Press Statement

by Penang Institute

GST Is A Regressive TAX

Dr. Lim Kim Hwa, Fellow, Penang Institute

limkimhwa@penanginstitute.org

Fixing the fiscal deficit is the central theme in the Budget 2014. The Government now expects the Budget deficit to fall to 3.5% of GDP in 2014, with economic growth at 5-5.5% (vs. 4.5-5% in 2013).

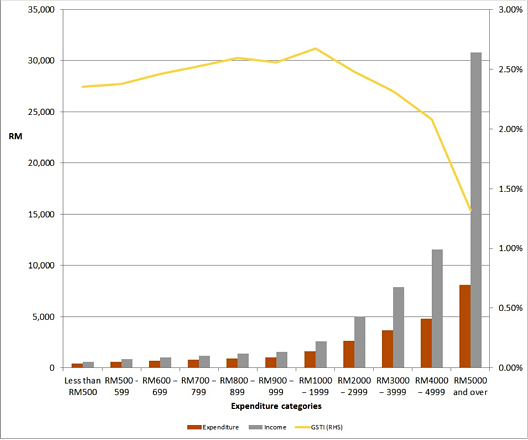

To address the fiscal deficit, the Goods and Services Tax (GST) will be implemented from 1 April 2015. Our analysis shows that at 6% GST, prices could go up by as much as an additional 3.38%. GST will raise RM 6 billion from households (ignoring any fraud). Despite setting essential items like basic food, public transportation, education and healthcare as exempt or zero rated items, we show that GST is a regressive tax (i.e. the lower income households will bear a higher tax burden than the higher income households). Using 6% as the standard GST rate, the average household is expected to pay 2.52% of monthly income as GST (equivalent to RM 90 per month).

The yellow line in the figure below shows that the proportion of income payable as GST (GSTI) is higher for the low and middle income households compared to the highest income households. The worst hit households are those earning about RM 2,500 per month – with GST burden at 2.67% of their income. The lowest income households (with average monthly income of RM 605) will pay 2.35% of their income in GST. However, the highest income households (with average monthly income of RM 30,815) will bear only 1.32% GST burden.

Apart from hitting the low to middle income households, we also find that households will pay higher percentage of their income as GST if they are:

· engaged as technicians, clerical and services workers, farmers and fishermen

· in single person household

· in young households (less than 24 years old)

· Bumiputera-led households

· households residing in Peninsular Malaysia

For more information and our interactive spreadsheet detailing the impact on different households, visit:

https://www.penanginstitute.org/gst/