Diamond City project in Semenyih in the district of Hulu Langat in Selangor. 333 units have been sold with 64 units (15.4%) being sold to foreigners. 14.7% or 61 units remain unsold.

[1] With research assistance from Nelynn Ng, intern at Penang Institute.

[2] http://www.forestcityjohor.info/home/4591457883

[3] https://www.bloomberg.com/news/features/2016-11-21/-100-billion-chinese-made-city-near-singapore-scares-the-hel l-out-of-everybody

[4] Note: The developer of Forest City is Country Garden PacificView Sdn Bhd (‘CGP’), a joint venture between Country Garden Holdings Ltd. (67%) and Esplanade Danga 88 Sdn Bhd (33%). The former, Country Garden Holdings Ltd. is owned and controlled by foreign mainland Chinese capital. The latter, Esplanade Danga 88 Sdn Bhd, however, is majority owned by Sultan Ibrahim, the ruler of Johor (64.4% share). Kumpulan Prasarana Rakyat Johor (KPRJ), a Johor state-owned company and Daing Malek Daing A Rahaman owned then rest of the shares of Esplanade Danga 88 Sdn Bhd. [source: https://www.malaysiakini.com/news/268649]

[5] http://www.todayonline.com/singapore/penalty-clause-adds-to-woes-of-forest-city-chinese-buyers and http://www.thestar.com.my/business/business-news/2017/04/05/country-garden-pledges-refund-for-forest-city-buyer s-caught-in-beijing-crackdown/

[6] http://idaman2.kpkt.gov.my:8888/idv5/verify/index.cfm?noAccess=true

[7] A KPKT officer, when contacted by Penang Institute, said that KPKT leaves it to the developers to upload the data onto the e-pemaju website.

[8] The number of approved units is more than the number of sold and unsold units because not all of the approved units have been built and are on the market to be sold.

[9] There is a discrepancy of 682 units. Some developments recorded more property sales than were approved.

[10] https://cgpvforestcity.wordpress.com/

[11] https://www.theedgeproperty.com.my/content/942560/country-garden-danga-bay-targets-full-take-end-2017

[12] Longcheer, a Chinese developer, acquired a 51% stake in this project (https://www.dealstreetasia.com/stories/longcheer-to-acquire-stake-in-puteri-cove-development-for-over-89m-7815/)

[13] http://www.theedgemarkets.com/article/cover-story-chinas-liquidity-squeeze-casts-shadow-over-iskandar-malaysia

[14] These are two of the most recent newspaper reports documenting the oversupply of high-end property in Johor Bahru. http://www.theedgemarkets.com/article/cover-story-johor-residential-market-remains-under-pressure and https://www.ft.com/content/33d55b8e-ffe0-11e4-bc30-00144feabdc0

[15] http://www.theedgemarkets.com/article/cover-story-chinas-liquidity-squeeze-casts-shadow-over-iskandar-malaysia

[16] http://www.straitstimes.com/business/property/housing-market-struggles-amid-weak-interest

[17] http://www.theedgemarkets.com/article/iskandar-malaysia%E2%80%99s-best-performing-areas-2016

[18] https://www.citylab.com/equity/2016/12/is-china-building-a-ghost-city-abroad/511757/

[19] http://www.theedgemarkets.com/article/strata-problem-brewing-forest-city

[20] https://www.malaysiakini.com/news/381555

[21] http://melakagateway.com/

[22] http://cgdiamondcity.com.my/

Managing Editor: Ooi Kee Beng Editorial Team: Regina Hoo, Lim Su Lin, Nur Fitriah, Ong Wooi Leng

You might also like:

![Unleashing Potential: Policy Insights for Malaysia’s Creative Industries]()

Unleashing Potential: Policy Insights for Malaysia’s Creative Industries

![Report of the Penang State-Federal Relations Select Committee 01/25]()

Report of the Penang State-Federal Relations Select Committee 01/25

![Penang: Becoming A Smart State]()

Penang: Becoming A Smart State

![A Critical Need for Effective State-Federal Relations in Malaysia]()

A Critical Need for Effective State-Federal Relations in Malaysia

![Crafting Employment for Persons with Learning Disabilities is a Sound Socio-economic Stratagem]()

Crafting Employment for Persons with Learning Disabilities is a Sound Socio-economic Stratagem